CIA.FCT-1

Reading: Canadian Institute of Actuaries, “Draft Educational Note: Financial Condition Testing,” April 2020. CIA FCT 1

Authour: Canadian Institute of Actuaries

BA Quick-Summary: FCT 1

|

Pop Quiz

Study Tips

Don't be scared by the fact that this reading is 51 pages. It is not difficult and although it looks like there's a lot to memorize, you can cover it quickly. It's really just an update of a reading that has been on the syllabus for many years. If you're interested, you can glance at the old wiki article: Dynamic Capital Adequacy Testing. Even though the name of the reading was changed to Financial Condition Testing, the new exam questions will likely be similar to past exam questions.

Warning: Even though the new exam problems are likely to be similar, some of the answers will be different. For example, there have been important changes to the criteria for satisfactory financial condition.

Anyway, this is a reading that people normally score pretty good points on. You can check out average scores by question in the Exam Summaries. This material is often combined with other readings like OSFI.MCT, OSFI.Stress, and going forward, probably OSFI.ORSA. One of the changes in this new version is that it's more integrated with ORSA (Own Risk Solvency Assessment). The OSFI.ORSA reading is very short and it might help to spend 10-15 minutes reading through it just to get familiar.

By the way, I'm 99.9% sure that Appendix A is not on the syllabus because it covers life insurance risk categories. The material you need to know is in Appendix B on P&C risk categories. (Appendix A is not listed as an exclusion in the official CAS Exam 6-Canada syllabus but that appears to be an oversight because it was excluded on previous syllabi.)

The BattleQuizzes do not include old exam problems because all the old exam problems are from the outdated DCAT reading. You can look at the ones that aren't outdated by clicking on the links in the BattleTable.

Estimated study time: 1-2 days (not including subsequent review time)

BattleTable

No past exam questions are available for this new FCT reading.

But based on past DCAT exam questions, the main things you need to know (in rough order of importance) are:

- adverse scenario: examples, ripple effects management actions

- evaluating the financial condition of an insurer

- how to select adverse scenarios

- steps in the FCT process (especially the base scenario)

- definition of reverse stress-testing

- definition of social inflation

Outdated → questions highlighted in orange are outdated because they use the old definition of satisfactory financial condition.

reference part (a) part (b) part (c) part (d) E (2019.Spring #19) DCAT process:

- base scenariofinancial condition:

- evaluateadverse scenario:

(c) management actions

(d) ripple effects(e) CIA.Subseq E (2018.Fall #20) base scenario:

- identifybase scenario:

- vs business planadverse scenario:

(c) example

(d) management actions(e) CIA.Mat

(f) financial condition: evaluateE (2018.Spring #19) define: 4

- Plausible Adverse Scenarioadverse scenario:

- propose & justify 2adverse scenario:

- ripple effects 2financial condition:

- evaluateE (2018.Spring #24) SCENARIO:

- identify AA errors 3E (2017.Fall #22) financial condition:

- evaluatedefine:

- social inflationadverse scenario:

- off-B/S riskE (2017.Fall #23) define: 4

- Plausible Adverse Scenarioadverse scenario:

- premium volumeE (2017.Spring #21) PAS:

- how to selectE (2016.Fall #19) DCAT process:

- base scenariofinancial condition:

- evaluateadverse scenario:

- frequency & severityadverse scenario:

- policy liabilities misestimationE (2016.Spring #21) base scenario:

- identifyadverse scenario:

- exampleadverse scenario:

- impact on MCT ratioadverse scenario:

- management actionsE (2015.Fall #20) PAS:

- how to select 5adverse scenario:

- ripple effectsadverse scenario:

- management actionsfinancial condition:

- comment (see OSFI.MCT)E (2015.Spring #29) financial condition:

- evaluateadverse scenario:

- variousdefinition & examples:

- social inflationE (2014.Fall #26) define:

- reverse stress-testingE (2014.Spring #25) DCAT filing:

- actuary's actionsDCAT base scenario:

- cash injectionDCAT PAS:

- cash injectionE (2014.Spring #27) define:

- reverse stress-testingE (2014.Spring #28) financial condition: 1

- evaluateadverse scenario:

- OSFI interventionadverse scenario:

- premium riskadverse scenario:

- frequency & severityE (2013.Fall #29) DCAT process:

- base scenariofinancial condition:

- evaluateadverse scenario:

- premium riskadverse scenario:

- policy liabilities riskE (2012.Fall #29) financial condition:

- evaluate

- 1 This problem relies on an invalid assumption.

