Capital Composition Limits

Hello,

Referring to the step by step procedure you wrote out for calculating the Capital Limits;

Wouldn't the step 1 not just include Capital A but also Capital B and C? This is how I see the formula for calculating the limits.

Max of

- 0

- Capital B + Capital C - 40% x ( Capital A + Capital B + Capital C - AOCI - Deductions + CSM )

- C capital - 7% * ( Capital A + Capital B + Capital C - AOCI - Deductions + CSM )

Is this correct?

Comments

Yes, but "Common Shares" would already include category B, and C capital. Category A, B, and C is mixed together on page 20.11. That page doesn't provide a breakdown for different categories of common shares.

No sure to understand, because in the latest examples the capital B and C is included in the "gross capital" while it wasn't before septembre. Is it due to the IFRS update ?

I don't think this calculation hasn't changed.

Ok that might be on me thanks

So we would only add B & C to get the 'gross' capital if we were explicitly given Category A common shares and category B & C separately? Otherwise, just 'common shares' covers category A CS and category B + C also?

I believe that's the case, although that's not explained in the source.

In the excel exercise, the solution does include Capital B and C in the gross capital but you mention that the Common shares is suppose to already include Capital B and C... are we double counting somewhere?

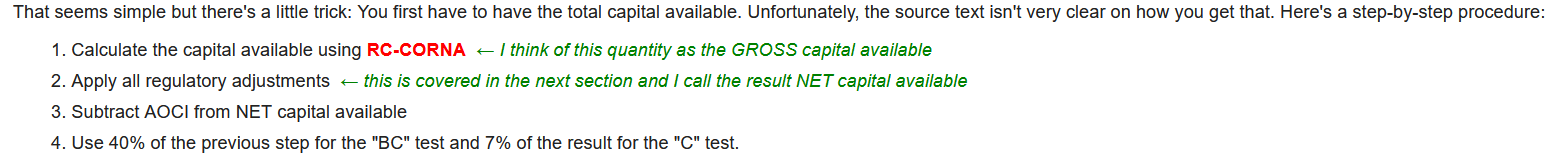

Ok, I just reread what I wrote in the wiki and if I'm being honest, I just don't know for certain. Originally I must have thought that the "Common Shares" listed on the "Liability & Equities" section of the financial statements was specifically Category A because this is what I wrote:

And that was my assumption when I created the example problem above. But after I thought about it some more, I came to a different conclusion. If Common Shares did not include Category B & C capital, then it seems you can't calculate Capital Available from the financial statements and that does not seem reasonable.

But then I remembered a couple of exam exam problems. They are from the pre-IFRS17 version of the reading, but most of the material from the source text on Capital Available did not change and in this problem, Common Shares did not include Category B & C capital. The solution considered Common Shares, and Category B & C capital as separate components.

The other exam problem where you had to calculate Capital Available and check for the BC limit was:

Conclusion:

Sorry, I can't provide a definitive answer. I strongly suspect you'd be given Capital Available but if not, follow the procedure in this exam problem from 2019-Fall:

Of course, that still leaves your very first question right at the top of this discussion unanswered. I guess if the assumption is that Common Shares don't include Category B & C capital then you can't calculate Capital Available from the financial statements (unless Category B & C capital are listed somewhere else, but the CCIR instructions do not mention B & C capital.) In that case, the procedure you outlined for checking the BC limit would be correct and the first step in my step-by-step procedure would have to be changed.