CIA.IFRS17-PAA

Reading: Assessing Eligibility for the Premium Allocation Approach Under IFRS 17 for Property & Casualty and Life & Health Insurance Contracts (28 pages)

Authour: Canadian Institute of Actuaries

BA Quick-Summary: IFRS17 Premium Allocation

|

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 4.1 Section 1: Introduction

- 4.2 Sections 2-8: Details on Assessing PAA Eligibility

- 4.2.1 Section 2: Decision Points

- 4.2.2 Section 3: Coverage Period Considerations

- 4.2.3 Section 4: Assessing “would not differ materially”

- 4.2.4 Section 5: Significant Variability in the Fulfilment Cash Flows

- 4.2.5 Section 6: Onerous Contracts

- 4.2.6 Section 7: Reinsurance

- 4.2.7 Section 8: Subsequent Assessments of Similar Contracts in New Groups

- 4.3 Appendices

- 5 POP QUIZ ANSWERS

Pop Quiz

Study Tips

This reading overlaps with CIA.IFRS17 and expands on the material from: Section 5: Measurement Approach for LRC. Recall that LRC (Liability for Remaining Coverage) can measured using GMA (General Measurement Approach) or the simpler PAA (Premium Allocation Approach).

The previous reading, CIA.IFRS17, already covered basic eligibility requirements for being able to use the simpler PAA versus GMA. This reading goes into more detail and provides a numerical example in Appendix A for determining PAA eligibility. That's what you should focus on.

Estimated study time: ½ day (not including subsequent review time)

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

In Plain English!

Section 1: Introduction

The introduction for this reading is actually pretty good, and I think you should read it. Pay attention to the text under the highlighted paragraphs. The GMA approach is labeled 32 and the PAA approach is labeled 55. Here's a direct link:

Recall that we used the GMA for calculating LIC in this example from CIA.IFRS17-DR. Here we're using the PAA to calculate LRC. If you opened the link above and read the introduction (Alice really hopes you did!) then you should be able to answer the following questions:

Question: describe the carrying amount for LRC using PAA for non-onerous groups (calculated at initial recognition)

- premiums received (at initial recognition)

- minus acquisition cash flows at that date (unless already expensed)

- plus any assets for acquisition cash flows derecognized minus liabilities previously recognized

Information in this box is DELETED: (Based on a reading that was removed from the syllabus.) Compare this description to the PAA LRC formula given in Section 5: Measurement Approach for LRC, which was:

- LRC = UEP – (premiums receivable) – DAC

This formula doesn't seem to match the verbal description above but I think that's because the verbal description is the value of LRC at initial recognition, whereas the formula works at any point in time. That's why it starts with UEP instead of premiums received. (At initial recognition, premiums received would equal UEP.)

Question: identify differences between GMA and PAA for calculating LRC

- PAA is simpler

- PAA doesn't required estimation of FCFs (Fulfillment Cash Flows)

- PAA doesn't require a CSM (Contractual Service Margin)

You can review FCFs and CSM in the IFRS 17 Overview.

Sections 2-8: Details on Assessing PAA Eligibility

These sections seem far too detailed for a reasonable exam question. We're going to quickly cover the main points in these sections then move on to the calculation examples in the appendices. I think portions of the appendices are far more likely to be a source of exam questions.

Section 2: Decision Points

The eligibility criteria for using PAA instead of GMA were covered in Section 2: CIA.IFRS 17 - Valuation Methods under IFRS 17. Alice recommends memorizing those criteria. The source text also mentions that the eligibility criteria are not met if an insurer expects significant variability in the fulfilment cash flows. Keep that in mind. It could be important.

Section 3: Coverage Period Considerations

For the purposes of the exam, the coverage period should be obvious and as noted in the previous section, PAA can automatically be used when the coverage period is ≤ 1 year.

- Example: If each contract in a group of contracts has a coverage period of ≤ 1 year, is this group PAA eligible.

- yes

- Example: Each contract in a group of contracts has a coverage period of > 1 year, is this group automatically inelgible?

- no, it could still be PAA-eligible if PAA does not produce a materially different result from GMA

Section 4: Assessing “would not differ materially”

This is an important question but it's easier to explain with an example as shown in the appendices. Nonetheless, there are a few general general concepts worth noting. The general topic of materiality is covered in CIA.Mat and this is a specific application of the materiality concept. Recall the second eligibility requirement for PAA:

- can be used for longer-duration contracts IF PAA is a reasonable approximation to GMA over the life of the contract

But how do you determine that? One way is to measure LRC using both PAA and GMA then directly verify they are close. But that defeats the advantage of PAA! (If you have to do the measurement both ways, you might as well just use the more accurate GMA.) Instead, the actuary must make an informed judgment based on quantitative and qualitative considerations that would not involve direct comparison to the full GMA approach.