- 2 This is a GREAT PROBLEM. Make sure you study it thoroughly.

- 3 This is a good Bloom's Taxonomy problem for learning the DCAT process. It's listed under mini BattleQuiz 7 under old exam problems, but it relates closely to the DCAT "method" discussed here.

- 4 The definition of plausible adverse scenario in the examiner's report is outdated.

- 5 See this forum thread for an explanation of how capital available is adjusted.

In Plain English!

Introduction

Financial Condition Testing or FCT is one several stress-testing processes within an insurer’s overall risk management process. The first goal of FCT is to identify threats to the insurer's financial condition. The second goal is to take corrective actions to address those threats. (It should be performed at least once during each financial year.)

Note that FCT is closely related to ORSA (Own Risk Solvency Assessment), which has it's own reading OSFI.ORSA. The stated goal of ORSA is to enhance an insurer's understanding of the relationship between risk profile & capital needs. We will see below how ORSA and FCT are connected but first let's answer a couple of basic questions.

Question: why does an insurer perform stress-testing [Hint: risk-complement-Cap-Liq]

- risk: risk identification & control (stress-testing helps identify and control risk)

- complement: stress-testing complements other risk management tools such as Best's Capital Adequacy Ratio as described in BCAR.Cdn2018 and BCAR.Cat (may also involve simulation of shocks like earthquakes)

- Cap: stress-testing supports capital management

- Liq: stress-testing improves liquidity management

The above question has appeared on old exams several times. Memorize it! See BattleTable for OSFI.Stress for links to exam questions where this was asked. The BattleCards in quiz 1 have a few more details related to the above bullet points. Sorry for putting new material in the BattleCards – I didn't want to clutter up the wiki.

It is essential that the board of directors or chief agent and senior management are involved in the determination of the stress scenarios and understand the key findings of the stress tests to develop and implement risk mitigation strategies. Risk concentration would be considered throughout the stress-testing process

Question: what are the key elements of FCT [Hint: BACRO]

- Base scenario - must develop a base scenario (this is basically the insurer's current business plan)

- Adverse scenario - must develop multiple adverse scenarios (Ex: hurricane, drop in stock market, COVID, climate change, one of Alice's legendary all-night dance parties)

- Corrective action - identification and analysis of corrective management actions to mitigate risks

- Report - submit recommendations to management and the board of directors (or chief agent)

- Opinion - Appointed Actuary signs an opinion regarding the financial condition of the insurer

In my mind, I hear the hint as bake-ro as in 'bake' the FCT cake. (Worst cake flavour ever.) You might not be asked to list these steps on the exam but you should still know them. You will however have to memorize the definitions of the different kinds of scenarios. These are covered further down.

Method

Process & Approach

FCT is used for risk identification and control. ORSA enhances an insurer’s general understanding of the interrelationships between its risk profile and capital needs. FCT and ORSA are closely related although ORSA is more comprehensive in nature. To perform FCT, it is necessary to understand:

- regulatory capital minimum(s)

- insurer's internal target capital requirements ← determined by ORSA

This will be more clear when we will look at a numerical example.

The source text has a subsection called "Approach" that elaborates on BACRO (the 5 key elements of FCT.) In particular, there is a preliminary step where the actuary would review company operations for recent years and the financial position at the end of each year. There is also an extra step at the end to identify possible regulatory action. So if we wanted to, we could add both the preliminary and extra steps to our memory trick to get: rev-BACRO-reg where "rev" stands for "review" and "reg" stands for "regulatory.

Definitions

The rest of the "Method" section in the source text covers a bunch of definitions that you have to memorize. Sorry, sometimes these are asked on exams. On your first pass, just read through them so you can follow the rest of the reading. You can come back later to do the actual memorization.

