CIA.IFRS17-DR

Reading: IFRS 17 Discount Rates and Cash Flow Considerations for Property and Casualty Insurance Contracts (40 pages & plus related Excel Files)

Authour: Canadian Institute of Actuaries

BA Quick-Summary: IFRS17 Discount Rates

|

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 4.1 Sections 1-2: Introduction and Terminology

- 4.2 Sections 3-7: Fulfillment Cash Flows

- 4.3 Sections 8-13: Additional Guidance on Discounting

- 4.4 Section 14: Discussion of Excel Examples

- 5 POP QUIZ ANSWERS

Pop Quiz

Study Tips

This is a brand new reading. It's 40 pages and it's complicated. There is also an appendix with an Excel file demonstrating the calculations. Unfortunately there are no old exam questions to guide your studying so before we dive in, let's think about a study strategy. Here are some things to consider:

- Based on 400 hours of studying for Exam 6C and roughly 60 readings, you have roughly 7 hours of study time per reading. Some readings take more time, some less.

- IFRS discounting is an important topic and this reading is quite long, but there are 6 IFRS readings on the syllabus so there's going to be some overlap

I'm going estimate 7-10 hours to extract the important information from this reading. Here's what I want to be able to do when I'm finished:

- describe IFRS 17 discounting in general terms (you already know some of this from CIA.IFRS17)

- learn a few specific concepts about IFRS 17 discounting discussed in this reading that are not covered in the main CIA.IFRS17 reading

- learn to do 1 or 2 types of calculation problems based on the appendix (I will make my own Excel templates for this and populate them with random numbers for practice.)

This wiki article covers what I think are the most likely testable topics, but there are some detailed sections from the source text that I didn't cover. If you wanted to be absolutely certain you could answer any question from the reading, you would probably need to spend double the time. If I were taking this exam myself, I would feel very confident spending 7-10 hours learning the main concepts and knowing how to do some basic calculations.

Estimated study time: 1 day (not including subsequent review time)

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

In Plain English!

Sections 1-2: Introduction and Terminology

The purpose of this draft educational note is to provide practical guidance on Canadian-specific issues relating to discounting estimates of future cash flows for property and casualty (P&C) insurance companies under IFRS 17.

The reading then provides a list of 12 terms and their definitions. Some of them are obvious. Here are the ones I would memorize:

| Discount rate |

- Rate used to discount the estimates of future cash flows which is consistent with the timing, liquidity and currency of the insurance contract cash flows.

- A discount rate may be a single rate, or a curve of rates varying by duration. ("Discount rate curve" and "yield curve" are used interchangeably.)

| Fulfilment Cash Flows (FCF) |

- Present value of the estimates of future cash flows plus the risk adjustment for non-financial risk.

- (this is also discussed in CIA.IFRS17 - Overview)

| Liquidity premium (also called illiquidity premium) |

- adjustment made to a liquid risk-free yield curve

- reflects differences between

- → liquidity characteristics of the financial instruments that underlie the risk-free rates

- and

- → liquidity characteristics of the insurance contracts

- Examples:

- If the insurer's investments were all risk-free, the liquidity premium would be zero. (Ex: government bonds)

- If the insurer's investments were all high-risk, the liquidity premium would be very high. (Ex: biotech startups)

| Reference portfolio |

- a portfolio of assets used to derive discount rates based on current market rates of return

- the portfolio rate of return is then adjusted to remove returns related to risk characteristics that are not in insurance contracts

- (this relates to the top-down approach for selecting discount rates discussed in the section: Determining Discount Rates)

Sections 3-7: Fulfillment Cash Flows

Section 3: Determining Estimates of Future Cash Flows

Determining estimates of future undiscounted cash flows is the first step in deriving the overall insurance contract liabilities. The company Alice works for issues its own "regular" insurance policies (direct liabilities), but they also also carry reinsurance (ceded liabilities) and act as reinsurers for other primary insurers (assumed liabilities.) These 3 types of liabilities all have to be considered but there is some choice in how they're grouped for the purposes of analysis. You can combined them:

- net liabilities = direct + assumed - ceded

or analyze them separately as:

- gross liabilities = direct + assumed

- ceded liabilities = gross - net

How do you decide whether to group your data together into net liabilities or separate them into gross and ceded? This is closely related to an exam question that has appeared in the past.

