Commuted Value of Claims - Fall 2013 Q18

Hello,

Within this example, a reinsurer is entering into a commutation agreement with a primary insurer. Some of the advantages of this transaction for the primary insurer are admin cost savings (no longer have to monitor claims), removes concern of creditworthiness of reinsurer, while the disadvantages are risk of future adverse loss experience and increased capital requirements to support the liabilities.

I am confused as to whether in this case the reinsurer is assuming the liabilities of the primary insurer? Or this transaction at the point where the claims that were previously assumed by the reinsurer being transferred back to the primary insurer?

I find if confusing that the primary insurer has less admin expenses, but higher capital requirements to support the liabilities, for example.

Thanks in advance!

Comments

There are two ways to commute claims:

1. reinsurere commutes BACK to insurer (bringing uncertainty back)

2. insurer commutes (NEW contract) to a reinsurer (bringing certainty).

The entire paragraph above refer to #1. Claims are being commuted back to insurer. This is typically how commutations work. Otherwise it would just be called a new reinsurance contract.

Savings in admin are due to no longer requiring additional reports / financial transactions with reinsurer:

To Commute or Not To Commute, that Is the Question

https://www.irmi.com/articles/expert-commentary/to-commute-or-not-to-commute

Thx chrisboersma. Good answer.

To danielle4nan: I see your confusion. When I first did this problem (a long time ago) I wasn't sure what was happening either. But yes, the reinsurer is giving the claims back to the insurer. The reinsurer also has to pay the primary insurer an agreed upon price to take the claims back, but the mechanics of that are beyond the scope of the syllabus.

Thanks everyone! I appreciate it, I understand now.

Hi Graham, when you talk about "The reinsurer also has to pay the primary insurer an agreed upon price to take the claims back", is that what the margin is?

Thanks!

Not quite. The margin is different from the commutation price. In this problem, the margin is just a cushion when calculating the present value of the claims that are being transferred from the reinsurer back to the primary insurer. The commutation price is the amount the reinsurer pays the primary insurer to be relieved of the liability.

The calculation of the commutation price isn't on the syllabus but just to give a really simplified example:

The primary insurer and the reinsurer would likely agree on a price between $1,000 and $1,200, let's say $1,100.

So they both think they got a good deal monetarily. (Only 1 of them did but we won't know which until the claims are settled.) But there are other benefits to a commutation so in overall terms they probably both got what they wanted.

How can we tell from the question whether the reinsurer is giving claims back to the insurer or vise versa? In the question, the table says "Estimated Payment to Reinsurer", I assumed this meant the the insurer is paying the reinsurer to take the rest of their claims?

I am confused, isn't the commuted value of the claims the commutation price? (The price the insurer thinks the reinsurer should pay to commute their claims back to the insurer)

Thanks

@Staff-T1 @Staff_T2 or @graham

Hi,

I wasn't in the original discussion but here's my 2 cents on this.

There is an error in the question according to the Examiner's report -> so for this specific question, assuming either is fine.

Generally for commutation, assets (cash payment) and liability (future claims) move in the same direction. This means that when you send cash over to someone, you also send over your liabilities and release it to the person receiving the cash. So when you receive a cash payment from a reinsurer, you are also receiving the obligation to handle future claims and vice versa for sending cash over.

You are right for your second point. It's just confusing because the actual wording should be payment from reinsurer

thank you, understood!!

Hello,

@chrisboersma mentioned above that Primary Insurer can commute NEW Claim to reinsurer. Could you please explain further what this mean?

Also, graham mentioned that reinsurer pays commutation price to insurer, which makes sense

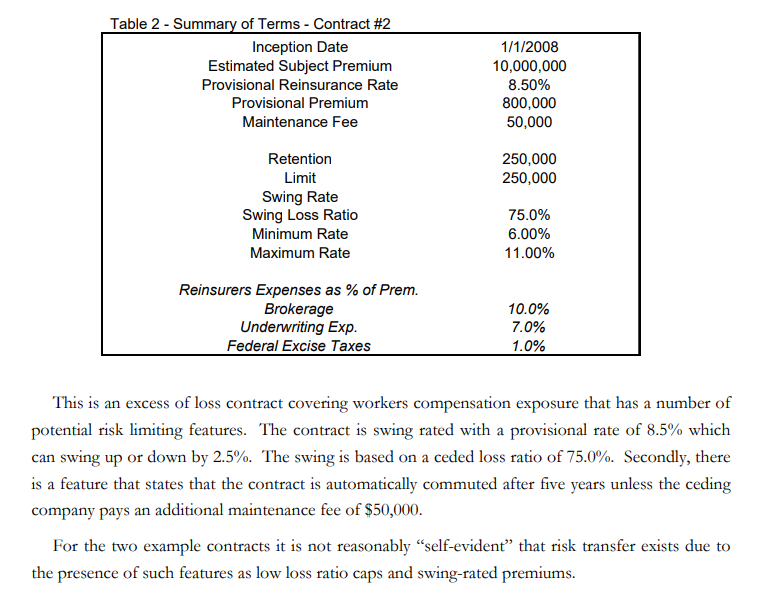

In the Freihault text example below, the contract commutes automatically. To prevent that, the insurer can pays a fee of $50,000. Is that what @chrisboersma meant above?

Thanks,

Andrew

@AndrewL - I sent you a message.

so are you saying this question 2013 F18 is kind of worded incorrectly, because it says "Estimated Payment to Reinsurer". That is the part that threw me off.

Yes, I believe so. The examiners report states: "Because the table in the question incorrectly stated that the payment was to the reinsurer, and not from the reinsurer..."

They did give full marks to candidates who answered correctly, regardless of which way they thought the transaction was moving.

Cases like this are exactly why it's important to state your assumptions when answering questions!