Alice will bring you a 🍩 from Timmy's when you're done. :-)

what is a review of operations and financial position

- review balance sheet, statement of income, and source of earnings for an appropriate number of years

- analyze any trends in these numbers

what is the forecast period for FCT

- the forecast period should be long enough to capture [1] risk emergence, [2] financial impacts, [3] ripple effects (defined further down), and [4] corrective action

- generally 3-5 years although there is no minimum, as some risks evolve over a longer period such as climate change (should also be consistent with ORSA)

how do you determine the materiality standard for FCT

- see definition of materiality from the CIA reading on materiality

- see company characteristics and intended users for general information on setting materiality standards

- FCT sets the materiality standard with management input and by specifically considering: size of insurer, financial position, nature of regulatory test

define the terms base scenario, adverse scenario, solvency scenario, going-concern scenario

- base scenario: a set of assumptions on risk factors that are consistent with the business plan over the forecast period (if plan is realistic & consistent)

- adverse scenario: a scenario that is developed by stress-testing assumptions used in the business plan, looking specifically for risk factors that threaten financial condition

- solvency scenario: a plausible adverse scenario (an adverse scenario that has a non-trivial probability of occurring)

- going-concern scenario: an adverse scenario that is more likely and/or less severe than a solvency scenario, and could include risks not considered in solvency scenarios

- (intended to measure insurer's ability to maintain operations and meet its obligations while meeting or exceeding regulatory minimum levels)

- → side note 1: it's recommended that a going-concern scenario falls above the 90th percentile on the loss distribution (if the distribution is available)

- → side note 2: it's recommended that a solvency scenario falls above the 95th percentile on the loss distribution (if the distribution is available) and possibly as high as the 99th percentile and beyond depending on circumstances

what is a ripple effect

- an event that occurs when an adverse scenario triggers a change in 1 or more inter-dependent assumptions

- ripple effects can include many things like policyholder actions, management's routine actions, regulatory actions,...

- Example: a ripple effect of an earthquake may be loss of reinsurance (non-renewal)

what is a corrective management action (oxymoron? ← joke)

- an action management takes to mitigate adverse ripple effects

- Example: management may seek alternate reinsurance arrangements if reinsurance is lost due to a large claim from a severe earthquake

- → my definition is a paraphrased version of the definition...

- → there is a forum discussion on the definition of corrective management action that you should read (if not now, then come back later!)

what is an integrated scenario for FCT

- a scenario created by combining two or more risks factors to produce a new plausible adverse scenario

- Example (general): combine a low-probability scenario with a higher-probability adverse scenario

- Example (specific): climate change

Climate change integrated scenario (NEW): identify considerations in the development of a climate change scenario [Hint: PTL]

- Consider these climate-related risks:

- Physical risk: frequency and severity of wildfires, floods, wind events, rising sea levels

- Transition risk: due to economic shift to greener technologies

- Liability risk: exposure to climate-related litigation

- (The discussion of climate-related scenarios is actually from the new version of CIA.FCT-2 but I put it here so you don't have to refer to CIA.FCT-2.)

IFRS 17 Update #1

The next topic is new for 2023-Fall. Scan the question and answer below then read the brief discussion further down.

IFRS 17 Considerations (NEW): Identify specific examples of IFRS 17 measurement features to consider when creating FCT scenarios.

- IFRS 17 liabilities make no provision for:

- default risk

- reinvestment risk

- asset-related risks

- IFRS 17 liabilities make no provision for:

- IFRS 17 liabilities only include maintenance expenses directly attributable to administration of contracts

- IFRS 17 liabilities do not reflect certain benefits such as:

- impact of discounting arising from deferred tax assets

- impact of discounting arising from risk premiums that are deducted in determining discount rates

- IFRS 17 liabilities do not reflect certain benefits such as:

- Risk adjustment incorporates the entity’s view of risk and...

- may incorporate diversification benefits not realized in adverse scenarios

- Risk adjustment incorporates the entity’s view of risk and...