Question: identify considerations for using net versus gross & ceded data for analysis [Hint: DC-Re]

- Data availability:

- → if data is sparse, it may not be possible to directly estimate the present value of ceded cash flows

- Cash flow volatility:

- → different approaches may be warranted for different segments of business depending on the volatility of cash flows by segment

- Reinsurance held:

- → consider type and consistency of reinsurance held.

- Example: if the insurer's retention has changed significantly, it may not be appropriate to use net data as a starting point

The following exam question is from an outdated reading but it shows you a type of question that can be asked relative to the above options:

- E (2015.Fall #26)

Once you've decided how to group your data according to net/gross/ceded, the next step is to select payment patterns. Insurers make payments potentially over many years and the payment pattern can have a big effect on the final value of your balance sheet liabilities.

Loss payments and estimates of ultimate losses are generally divided into homogeneous business segments for the selection of payment patterns. ALAE and ULAE may be included or kept separate as appropriate. In any case, there are considerations in how to segment your data for analyzing payment patterns.

Question: identify considerations in segmenting data for selecting payment patterns

- business segments used for analyzing undiscounted data (Alice likes to use these same segments for the payment pattern analysis - it's less work that way!)

- payout period (you wouldn't group short-tailed lines with long-tailed lines)

- existence of a predetermined schedule of payments (if you already have a payment schedule then there's nothing else to do!)

Section 4: Determining Discount Rates

Basic Information

Determining the discount rate under IFRS 17 is the most important topic in this reading. Let's start by helping Ian-the-Intern understand what we want a discount rate to be.

Question: identify characteristics an IFRS 17 discount rate should possess

- (a) the discount rate should reflect the:

- time value of money

- characteristics of cash flows

- liquidity characteristics of insurance contracts

- (a) the discount rate should reflect the:

- (b) the discount rate should be consistent with:

- market prices for financial instruments with similar cash flow characteristic as insurance contracts

- (b) the discount rate should be consistent with:

- (c) the discount rate should exclude:

- factors that affect market prices but do not affect cash flows for insurance contracts

- (c) the discount rate should exclude:

That's a lot to take in but it really just means that the discount rate you select should match your insurance contracts. You could open up the TSX Composite Index and look for financial instruments that are "similar" to your insurance liabilities and then use the rate of return on those financial instruments as your discount rate. You might have to make a few further adjustments because insurance risks aren't quite the same as general market risks but we'll discuss that next. The diagram a little further down is what made everything click for Ian-the-Intern. :-)

Question: identify methods for selecting a discount rate for valuation of insurance contract liabilities under IFRS 17

- bottom-up approach:

- a liquid risk-free yield curve is adjusted to reflect the differences between the liquidity characteristics of market financial instruments and the liquidity characteristics of the insurance contracts

- bottom-up approach:

- top-down approach:

- the yield to maturity of a reference portfolio of assets is adjusted to eliminate any factors that are not relevant to insurance contracts

- top-down approach:

So, the next time Ian-the-Intern is in the elevator with the CEO and wants to impress her with his awesome knowledge of IFRS 17, here's what he's going to say:

Ian's Awesome Elevator Speech: The bottom-up approach starts with a risk-free rate then adds a liquidity premium. The top-down approach starts with a reference portfolio then removes any non-insurance characteristics. Theoretically, you could get the same answer with each method but in practice that usually doesn't happen.

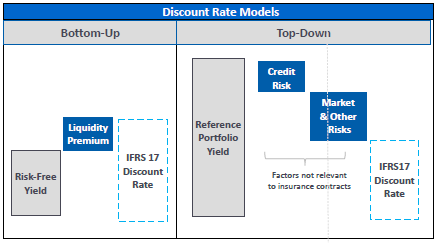

And here's the diagram I mentioned earlier:

- The grey boxes represent an initial discount rate for each method.

