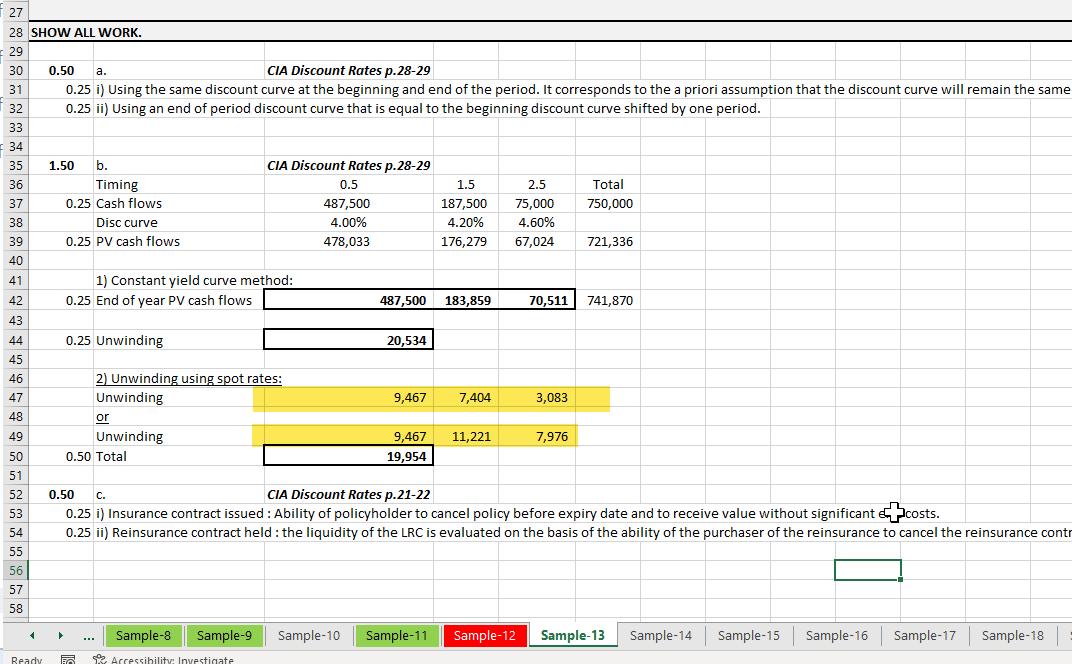

CAS IFRS17 Sample Question #13b

Hi there,

The question asks you to solve for unwinding of discount using constant yield curve method, and am struggling to understand the discount period in the highlighted section of the screenshot:

Shouldn't the "End of year PV cash flows" be measured as of 2024-12-31? In that case, we would have the following CFs:

Maturity 0.5 --> 487500 x (1+0.04)^0.5

Maturity 1.5 --> 187500 / (1+0.04)^0.5

Maturity 2.5 --> 75000 / (1+0.04)^1.5

Thank you in advance!

Comments

End of year CFs are measured at times 0.5,1.5 and 2.5. This is because we are calculating the unwind of the discount. For example, just looking at the claim incurred at time 0.5, you will have half a year of discounting at time 0. Thus, when you unwind, you should also unwind half a year of discount.

Anyways, your calculation above doesn't make sense -> What you are showing is a negative discount

I am still very confused by these two methods. Constant yield curve method is using the same discount curve at the beginning and end of the period. so when the timing is 0.5, is beginning period is 0?

For this example, beginning of the period is time 0. An unwind is just basically calculating the PV at time 1 minus the PV at time 0.

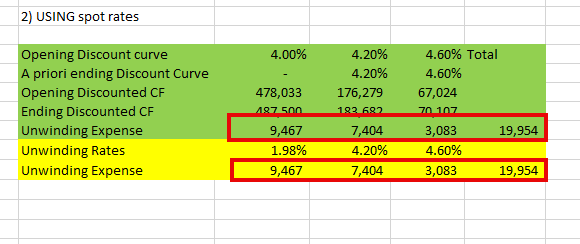

Hi , I have a question about the spot rate calculation: why is the sum of the total below different, are they mistake in the second calculation for unwinding expense?

Its a different method of unwind - You wouldn't expect them to be the same

Hi, I think the total of the 2 methods should still be the same even when using different methods:

I am not sure what you are asking here. Could you clarify? The usage of the three different methods of unwind will lead to a different unwinding expense. The sample discount rate file on the CIA website (Not the IFRS17 sample questions) makes this clear on tab 6.

@JChua Can you post how you got those calculations?

@BattleActsTeam It appears that in this IFRS17 sample questions, row 47 & 49 would yield a different response (BOTH under method 2: Spot Rates) - isnt this incorrect? No matter the method of reaching the response we should be able to get there in the same way.

Sure, I attached my file. Exactly what emilia said.

Oh I see what you mean. The CAS is just calculating the unwind for one period, and for the second approach, they are calculating a complete unwind and are showing they will accept both answers. That's what I think anyways