- IFRS 17 liabilities includes the CSM when evaluating solvency scenarios (see FCT Reporting for further details)

Brief Discussion:

- An exam question on this new IFRS 17 material would likely be a list-type memory question as given above.

- They would likely ask you to list 2 or 3 measurement features to be considered when creating FCT scenarios.

- Here are the 3 I would memorize if I were studying for this exam again:

- IFRS 17 liabilities make no provision for default risk.

- IFRS 17 liabilities do not reflect certain benefits such as impact of discounting arising from deferred tax assets.

- IFRS 17 liabilities include the CSM when evaluating solvency scenarios.

- If you were actually creating a model scenario, you would have to incorporate more than these 3 items, but creating a model seems way to complex for an exam question (and has never been asked before.)

- Typically, exam questions give you the model results and merely ask you to determine whether the insurer is in satisfactory financial condition. (See further down for how this is done.)

END of IFRS 17 Update #1

Modeling

This section on modeling was not heavily tested in the old CIA.DCAT reading but there was one relevant exam problem from 2018.Spring that we'll look at further down.

The purpose of any model is to portray, on a simplified level, a process occurring in the real world. You can click to review the general definition of a model according to the reading CIA.Models. In any case, an FCT model should reproduce certain key elements of the Financial Statements:

- balance sheet: includes assets, liabilities, retained earnings

- income statement: includes revenue & expenses

- regulatory measures of capital adequacy: MCT ratio, and possibly others like BCAR and MSA ratios

- sources of earnings: includes detail on sources of premium and investments

This is all common sense. The text also states that the actuary should verify the validity of the model by checking that this equation holds:

- statement of income = (cash flows) + (change in balance sheet items)

Another way to check the validity of an FCT is to check projections of the base scenario. In the absence of significant changes in the insurer's operations or in the insurance environment, the model's projections should exhibit continuity from one year to the next. For example, Given cash-on-hand for the base scenario of models 1 & 2, which model is more likely to be valid?

Model Latest Year Projection Year 1 Projection Year 2 Projection Year 3 Model 1 - Base Scenario (Cash) 20,000 20,800 21,600 22,400 Model 2 - Base Scenario (Cash) 20,000 18,225 23,125 15,800

The answer is that Model 1 is more likely to be valid because the cash in Model 1 is smoothly increasing whereas in Model 2, it is erratic. So, the first thing to look for when validating a model is whether the base scenario exhibits continuity of results from year to year. Just so you know, this topic connects with Choice of Model from the CIA.Models reading but I don't think you need to worry too much about that right now. (There are a few other validation items in the next quiz. Sometimes I get complaints about putting new material in the BattleCards but some of this material on modeling is so unlikely to be asked on the exam and I didn't want to clutter the wiki with useless junk.)

Anyway, part (a) of the following exam problem is similar to the previous example. See if you can do it. It is pretty easy.

- E (2016.Spring #21)

Remember, I put some factoids in the quiz that are not in the wiki. Based on the types of questions asked in the past from the old CIA.DCAT reading, I don't think they are likely exam questions but I didn't want to leave them out completely.

IFRS 17 Update #2

The source text added a section on aspects of IFRS 17 that need to be considered when modeling FCT scenarios. Some of this isn't going to make sense until you've covered the IFRS wiki articles, so for now just scan it quickly. You can return later.

This section is very general as there are no examples to illustrate these concepts. For that reason, any exam questions on the topic will likely be a list-type memory question. Here are some introductory comments:

For the General Measurement Approach (GMA) and the Variable Free Approach (VFA):

- → IFRS 17 accounting involves a new concept - the Contractual Service Margin or CSM. (This is explained in detail in the IFRS 17 wiki articles)

- → Changes in CSM influence earnings and capital, with corresponding effects on regulatory capital ratios and taxes, which is why it must be considered in FCT scenarios.

For the Premium Allocation Approach (PAA):

- → There is no CSM but a Loss Component (LC), must be included for onerous contract, and this cannot be offset by future profits so careful consideration must be given to the level of aggregation in an FCT scenario.

The source text then provides a bullet point list of 10 additional items regarding IFRS 17 that must be considered. I've picked out 4 simple ones that might be a good idea to memorize. (You can refer to the source text for more detail but I'm not sure it's necessary.)