- The blue boxes represent either additions or subtractions depending on whether you're doing the bottom-up or top-down approach

- The boxes with the blue dotted lines represent the final discount rate selection for each method

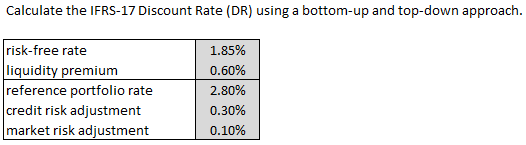

Let's now look at a numerical example. This is a ridiculously simplified version of the Excel exhibit in the appendix but you gotta start somewhere. :-)

| Here's the problem: |

| Here's the solution: |

Example

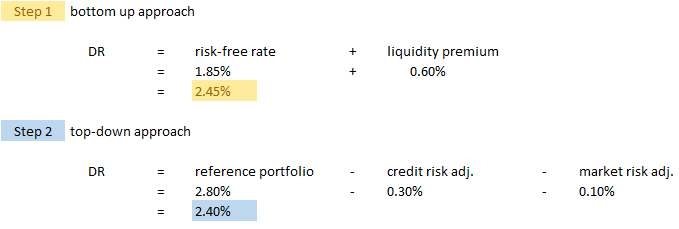

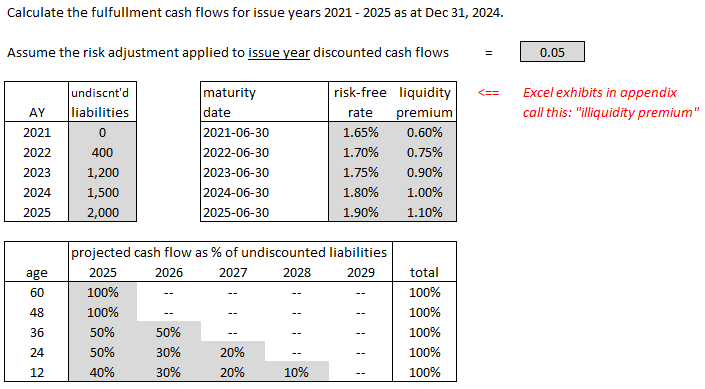

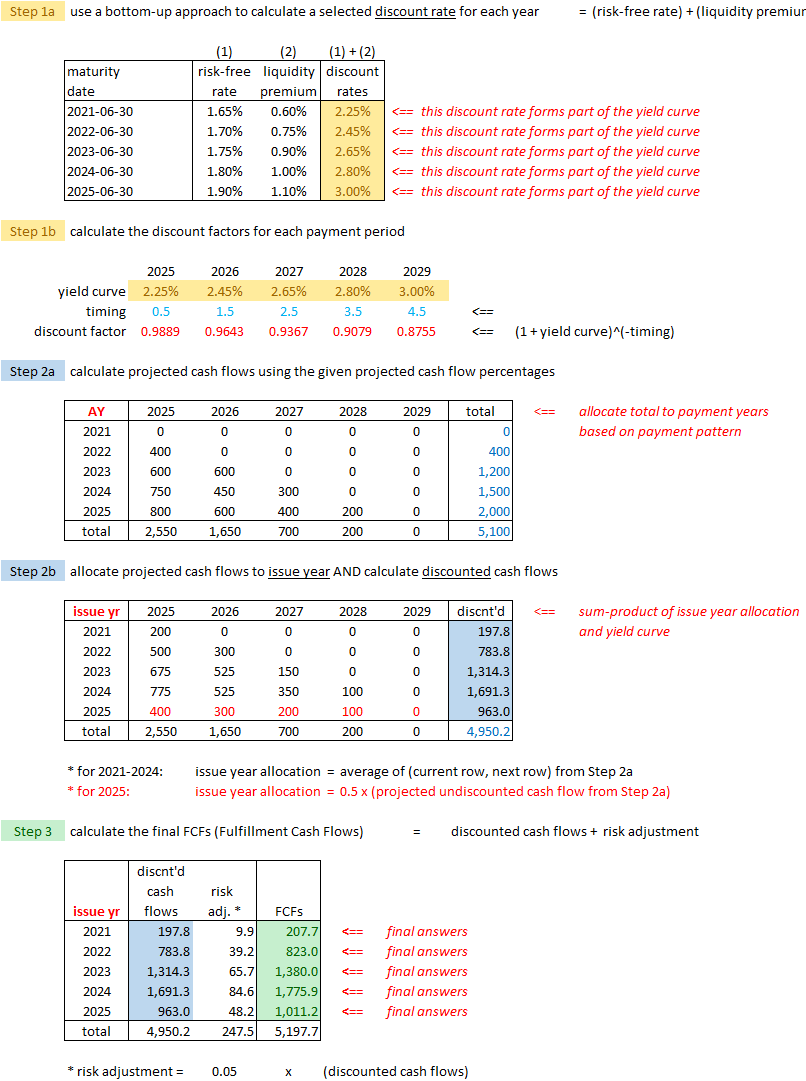

Below is a less simplified version of the example in the Excel appendix. It covers the important steps in selecting a discount rate all the way through to calculating the final FCFs (Fulfilment Cash Flows.) I think this would be a reasonable question to ask on the exam, especially now that the exam is given in Excel. None of the steps is hard but there are lots of little details you have to keep straight.

There is a new concept here: issue year. The idea of allocating undiscounted losses to accident year was covered in CIA.MfAD but in IFRS there's the extra step of converting the AY allocation to an issue-year allocation. There are different ways of doing this and the appendix uses a simple default approach of averaging successive years.

The actual appendix also uses a hybrid approach to select the discount rate. Without getting into the gory details, the hybrid approach estimates the liquidity premium using a top-down approach. You then use this liquidity premium in the bottom-up approach to get the final selected discount rate. My example skips that very long calculation and provides the liquidity premium directly. (The appendix uses the equivalent term: illiquidity premium.) The long calculation that I skipped is shown on the appendix worksheet tab "2-Current Curve". I think it's too detailed to ask on the exam so I didn't include it in my version.

I also omitted the following items from my example because I felt they were too detailed: (We will discuss these items briefly on a more conceptual level further down.)

