Inconsistency between MSA ratios and current financial returns.

So there have been lots of inconsistencies between MSA ratios and current financial returns, for example:

1. UW. income used in ROR is in P&L previously, but currently we don't have UW. income, we just have TIR, ISR, etc.

2. Net income before tax is another one in P&L previously, we currently have one more item called discontinued operation, do we need to include discontinued operation in the formula of ROA?

3. ....

There are a few more that I'm not gonna list all. I took a look at CAS syllabus and it seems that we are still using MSA ratios 2020. I'm getting confused - I guess in the real exam we will see the new financial returns under IFRS 17, and also the old financial returns items just for calculating MSA ratios purposes...

This is really confusing.

Comments

Yeah tbh I am not sure how it is gonna be handled. Knowing the CAS they'll probably do everything on the new standards and expect you to know how to calculate the MSA ratios on those new financial statements. It's unfair but the CAS is the CAS

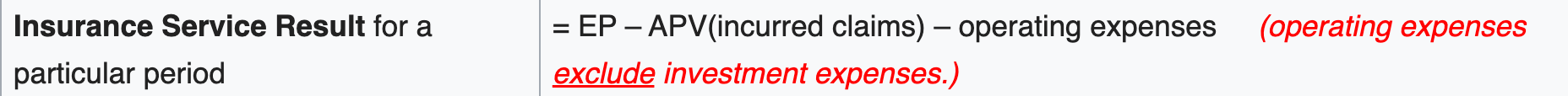

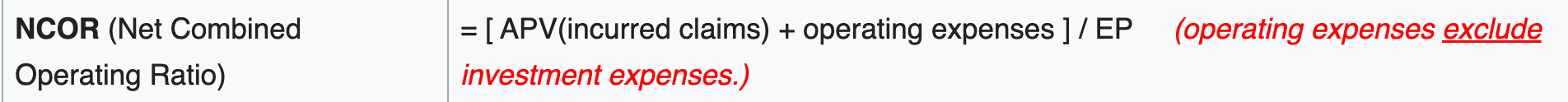

Could you please correct me/fill in the gaps (I've basically taken some ratios and looked if IFRS concepts could be applied there)?

Components needed for MSA ratios:

OLD (IFRS4) -> IFRS17

UW Inc -> ISR

GWP -> TIR

NEP -> ?

NWP -> ?

NetLossReserves - LRC?

Also have another question, this formulas in CCIR.Instructions:

Would the first one be ISR = TIR + NRE - ISE. And the formula above is obsolete?

and the second one use something else but the EP in denominator (like TIR or related)?

Thank you!

Also i wanted to add here,

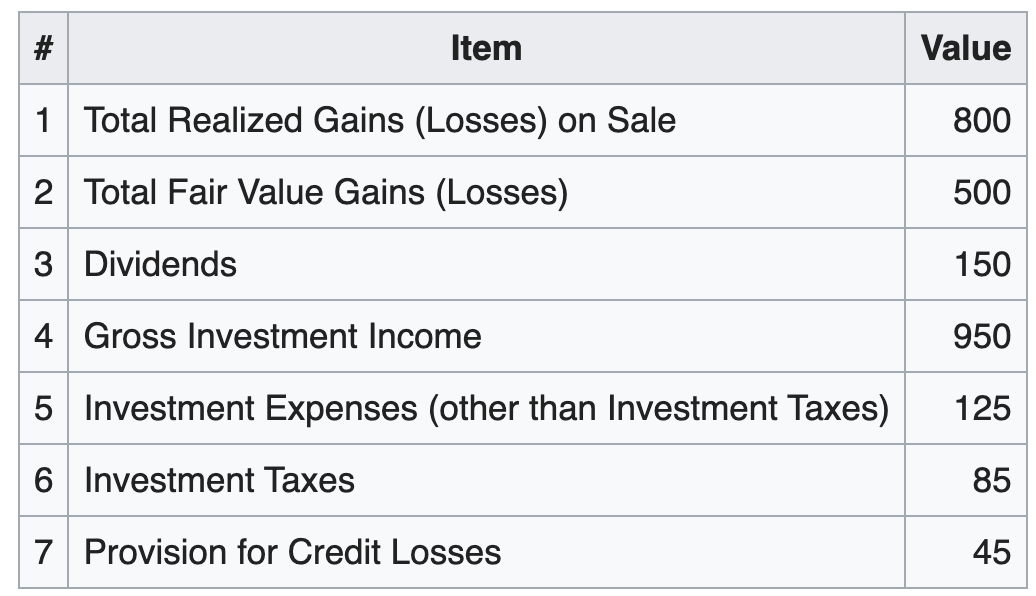

In MSA prior questions i was having troubles with whether Net Investment Income includes/excludes Realized gains, as it's also mentioned here: https://www.battleactsmain.ca/vanillaforum/discussion/44/fall-2017-25-ro

But seems like under IFRS 17 this concept is more clear:

You would just sum first 4 (which has Realized gain) items and subtract items 5-7 to get to Investment Return, and then after few more add ons arrive with Net Investment Result which will be used for calculation of NI

Am i comparing correct things, or am i missing something?

NEP -> Insurance Revenue, while the Net Loss Reserve doesn't really exist anymore but conceptually, it would be LIC - AIC. I do not think there is an equivalent IFRS17 term for GWP and NWP as far as I am aware. The concept of "Net" has really been obfuscated with the LRC/ARC and LIC/AIC introductions.

My guess would be ISR = IR - LIC + AIC - ISE

It is hard to tell without MSA coming up with an updated guide.

For your second question, could you refer me to the place where you found this table?

Thank you for your response,

So if i rewrite it again after your corrections:

UW Inc -> ISR

NEP -> TIR

NetLossReserves ~~> LIC - AIC

I have 2 questions remaining:

For ISR I would believe that this is the only one formula that we're currently save to use (as per formula here: https://battleactsmain.ca/wiki6c/CCIR.Instructions#Statement_of_Profit_or_Loss_-_page_20.22):

ISR = TIR + NRE - ISE, where ISE I believe includes LIC and adjustments to LRC (as per page 60.25 in Quarterly Return (PC2)). Please correct me if i'm wrong.

Would AIC be a reinsurance, or there's more into it?

For my second question sorry i should have mentioned that. The table is under CCIR.Instructions: https://battleactsmain.ca/wiki6c/CCIR.Instructions#Brief_Discussion_of_PC1_-_Core_Return

Thank you!

1.That is correct.

2. AIC stands for Asset for incurred claims. Basically the receivables that you expect from reinsurance

Yes, I think it will be fair to just use NII under IFRS17 for any MSA related questions