Deduction from Capital Available (unregistered reinsurance) - Example

I am having difficulties to map letters to page 70.60. I have 2 questions.

First question:

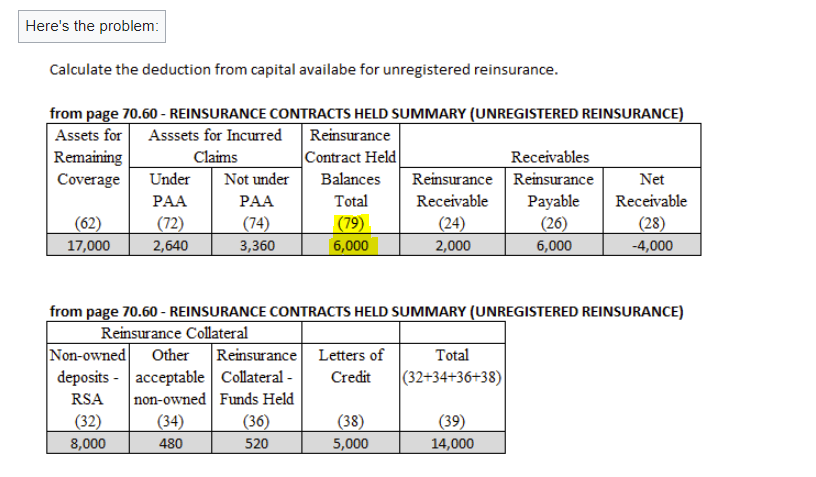

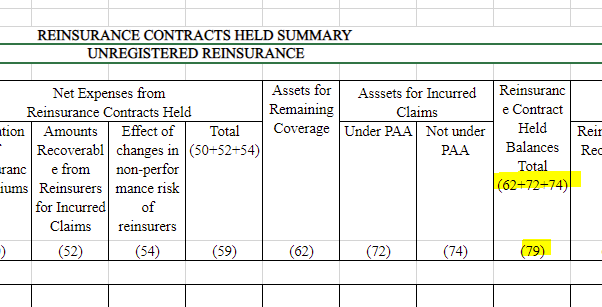

In the wiki page example: (79) = (62) - (72) - (74)

In PC-2, (79) = (62) + (72) + (74)

Will this impact how we link letters A through I to page 70.60? If yes, how should we link them?

Second question:

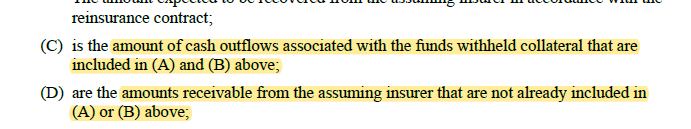

Based on the descriptions of letter C and D, it feels like that column (24) from page 70.60 correspond to letter D. Can you help me understand why column (24) also includes letter C? Thanks!

Comments

Piggybacking off this post to not create a new one with a similar name and questions.

Definition of A: Amount of premiums associated with unexpired coverage on reins contracts held.

Q: Do you have an example of what ARC and AIC (Assets for Remaining / Incurred Covered) are in the context of holding reinsurance? Is this assets that are being held by the primary insurer for the case of a reinsurer not being able to pay? Or is ARC the amount left in the layer of reinsurance that can be used? In which case, wouldn't AIC and ARC be the same?

Definition of B: Ceded claim amounts relating to unexpired portion that the primary insure expects to get back.

Q: What exactly does this look like? I can't picture a scenario where we would be ceding claims for the future portion of the policy.

About the formula for column (79):

Inclusion of C in column (24):

@Staff-T1, can you address the question from @tshute?

Hi,

Yes, for (A) conceptually let's think of it from the reinsurer's point of view. They sell insurance to an insurer and correspondingly have an LRC for unearned coverage and LIC for earned coverage. Now take this LRC and LIC which is a liability on the reinsurer's side and look at it from the insurer's point of view. It is an asset, which is why you call it AIC and ARC. The LRC on the reinsurer's balance sheet would not be exactly equal to the ARC on the insurer's balance sheet due to differences in RA, discounting, expenses, etc but the general concept here is that someone's liability is another person's asset.

(B) is simply the AIC as mentioned above

Thanks, graham, for your detailed answers. Really appreciate your time.

If (B) is the AIC, should (b) be column (72) instead of (79)?

Yes, I've corrected it thanks. And thank you to everyone for their input on getting this section of the MCT reading sorted out.

Thanks @graham and @Staff-T1. This is extremely useful. It may be a good idea to have a list of the definitions or the above examples in the wiki, as this has helped my understanding immensely, both for this reading as well as the IFRS 17 readings.

Hello @tshute

I've added a list of examples and web-based problems for MCT in the "Study Tips" section of that wiki article:

Hope that helps.