- locked-in yield curve calculation (this shows alternate yield curve assumptions used for the OCI option or Other Comprehensive Income option)

- income statement calculations including insurance finance expenses (there's a general discussion of this part of the calculation further down)

Last bit of advice: When you learn how to do this problem, you should make sure you have a good grasp on the information that's provided. In my version, there are 4 different components to the given information, as you can see below. It's important you really understand that because an exam question may not use quite the same layout and that could throw you off.

| Here's the problem: |

| Here's the solution: |

Here are 2 pdf and 2 Excel practice problems:

Extra Information

Alice and Ian helped me scan the next few sections of the source text for factoids that would make good exam questions. The first relates to the top-down method for selecting a discount rate. Recall that this method begins with creating a reference portfolio, then adjusts the reference portfolio's rate of return to achieve consistency with a portfolio of insurance contracts. This may involve removing credit risk, market, and any other risk not present in the insurance portfolio.

Question: identify risk factors that may differ between a reference portfolio and insurance contracts

- liquidity

- investment risk (Ex: credit risk, market risk)

- timing

- currency risk

The credit risk adjustment may include default risk and downgrade risk. Note also that a market risk adjustment would not be necessary if the reference portfolio consists solely of bonds.

Estimating the premium liquidity is an extremely important component in selecting a discount rate and yield curve under IFRS 17. There are various methods but the source text only discusses one method in any detail. Recall that in example from Section 4 above, I provided the premium liquidity as given so you could use it in the bottom-up approach for selecting a discount rate.