- Alice sometimes does the PAA and GMA calculation for a single reporting period. If the results are close, that increases her confidence. This is a quantitative assessment.

- She may also do a qualitative assessment. If she has already done a full GMA for a similar group of contracts and found that it does not differ materially from the PAA assessment on that group, that would further increase her confidence that the PAA does not differ materially for the group currently under consideration.

Section 5: Significant Variability in the Fulfilment Cash Flows

There is no explanation of "significant variability in fulfilment cash flows" in IFRS 17 itself. The source text discusses ways variability can be assessed but it seems to detailed and too vague to make for a good exam question.

Section 6: Onerous Contracts

That key fact for onerous contracts is:

- for onerous contracts eligible for the PAA: LRC based on PAA is increased to reflect a loss component

This is covered in the example from the Appendix A further down. Accordingly, the PAA estimate for an onerous group is, by definition, equal to the GMA estimate at inception.

Section 7: Reinsurance

There is no difference between primary insurance and reinsurance contracts issued with regards to the PAA eligibility.

Section 8: Subsequent Assessments of Similar Contracts in New Groups

In practice, a quantitative test may not be required for each subsequent group of contracts if the entity has already performed quantitative calculations for similar groups of contracts with substantially the same characteristics. If the previous group passed the PAA eligibility test, then the current "similar" group can be assumed to also pass.

Appendices

Of the 3 appendices A, B, and C, Appendix A seems the most relevant because it has examples of determining PAA eligibility. Appendices B & C go too deeply into details of the differences between PAA and GMA and do not seem like good sources for exam questions. (If you feel uncomfortable skipping B & C, please refer to the source text.)

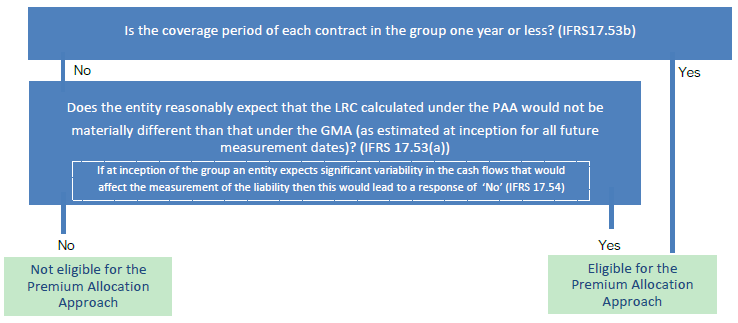

Section 2 of the reading shows the following decision tree determining PAA eligibility: (It's just a visual way of applying the PAA eligibility requirements)

The first decision point involves checking the coverage period for each contract with a group. The full example in the appendix calls this Threshold #1, and it follow directly from the basic PAA eligibility criteria for PAA which we've already covered. If the coverage period is ≤ 1 year for each contract in the group then the group is eligible for PAA. That means you're permitted to calculate LRC using the simpler PAA approach instead of the more complicated GMA approach. Easy. And if the group doesn't contain any onerous contracts, you're done. If the group does contain onerous contracts, you must add a loss component to the PAA estimate of LRC. This loss component equals the difference between the PAA and GMA estimates of LRC.

Example 1: If each contract in a non-onerous group of contracts has a coverage period of 1 year, is this group eligible for PAA?

- Yes, and a loss component is not required.

Example 2: If each contract in an onerous group of contracts has a coverage period of 1 year, is this group eligible for PAA?

- Yes, and a loss component is required.

Unfortunately, the full example in the appendix has a step that is not specifically covered in this decision tree. This extra step is referred to as Threshold #2. It states that if the revenue for a group is ≤ 1% of the total company revenue then the group is PAA eligible. My assumption is that this threshold is based on actuarial judgment. In particular, the actuary has judged that if the revenue for the group is small enough then the PAA estimate of LRC would not be materially different from the GMA estimate, although no explanation seems to be given.

