CIA.IFRS17-2

Reading: IFRS 17 Risk Adjustment for NonFinancial Risk for Property and Casualty Insurance Contracts (43 pages)

Author: Canadian Institute of Actuaries

BA Quick-Summary: IFRS17 - 2

|

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 4.1 Section 1: Introduction

- 4.2 Section 2: Transition from IFRS 4 to IFRS 17

- 4.3 Section 3: General Considerations

- 4.4 Section 4: Quantile Techniques

- 4.5 Section 5: Cost of Capital Method

- 4.6 Section 6: Margin Method

- 4.7 Section 7: Reinsurance Held Methods

- 4.8 Section 8: Catastrophe Reinsurance

- 4.9 Section 9: Combining Approaches and Methods

- 4.10 Section 10: Quantification of the Confidence Interval

- 4.11 Appendix 1: Margins – Brief Summary of IFRS 4 CIA Standards of Practice

- 4.12 Appendix 2: Simplified Calculation of RA based on CoC Method

- 4.13 Appendix 3: Using the MCT to calculate the confidence level

- 4.14 Appendix 4: Using the MCT to calculate the confidence level

- 5 POP QUIZ ANSWERS

Pop Quiz

Study Tips

Updates for 2022.Spring: The new version of this reading is 10 pages longer (now 43 pages) and had 3 additional sections inserted:

The remaining sections are mostly unchanged, aside from how they are numbered. |

At first glance, I thought appendix 3 would be important because the prior version of the reading didn't have enough examples. But what's provided in appendix is not the full example. The full example is in an Excel workbook that is not provided. The appendix only provides a description of what's in the Excel workbook but without the workbook, the description alone is not particularly helpful. I think if the CAS wanted to test you on this, they would have provided these supplementary Excel exhibits. For that reason, you can probably just ignore appendix 3.

| General study tips |

This reading covers methods for calculating the Risk Adjustment for non-financial risk according to IFRS 17. Recall that risk adjustment is one of the components of FCFs (Fulfillment Cash Flows) and corresponds roughly to PfADs under current practice. There is only 1 extremely simple calculation, and I do mean simple. You can learn it in about 2 minutes. The reading is 43 pages long but 1 hour should be enough time to cover the testable items. I believe the most likely exam question is:

- briefly describe methods for calculating the Risk Adjustment for non-financial risk under IFRS 17

(I don't believe the exam would ask you to perform the calculations because the source text does not provide detailed examples.)

My usual disclaimer: I can't be 100% certain what will appear on the exam, but there are already several other detailed IFRS 17 readings on the syllabus and this one doesn't seem to have much reasonable testable material compared to the others. Plus there's overlap with the other IFRS readings. But just to be on the safe side, I've included a little more than what I think is probably necessary to know for the exam.

Estimated study time: 1 hour (not including subsequent review time)

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

In Plain English!

Section 1: Introduction

Risk Adjustment for non-financial risk, or RA, was introduced in CIA.IFRS17 Section 9: Risk Adjustment for Non-financial Risk. There is also a detailed example of calculating FCFs (Fulfillment Cash Flows) in CIA.IFRS17-DR (Discount Rates) - Section 4 although you may not have read that yet. The basic formula used in that calculation is:

FCF = PV(future cash flow) + RA

The RA term is what we're interested in here. In that example, we made the very simple assumption that RA was 5% of the PV of future cash flows. Here we will cover several specific methods for calculating RA that are hopefully more accurate than simply applying a single percentage factor.

Question: identify 4 methods for calculating RA under IFRS 17

- quantile methods

- cost-of-capital method

- margin method

- a combination of methods

The only other important item in the introduction has already been covered in IAA.RiskAdjs: Characteristics of a Good Risk Adjustment.

Section 2: Transition from IFRS 4 to IFRS 17

Alice-the-Actuary's company is transitioning from IFRS 4 to IFRS 17. She doesn't want to lose all the work she did following IFRS 4 procedures so she's going to use that as a starting point for calculating the RA (Risk Adjustment) under IFRS 17. Here are a couple of things she'll need to consider:

- Are current PfADs consistent with the compensation the entity requires for bearing uncertainty?

- Are the diversification benefits included in current PfADs consistent with those that would be reflected in IFRS 17?