- The impact of adverse scenarios on onerous groups is not absorbed by the CSM - it will be reflected in earnings immediately.

- Modelling will need to capture the behaviour of groups of contracts rather than individual contracts

- Groups of reinsurance contracts are modeled separately from the underlying primary insurance contracts issued.

- The business volume forecast requires sufficient granularity to model the timing of recognition of new cohorts.

END of IFRS 17 Update #2

Reporting

Alice stayed up all night writing her FCT report.

Question: why did she bother??!!

- because her mean boss told her to

- also because that's part of how an actuary communicates the state of the company to the BoD (Board of Directors) and includes

- → identification of risks to the insurer's financial condition

- → identification of ways to mitigate and reduce risk

Readers of the report may also include management and regulators, but they would get a more detailed statistical report than the Board of Directors. The report to management may include details related to operations. The report to regulators would likely focus more on solvency.

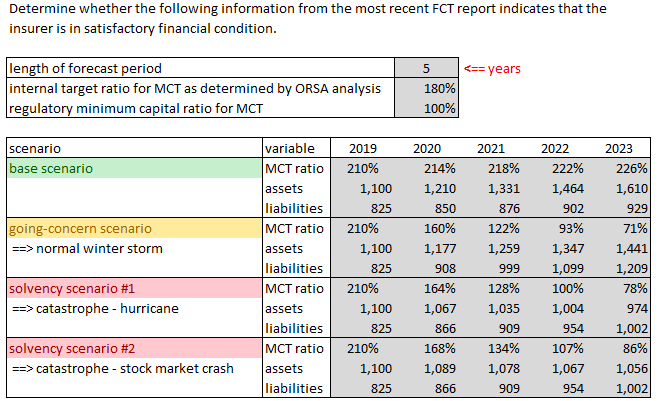

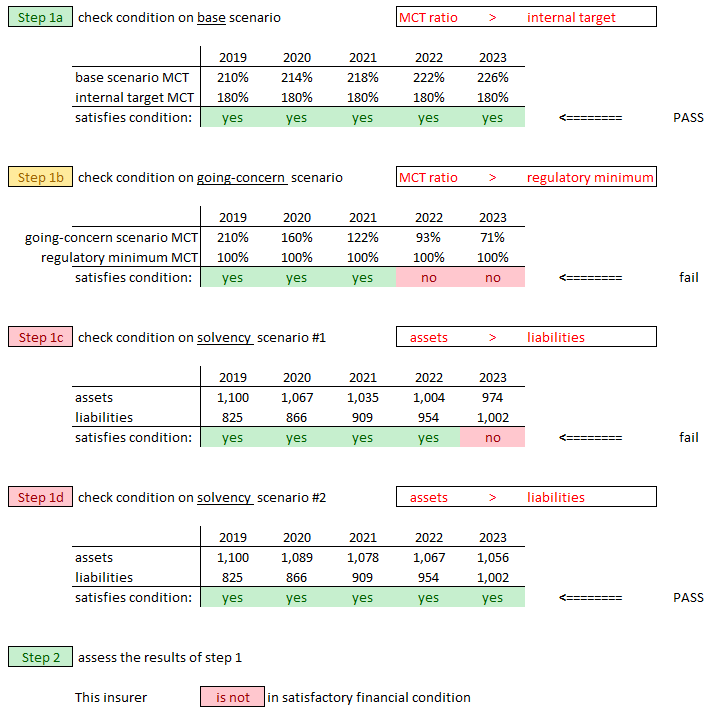

| Most important item in the FCT reading!! → when can the actuary report that the insurer is in satisfactory financial condition |

- The following conditions must hold throughout the forecast period:

- [1] under the base scenario insurer meets its internal target capital ratio(s) as determined by the ORSA

- → in practice this may be MCT ratio > 180% (180% is just an example and would vary based on insurer and circumstances)

- [2] under the going-concern scenarios → insurer meets the regulatory minimum capital ratio(s)

- → in practice this may be MCT ratio > 100% (see related forum discussion)