The next decision point specifically asks whether the PAA estimate of LRC is materially different from the GMA estimate on an absolute basis, and this is referred to as Threshold #3. If the difference is small enough then the group is PAA eligible. In the example, this is determined by calculating both the LRC and GMA estimates and testing whether the difference is less than a certain amount. This amount is the group's share of the aggregate materiality threshold of $5 million. This aggregate threshold of $5 million is not explained - it's part of the given information. The group's share of this threshold is based on the group's loss ratio as explained in the example below.

| If a group of contracts satisfies at least 1 of these thresholds then the group is PAA eligible. |

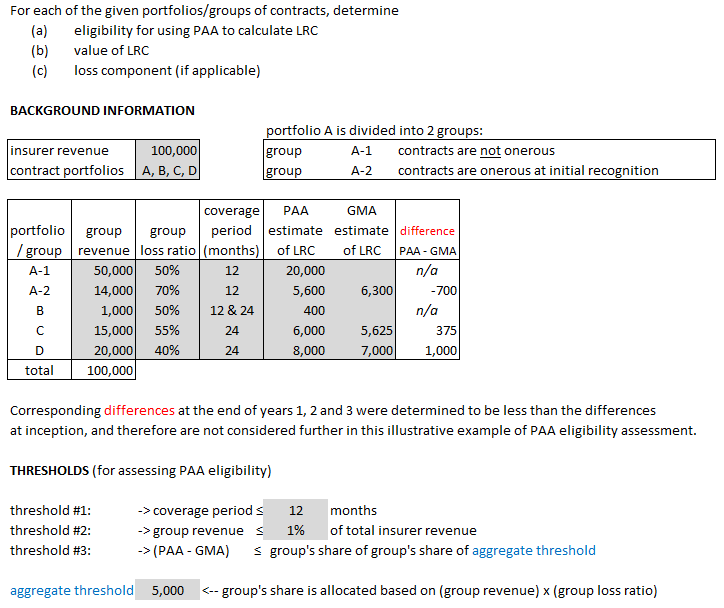

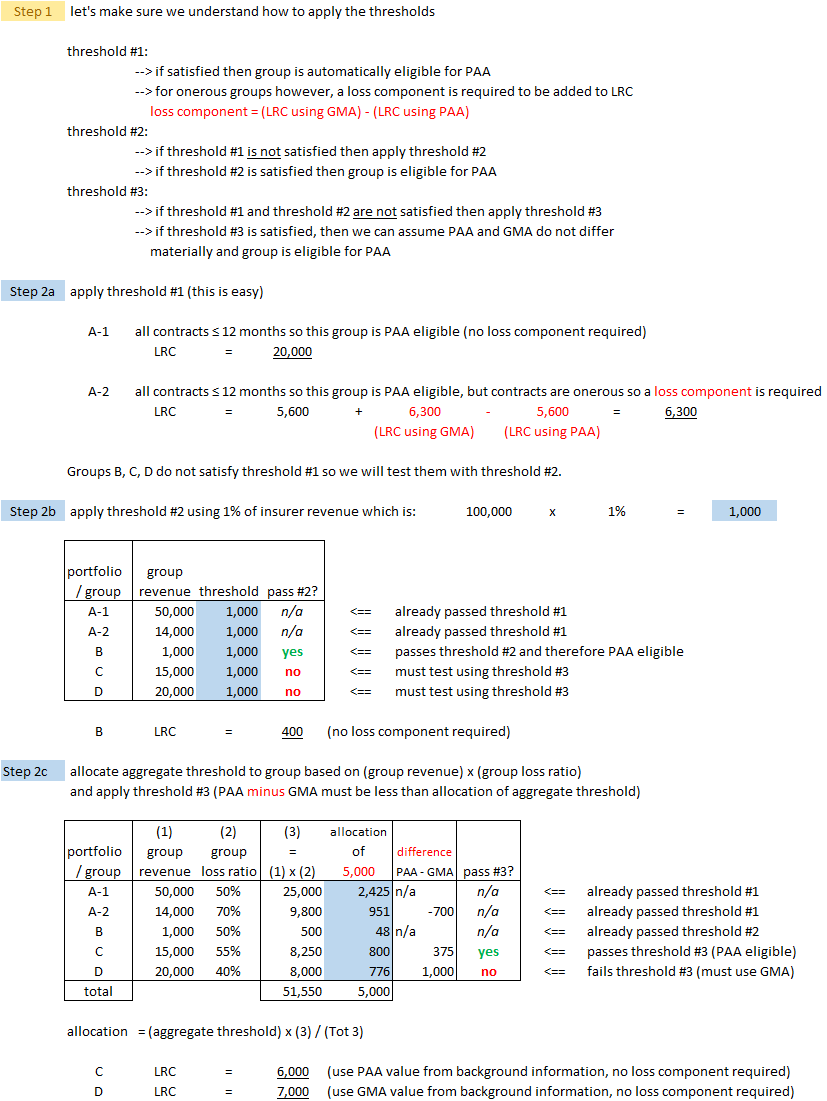

Here's the example from the text but I put it into my own words. I found it a little confusing and it helped a lot to rework it my own my way in Excel.

| Here is the question and given information for the text example... |

| Here is the solution... |