Question: identify the steps in a "combined approach" for estimating the Liability Liquidity Premium LLP

- [1] create a reference portfolio and calculate the rate of return (not adjusted to match risk profile of insurance contracts)

- [2] subtract the risk-free rate to get the indicated asset liquidity premium ALP

- [3] then LLP = r * ALP + (constant liquidity premium difference)

To me, the reasoning seems circular, but if you follow the formulas in the tab "2-Current Curve" in the Excel appendix, this is indeed what they do. Let's do a simple example to make it clearer. Suppose:

- rate of return on reference portfolio = 3.00% (this is calculated based on a weighted average of return rates on separate components of the reference portfolio)

- risk-free rate = 1.81%

Then the indicated ALP (Asset Liquidity Premium) is 3.00% - 1.81% = 1.19%. Let's round it off and select a value of 1.20%. You now apply the formula in step [3] to get the final selected LLP (Liability Liquidity Premium). But what are the values of r and constant liquidity premium difference? Well, the Excel example sets r = 1 for every year and constant = 0, so:

- LLP = r * ALP + constant = 1.0 * 1.20% + 0 = 1.20%

Alice was like, huh? But we double-checked it and that's how the "combined method" works. If there was a question on the exam that asked you to calculate the LLP (Liability Liquidity Premium), this is how to do it. Once you have the LLP, you simply add that back to the risk-free to get the final selected discount rate.

The reason this is called a "combined approach" is that it uses parts of both the top-down and bottom-up approaches. You start with a reference portfolio (that's the top-down approach) but you don't make credit or market risk adjustments to it. Instead, you use this reference portfolio only in calculating the LLP. Once you have the LLP, you go back to the bottom-up approach and add the LLP to the risk-free rate to get the final selected discount rate. Does that make sense? Ian-the-Intern is now curled up crying in the fetal position. :-(

Now that you have a some idea of how to calculating the liquidity premium, you should be aware of contract features that may influence the liquidity of an insurance contract:

Question: identify contract features that affect the liquidity premium

- exit costs

- → high exit costs like surrender penalties decrease liquidity (and increases the liquidity premium)

- inherent value

- → low inherent value increases liquidity (and decreases the liquidity premium)

- exit value

- → a large portion of inherent value being paid increases liquidity (and decreases the liquidity premium)

Section 5: Reference Curves

A reference curve is a "standardized" yield curve used to facilitate comparison among entities in the unobservable period. The observable period in Canada is 30 years so the unobservable period is the period beyond 30 years. Under certain circumstances, the actuary may compare the present value of liabilities calculated using their selected yield curve with the present value of liabilities using a reference curve, particularly in the unobservable period.

The rest of this section is very detailed and in my judgment is not likely to appear on the exam.

Section 6: Discounting the Estimates of Future Cash Flows

According to the source text:

- In accordance with IFRS 17.36, discount rates are expected to vary with the timing of the cash flows. The use of a yield curve rather than a single discount rate is one way to satisfy this requirement. Using a yield curve, the expected future cash flows at a given payment maturity are discounted using the rate from the yield curve with the corresponding maturity.

This use of a yield curve was demonstrated in the example from Section 4 above. Each age in the table uses a different discount rate and the set of all discount rates constitutes the yield curve.

Section 7: Applying the Risk Adjustment and Determining the Fulfilment Cash Flows

The calculation of Fulfillment Cash Flows was demonstrated in the example from Section 4 above. Recall the formula used in the example:

- FCF = Discounted estimates of future cash flows + Risk adjustment

If you can do work the practice problems from Section 4 then you're in good shape.