There are other considerations but that's enough to get her started. I think they're pretty obvious anyway. Whenever you're transitioning from one method to another, you should consider how much of the old method is still valid, and how much you might have to change to achieve consistency with the standards of the new method.

Section 3: General Considerations

This fairly long section is a mishmash of general considerations related to the RA. There don't seem be any facts or concepts that stand out above the others which makes it difficult to know what to study. Here are Alice's musings:

First, do you remember the memory hint RMPD from CIA.IFRS17 - Section 1: Introduction. If not, take a minute to review it. It basically says that IFRS 17 establishes principles for recognition, measurement, presentation, and disclosure related to insurance contracts.

- Section 3.1 states: It's necessary that the RA at each reporting date satisfies the overall requirements of IFRS 17 for measurement, presentation, and disclosure of insurance contracts. Measurement requirements are based on the unit of account (RA for a single contract or group), whereas presentation and disclosure requirements for the RA tend to be at an aggregate level.

- Based on that, here's something good to know: If the actuary calculates the RA at an aggregate level, this will have to be allocated back to the unit of account level.

The next subsection, section 3.2, talks about diversification benefits. If the units of account are diversified, then your aggregate RA should be lower, and if you calculate the RA at the aggregate level, this diversification benefit will presumably be factored in. If however, your RA is done at the unit of account level, and the aggregate RA is expressed as the sum of individual RA's, then the diversification benefit might not be accurately reflected.

Section 3.3 talks about reinsurance:

- Reinsurance credit risk is reflected through a reduction in expected cash flows, not through the RA.

If Alice were creating an exam question based on that factoid, it would be: How is reinsurance credit risk reflected under IFRS 17? And the answer, of course would be: through a reduction in expected cash flows.

Study tip from Alice: Do you see what she did with the reinsurance factoid above. She took the statement from the text and turned it into a question. That's called active reading as compared to passive reading. Active reading has been shown to increase recall significantly, something that's especially important when the material is so boring. :-)

Section 3.4 is about discounting but there is a whole separate reading on that: CIA.IFRS17-DR. Section 3.5 talks about time horizons. The appropriate time horizon for calculating IFRS 17 RA is the lifetime of the uncertainty in the insurance contract cash flows. There isn't much else there. Section 3.6 talks about disclosure requirements, something that's discussed elsewhere. And finally, Section 3.7, is about the RA under PAA. Remember that PAA is Premium Allocation Approach and there is a whole separate reading on that: CIA.IFRS17-PAA

Section 4: Quantile Techniques

For each of the 3 RA methods, you should be able to provide a concise description, and an advantage/disadvantage.

quantile methods: briefly describe the quantile method for calculating the RA under IFRS 17

- quantile methods assess the probability of the adequacy of the FCFs (Fulfilment Cash Flow)

- these probabilities are used to quantify the RA

- specific methods include VaR (Value at Risk) and CTE (Conditional Tail Expectation)

For example, suppose a CTE method concludes there is a 50% probability that FCF = $50 million is adequate but a 90% probability that FCF = $60 million is adequate. The RA would obviously have to be greater for the $50 million FCF estimate. (Maybe something like $15 million, versus $5 million for the $60 million estimate but that's just a wild guess for the sake of illustration!)

quantile methods: identify 1 advantage and 1 disadvantage of quantile methods

- advantage: satisfies the disclosure requirements regarding confidence level corresponding to the RA

- disadvantage: if misrepresented, it may introduce spurious accuracy

Section 5: Cost of Capital Method

The second method for calculating the RA under IFRS 17 is the cost-of-capital method. There is a simplified example in Appendix 2.

cost-of-capital method: briefly describe the cost-of-capital method for calculating the RA under IFRS 17

- RA is based on the compensation an entity requires to meet a target return on capital.