- [3] under solvency scenarios → must have assets > liabilities

| Memorize that! That was the most frequently asked question from the old CIA.DCAT reading and appeared on many exams. |

Unfortunately the old exam questions are not relevant because the conditions for satisfactory financial condition changed when DCAT was updated to FCT. The FCT reading also has no examples so here's one that Alice made up.

| Here's the problem... |

| Here's the solution... |

Here are some practice problems similar to the example. Remember to pay attention to the given length of forecast period. Even if the given information displays 5 years of projections, you only have to check the conditions for years that are in the stated forecast period. This might be a trick the CAS decides to throw at you and it comes up in one of these practice problems so be on the lookout. :-)

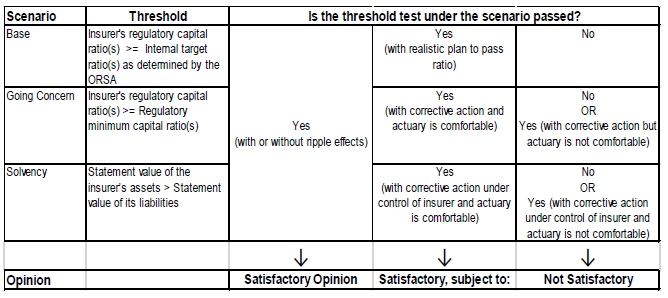

Ok, so once you've done all the calculations with the scenarios, the actual FCT report has 9 sections to it. The first section is an executive summary where you summarize the results, make your recommendations, and discuss any significant events since your last report or since the publication of your current report. The most important part is the FCT opinion. The AA's opinion is one of the following:

- satisfactory

- satisfactory subject to certain conditions (see decision grid below)

- not satisfactory

This is the decision grid to be used to determine which opinion is appropriate:

You should memorize this grid, but it's actually easy if you've done the practice problems. The only difference is that the practice problems either stated "satisfactory" or "not satisfactory". The other option "satisfactory, subject to..." basically means that if management promises to fix whatever is wrong then the AA will be nice. 😁 Unless their AA is Alice. 😈 She's hard-core.

The rest of this section is several pages of items that should be included in each section of the report. You have to describe in detail how you did your analysis: how you came up with the base & adverse scenarios, internal targets, materiality standard, assumptions, economic conditions, and so on. You get the idea. There has never been a detailed exam question on that and I don't think it would be fair to ask one. Knowing the details of what must be included would be very helpful if you were doing an FCT report yourself but I think the point here is that you know where to find this information when you need it.

Here's the quiz...

Appendix B: P&C Risk Categories

There are a few new risk categories indicated by aqua highlights

This appendix contains important information that's likely to show up on the exam. It's 13 pages long but there are some huge time-saving tricks. It covers 12 P&C risk categories and it's from these categories that adverse scenarios are created. In other words, an actuary doing an FCT analysis would consult these risk categories when modeling adverse scenarios.

Time-saving trick #1: You can remember the 10 + 2 P&C risk categories with the mnemonic F-PIP-REAGOR-C2 → Alternate Hint: click here

Here is what each letter stands for. You do have to memorize this and I'll explain how it works with a few examples.

F - P I P - R EA G O R - C2 Frequency & Severity - Policy Liabilities Inflation Premiums - Reinsurance Expense & Asset risk Government risk Off-B/S risk Related Company risk - Climate & Cyber risk

- Note that Asset risk includes market risk & credit risk. Also, Cyber risk includes both cyber & technology risk.

Each of these categories can be used to construct adverse scenarios. But not all categories will be relevant in all situations. You must use judgment to assess which are most appropriate. The FCT source text discusses each in detail but you don't need all that detail to answer exam questions. For each of these 9 risk categories, you must be able to state:

- causes

- ripple effects

- corrective management actions

Example 1: F = Frequency & Severity Risk: (This is the first letter in F-PIP-REAGOR-C2)

- causes: a change in frequency & severity can be caused by...

- catastrophe

- social inflation

- ripple effects: these may include...

- post-event inflation

- loss of reinsurance

- management action: to mitigate the risk, management may decide to...

