Loss Component under PAA

Under IFRS_LRC reading, LC is calculated as:

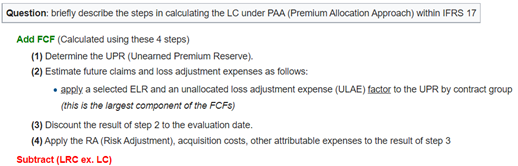

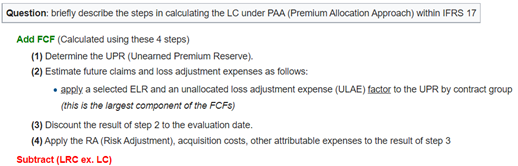

Under IFRS_PAA reading, LC is calculated as:

Can you please help me understand how the two reconcile.

It looks like you're new here. If you want to get involved, click one of these buttons!

Under IFRS_LRC reading, LC is calculated as:

Under IFRS_PAA reading, LC is calculated as:

Can you please help me understand how the two reconcile.

Comments

The only difference between the GMA and the PAA is the existence of a CSM/LC. Without it, you will have GMA = PAA. I think this will answer your second point

Two questions from the above thread:

Q1: I still don't understand the explanation above

Q2: Does "D" (highlighted in green) in the below screenshot equal to loss component? If so, why does the procedure from a225khan's screenshot not reconcile with the link to the FCF example (highlighted in yellow)

Q1: What don't you understand about the statement?

Q2: Why do you say it does not reconcile? The FCF here represents the LRC using the GMA method

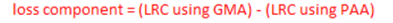

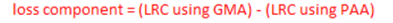

Q1: LRC using PAA = LRC ex LC + LC, putting it into the equation of loss component = (LRC using GMA) - (LRC using PAA) means:

loss component = (LRC using GMA) - (LRC using PAA) = FCF - (LRC ex LC + LC) = FCF - LRC ex LC - LC, so its not reconciling

Q2: I see, the future cashflow = expected liability = UPR * ELR

Your LRC using PAA should be (UEP - DAC) here not LRC ex LC + LC.

Also note, UEP - DAC = LRC ex LC

LRC ex LC + LC = GMM LRC = PAA LRC, but only for onerous contracts.

To find the loss component, you first calculate the GMM LRC and subtract it from the PAA LRC assuming it is not onerous.

Maybe it would be good to clarify in the PAA reading that it is the LRC using PAA assuming the contract is non-onerous @graham

This is very helpful, thanks!

@Staff-T1: Is this where you mean?

Yes!