- this method has 3 components:

- [1] projected capital amounts - for the level of non-financial risk during the duration of the contract

- [2] cost of capital rate(s) - for the relative compensation required by the entity for holding this capital'

- [3] discount rates - for the present value calculation

cost-of-capital method: identify 1 advantage and 1 disadvantage of the cost-of-capital method

- advantage: allows allocation of the RA at a more granular level

- disadvantage: method is more complex because the projection of capital requirements is an input to the liability calculation

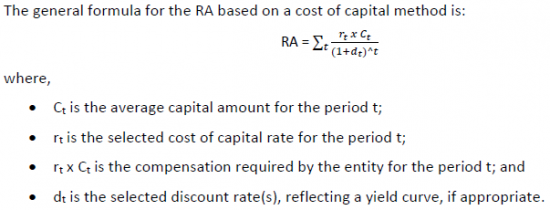

The source text provides a formula for this method although I think there is virtually no chance you would have to use it in a calculation problem. I like it however because it helped me understand the method more concretely beyond just a verbal description. Memorizing the formula will help you remember the 3 components listed above because each component appears as a term in the formula.

Section 6: Margin Method

The source text gives the margin method only 2 short paragraphs of explanation.

margin method: briefly describe the margin method for calculating the RA under IFRS 17

- select margins that reflect the compensation the entity requires for uncertainty related to non-financial risk

This explanation is far too brief to be meaningful. All you should have to know is that this exists as a method for calculating the RA. If you are ever called upon to use the margin method, you would have to research it much more thoroughly.

margin method: identify 1 advantage and 1 disadvantage of the margin method

- advantage: none provided

- disadvantage: none provided

Section 7: Reinsurance Held Methods

This section discusses methods and considerations when assessing risk adjustment for reinsurance held. Much of it is similar to what was covered in Sections 4 & 5, but there are a couple methods specific to reinsurance that were not discussed earlier.

The section begins by reviewing a reinsurance concept that is discussed in more detail in CIA.IFRS17-DR - Section 3. Very briefly, a reserve analysis for reinsurance requires estimates on 3 different bases: gross, net, ceded. You only need to perform the analysis on 2 of them however because the value of the third is determined either by addition or subtraction. The question is: How do you decide which 2? One answer could be to consider credibility of the data. If the amount of ceded reinsurance is small then it may make more sense to perform the analysis on gross and net data, then calculate ceded as gross - net. This question has come up on prior exams so don't skip over it.

Question: identify methods for calculating the risk adjustment for reinsurance held

- quantile methods ← discussed above

- catastrophe models ← specific to reinsurance held

- proportional scaling ← specific to reinsurance held

- cost of capital ← discussed above

I don't think this section is very important but if I were making up an exam question, I might ask you to briefly describe 2 methods for calculating a risk adjustment that are specific to reinsurance held. That means quantile methods and cost of capital would not be acceptable answers.

Question: briefly describe 2 IFRS 17 risk adjustments methods that are specific to reinsurance held

- catastrophe models

- → use output from a cat model tailored to an entity's book of business

- → select a percentile directly from the given distribution

- proportional scaling (works well for proportional or quota-share reinsurance)

- → use the same percentage of FCFs for the ceded RA as for the direct RA

- → but percentage could be modified for considerations such as: ceding commissions, expense allowances, reinstatement premiums

- → method may also work for non-proportional reinsurance if the ceded RA can consistently be expressed as a portion of the gross RA

I think that's all you need to know from here.

Section 8: Catastrophe Reinsurance

The risk adjustment for catastrophe reinsurance might have to be considered separately from non-catastrophe reinsurance because catastrophes are generally low-frequency, high-severity events and have a different loss distribution from "normal" losses. That means the "normal" methods may produce a risk adjustment that is too low, or even 0. To quote the source text:

- The expected ceded losses at a typical selected confidence level of the gross distribution may be zero. Hence, a quantile method may not generate a significant RA.

The remainder of this section seems too detailed, but a couple of reasonable (but low likelihood) exam questions on this topic might be as follows:

Question: why might ceded losses for catastrophe reinsurance require a separate risk adjustment analysis from an entity's direct losses

- catastrophe reinsurance covers low-frequency, high-severity events

- a standard quantile method may produce an RA that is too small or even 0

Question: describe a method for calculating a risk adjustment for ceded losses related to catastrophe reinsurance and high percentile events

- use a cost-of-capital method with an assumption for required capital set at a higher percentile

- (captures compensation required at higher levels of the treaty)

Section 9: Combining Approaches and Methods

This section discusses the idea of combining, or mixing-and-matching, the 3 previous methods for calculating the RA. Note there are different levels on which the RA can be calculated and that affects the method used. The different levels are:

- unit of account level (insurance contract, or group of insurance contracts)

- aggregate level

An aggregate level means to calculate a single RA for all of contracts. A unit of account level means to calculate the RA on a more granular level then sum to get an aggregate RA.