- raise rates

- review reinsurance

This is the pattern for learning each of these categories. Let's do another one.

Example 2: A = Asset Risk: (This is the first "A" in F-PIP-REAGOR-C2 and includes both market risk and credit risk.)

- causes: a change in asset risk can be caused by...

- significant changes in the yield curve

- decrease in return on equity investments,...

- ripple effects: these may include...

- forced sale or liquidation

- significant +/- change in cash flows

- management actions: to mitigate the risk, management may decide to...

- sell assets

- change investment strategy

This is already a more condensed version of the the source text but it would still be a big job to memorize causes, ripple effects, and management actions for all 9 categories. This leads to the next trick.

Time-saving trick #2: Instead of memorizing ripple effects for each risk category individually, just memorize some of the common ripple effects.

Here they are... (shout-out to ThrowGrow for posting a memory trick the forum!)

common

ripple

effectshigher LR

(due to higher losses or operating costs)loss of reinsurance post-event inflation forced sale or liquidation mix shift Policyholder actions regulatory action

If you're then asked for a ripple effect for a particular adverse scenario, you can take an educated guess and pick a couple of things from this list that seem most appropriate. You can use the same time-saving trick for corrective management actions.

Time-saving trick #3: Same as trick #2 except for corrective management actions. Just memorize some of the common management actions.

Here they are... (shout-out to ThrowGrow for posting a memory trick the forum!)

common

management

actionstighten U/W raise rates review reinsurance sell assets review mix (geography, limit,...)

If you're then asked for corrective management actions for a particular adverse scenario, take an educated guess from this list!

A few extra management actions that might be useful:

I would keep those 2 new management actions in mind just in case you get an adverse scenario where these actions would be appropriate. Actually, it might be an idea to glance at the source text and read over all the different management actions that are listed. I don't think you have to specifically memorize them, but reading them over should give you a better sense for all the different possibilities. |

You still have to memorize what F-PIP-REAGOR-C2 stands for and causes for each but much of that is common sense. You also have to memorize these common ripple effects and management actions but if you do that, you'll be able to answer all the exam questions dealing with adverse scenarios. It might be helpful to read through Appendix B once or twice at bedtime. Here's a direct link:

You should now refer to the BattleTable and try a few of the old DCAT problems that are listed as adverse scenario. Be careful however: Some of these old DCAT problems will have answers that are still valid but some may not. (It's usually obvious.)

This quiz is short, only 4 BattleCards. (The 4th one reminds you to at least glance at the actual source test for Appendix B.)

Final Comments (Important)

Below are a few things I've pulled from different parts of the FCT reading that seem important. The reason I didn't include them earlier is that I didn't want to get bogged down in details. Now that you have a good overview, it should be easier to absorb these extra details.

Selecting Adverse Scenarios

One very important topic is how adverse scenarios are selected. There are 2 types of adverse scenarios: solvency and going-concern. Selecting such scenarios is the basis of the FCT method and there are 2 broad ways of doing this:

- percentiles (if a loss distribution is available)

- reverse stress-testing

The percentiles method was mentioned earlier in the Definitions section. Recall that a solvency scenario is an adverse scenario that has a non-trivial likelihood of occurring. If I can get ridiculous for a moment, an alien invasion from a nearby galaxy is an adverse scenario, but it would not qualify as a solvency scenario because it has virtually no chance of happening! (I don't think your CEO would be pleased if you included an alien invasion in your FCT report.) In contrast however, a hurricane or an earthquake are good examples of adverse scenarios that would also qualify as solvency scenarios. A rule of thumb is that a solvency scenario should lie between the 95th and 99th percentile.

Once you have a few solvency scenarios chosen from the P&C risk categories in Appendix B, you can modify them slightly to create going-concern scenarios. Recall that a going-concern scenario is an adverse scenario that is more likely to occur but less severe than a solvency scenario. A rule of thumb is that a going-concern scenario should be between the 90th and 95th percentile. Maybe just a strong breeze rather than a full-blown hurricane. :-)

The following exam problem requires you to use the percentile method. For the old DCAT reading, a solvency scenario is the same thing as "plausible adverse scenario". This is actually a good, challenging problem that combines FCT and MCT.