Sections 8-13: Additional Guidance on Discounting

From Section 8: Locked-in yield curves refer to yield curves determined at the initial recognition of the group of contracts. Locked-in yield curves would be used when:

- the entity uses the GMA (General Measurement Approach) to determine the LRC for some or all groups of insurance contracts

- (GMA was introduced in CIA.IFRS17 Overview and refers to a method for valuing insurance contract liabilities)

- the entity elects the OCI option (Other Comprehensive Income) for some or all portfolios of insurance contracts

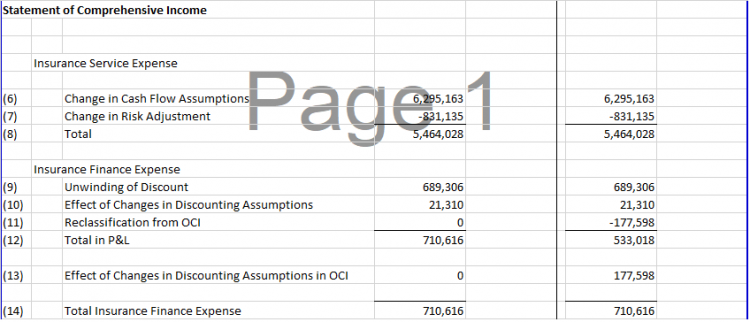

From Section 9: Under IFRS 17, incurred claims (and directly attributable expenses) create insurance expenses that are accounted for in two separate lines of the income statement:

- The insurance service expense

- The insurance finance expense

These expenses refer to the change in the carrying amount of the group of insurance contracts arising from:

- the effect of the time value of money and changes in the time value of money

- the effect of financial risk and changes in financial risk

From Section 10: This section briefly covers the unwinding of discounts. According to the source text:

- The release of the effect of discounting during a reporting period can be conceptualized as the difference between discounting the cash flows to the beginning of the period and discounting to the end of the period.

There are 3 methods for calculating the unwinding:

- constant yield curve:

- - uses the same discount curve at the beginning and end of the period

- unwinding using spot rates:

- - uses an end of period discount curve that is equal to the beginning discount curve shifted by one period

- expectation hypothesis:

- - proposes that the term structure of interest rates is solely determined by market expectations of future interest rate changes

From Section 11: This section mentions the effect of changes in discounting assumptions. The discounting process is what determines the value of the liabilities shown on the balance sheet so it's valuable to investigate how alternate assumptions could change the result. You could even construct a solvency scenario based on alternate discounting assumptions for an FCT analysis. See CIA.FCT-1 for details on that topic.

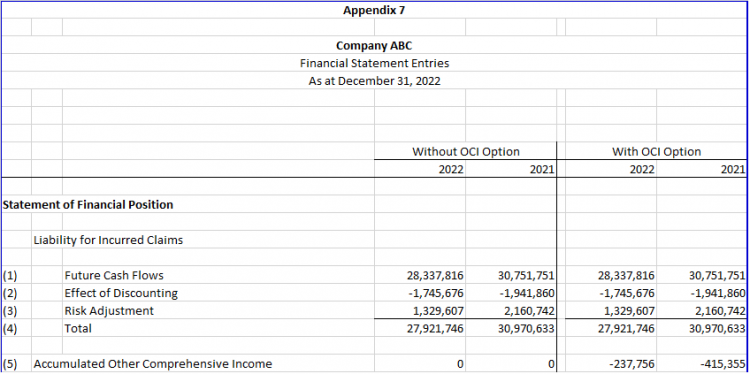

From Section 12: There is a crazy detailed discussion related to the Statement of Financial Position and Statement of Comprehensive Income. See below for examples of these financial statements from the example in the appendix. It's good to have some idea of the layout but constructing these exhibits yourself seems too detailed. Other than that, I don't know what kind of exam question could be asked here. Just make sure you know that the line (4) total = (1) + (2) + (3). That's just the FCF from the example from Section 4 above, although they don't label it as such.

| Statement of Financial Position: |

| Statement of Comprehensive Income: |

From Section 13: The calculation of FCF can be done at any level of aggregation provided the estimates of the LIC (Liability for Incurred Claims) can be allocated back to portfolios and groups of contracts

Section 14: Discussion of Excel Examples

This section from the source text is a detailed discussion of the Excel example from the appendix. It might be a good idea to download the Excel file from the CAS website. It's almost certainly more than would be asked on the exam but it may give you a broader perspective of the whole process. All the most likely testable material has already been covered in this wiki article but if you have an extra hour or so, you can take a look at their more detailed example.