One possible way to combine methods under a unit of account approach is:

- for groups with less skewed distributions: use VaR (recall that VaR is a quantile method)

- for groups with highly skewed distributions: use cost of capital method or margins

Under an aggregate approach, the primary methods for calculating the RA are:

- quantile methods

- cost-of-capital method

This discussion is so brief and high-level so as to be almost meaningless if you're actually trying to do the calculations, but it does at least give you a general sense for what would be involved.

Section 10: Quantification of the Confidence Interval

This section provides a good reminder of an IFRS 17 disclosure requirement that was discussed in Section 4 above and also in another IFRS 17 article, IAA.RiskAdjs. The requirement is:

- must disclose a confidence interval for the risk adjustment (for benchmarking against other entities)

This requirement might affect the RA method because quantile methods provide a confidence interval around the RA automatically. If a different method is used, more work is required to produce the required confidence interval. This section provides an overview of some of the mathematical details and mentions that an MCT analysis could possibly be used to generate confidence intervals for the RA.

Appendix 1: Margins – Brief Summary of IFRS 4 CIA Standards of Practice

This section is very brief and the material is covered in other readings anyway.

Appendix 2: Simplified Calculation of RA based on CoC Method

Recall from our earlier discussion that with the cost-of-capital method, the RA is based on the compensation an entity requires to meet a target return on capital (equity). This simplified example is way to estimate the RA for insurers that have a target profit margin instead of a target return on equity (ROE).

Question: what is the basic concept behind this simplified CoC approach

- target profit margin is allocated between reserve risk, underwriting risk, and other risks that are not relevant to the RA

Here's the super-simple example that you can learn in 2 minutes. It's kind of a lame example but that's all there is. :-(

Problem: Calculate the RA for the LIC and LRC components. Recall from CIA.IFRS17: Valuation Methods under IFRS 17 that LIC (Liability for Incurred Claims) and LRC (Liability for Remaining Claims) are the components of insurance contract liabilities under IFRS 17. LIC is the insurer’s obligation to pay claims for events that have already occurred while LRC refers to events that events have not yet occurred.

- Given information:

- profit margin = 10%

- capital allocation for U/W risk = 50% of total capital

- capital allocation for reserve risk = 30%% of total capital

- capital allocation for other risks = 20% of total capital

Solution:

- RA for LIC for a given policy year starts as

- = (expired premium) x (profit margin) x (capital allocation for reserve risk)

- = (expired premium) x 10% x 30%

- = (expired premium) x 3%

- → then decreases over time, although the source text doesn't explain this any further.

- RA for LRC

- = premium x (profit margin) x [ (capital allocation for U/W risk) + (capital allocation for reserve risk) ]

- = premium x 10% x [ 50% + 30% ]

- = premium x 8%

This example doesn't actually have a final numerical answer because we're not given any values for premium and we're not told how RA for LIC should decrease over time. But it's the only example in the reading so I didn't want to completely leave it out. I think it might be hard to create a decent exam question from this, but it doesn't hurt to be familiar with it.

- → A disadvantage of this simplified approach is that the target profit margin may vary by portfolio or group.

Appendix 3: Using the MCT to calculate the confidence level

This is mainly for smaller or less sophisticated insurers who intend to use the MCT factors to calculate the confidence level.

When considering this approach, insurers should remove the additional 10% loading on LIC factors that were implemented during the transition to IFRS17.

You don't need to know the details too much here as to how the 99.5th percentile was derived except for the fact that they took industry data from the AAR, and assumed a normal distribution and appropriate diversification.

When using these factors, the actuary should consider:

- Consider the insurer's mix and volume of business when aggregating multiple lines and potentially the LRC and LIC

- Adjustment for size relative to the "average" insurer in the MCT. Smaller insurers are usually more volatile and would have a larger spread in their distribution

Appendix 4: Using the MCT to calculate the confidence level

Just an explanation of the actual calculations for the risk adjustment. I would not spend too much time on this and rather focus on the practice exams and sample IFRS17 questions to learn how to calculate the risk adjustment.