- E (2015.Fall #20)

The other method of selecting adverse scenarios is reverse stress testing and it's much harder to apply than percentiles. The source text explains reverse stress-testing in general terms but provides no examples. The definition has been asked twice on past exams and that's probably all you need to know. I don't think the source text explains the concept very clearly so Alice and I came up with our own way of explaining it. The sample answers given in the examiner's reports are also not very good, although I assume they were given credit.

Question: describe the method of reverse stress-testing in an FCT analysis

- start by considering a specific adverse scenario where the insurer's surplus becomes negative (surplus = assets - liabilities)

- work backwards to find the risk factors required to produce that scenario

- determine if it's plausible for risk factors of the insurer's current financial position to deteriorate to that degree

- → if yes then this adverse scenario may be a solvency scenario

FCT and ORSA

The other topic that might become important is the relationship of FCT to ORSA. This is something that was absent in the old DCAT reading and it strikes me as a very important change. If I were on the exam committee, I would definitely ask a question about it. Note that both FCT and ORSA should be performed at least once during each financial year.

Question: should the actuary integrate the FCT report with the ORSA report or keep them separate

- actuary should use judgement - may produce 2 independent reports or 1 integrated report

Question: identify considerations supporting integration of FCT and ORSA

- FCT uses internal target capital ratios developed by ORSA (and these target ratios may develop over the time frame of a projection)

- ORSA is useful in assessing adverse scenarios

- may be more efficient to integrate the reports (both require data collection and similar types of analysis, both may be released at the same time)

- a single integrated report may be better for the end user

Question: identify challenges regarding integration of FCT and ORSA

- oversight: AA is responsible for FCT whereas the board and senior management is responsible for ORSA

- different methodology: FCT follows a prescribed regulatory basis while ORSA reflects own models and assumptions

- staff responsible: different for FCT versus ORSA and coordination may be costly

2018.Spring Q24 (A Good Bloom's Q)

| Note: This is from the old DCAT reading but it's a good problem to enhance your overall understanding of the FCT process. Remember that the definition of satisfactory financial condition has changed so you'll have to make a few adjustments to the solution provided in the examiner's report. Also, the new FCT report is much more closely related to ORSA whereas the old DCAT report did not mention ORSA at all. |

This question concerns the how of stress-testing that we discussed above in terms of the 7-step method rev-BACRO-reg. It is a long question for only 3 points. At 3.25 minutes-per-point, you have roughly 10 minutes to do it, but I think it may take you longer than that. The first step is understanding what you have to do. This information is given in the first paragraph:

- identify 4 incorrect actions by the AA

- describe the correct actions

Make sure you do both of the above items. The second step in this problem is making sense of the given information by making bullet point notes as shown below. The text in red & green font was added after I made the paragraph notes. Red indicates an incorrect AA action. Green indicates the corrected action.

- para 2:

- - operations begin 2012

- - current year-end: 12/31/2017

- - AA analysis done on: July 2018

- - business plan uses results through 12/31/2017

- para 3:

- - AA reviews opns in 2017 (1yr) → should review ≥ 3 yrs

- - prepares base scenario (uses business plan)

- - forecast period: 12/31/17 to 12/31/19 (2 yrs) → forecast period should be ≥ 3 yrs

- - reduces premium growth assumptions

- - MCT > 150%

- para 4:

- - review risk categories

- - test change in risk factors to get surplus < 0

- - adjust risk factors to get 95-99% probability for adverse scenario

- - discard reinsurance risk & off-Balance-Sheet risk

- para 5:

- - rank scenarios by MCT (low to high)

- para 6:

- - select 3 scen. for more analysis → all with MCT < 150% should be further analyzed

- - consider: interactions, ripple, macro-eco, management actions → should also consider regulator action due to low MCT

- para 7:

- - AA writes DCAT report with all sections

- - explains business plan deviation in base scenario (lower premium growth)

- - concludes financial condition not satisfactory (cat event MCT < 150%)

I've noted 4 items above but there are more. See if you can find them. Check your answers with the examiner's report.