CIA.IFRS17

Reading: “Comparison of IFRS 17 to Current CIA Standards of Practice” June 2022, excluding:

- 3.2

- 5.3

- 7.2

- 8.1.2

- Appendix A

- Appendix B

- Appendix D

Candidates will not be tested on issues related solely to life assurance.

Author: Canadian Institute of Actuaries

# of pages: 38

Contents

- 1 Study Tips

- 2 BattleTable

- 3 In Plain English!

- 3.1 Section 1: Introduction

- 3.2 Section 2: IFRS 17 Overview

- 3.3 Section 3: Classification of Contracts

- 3.4 Section 4: Separation of Contract Components

- 3.5 Section 5: Measurement Approach for LRC

- 3.6 Section 6: Measurement Considerations

- 3.7 Section 7: Probability-Weighted Cash Flows

- 3.8 Section 8: Discounting

- 3.9 Section 9: Risk Adjustment for Non-financial Risk

- 3.10 Appendix C: Examples of Service Components in Canadian Products

Study Tips

| Fall 2023: |

- The source text refers to IFRS 17 and to "current practice", but since Jan 1, 2023, "current practice" is IFRS 17.

- For that reason, in the wiki article below I use the term pre-IFRS 17 practice instead of current practice.

| Study Tips Summary: |

This reading, Comparison of IFRS 17 to Current CIA Standards of Practice, identifies key differences between IFRS 17 and pre-IFRS17 practice in how liabilities are valued. The differences relate to discounting and PfADs. Valuation of the nominal liabilities using the chain-ladder and other techniques is not affected.

This wiki article is long and detailed but I've provided my recommendations below for what you should definitely learn:

- Section 2: all of it (this is a general overview of IFRS 17)

- Section 3: definition of insurance contract

- Section 5: differences between IFRS 17 and current CIA practice regarding measurement of liabilities (See also this old exam problem in CIA.Valn)

- Section 6: measurement considerations for contract liabilities in IFRS 17 (Section 6.2 has been removed from the syllabus starting 2021.Spring.)

If I were studying for this exam myself, I would focus on those topics. (Sections 7 seems to detailed and Sections 8, & 9 ...)

| A few more things before you get started: |

IFRS 17 is replaced IFRS 4. Note that IFRS 4 was on the Exam 6C syllabus until 2019-Spring (and was removed for 2019-Fall). The wiki article for the IFRS 4 material has been archived in CIA.Disclosure. I think it's worth spending 30 minutes looking at the old exam problems for that reading. There was a question regarding concentration of risk that was asked multiple times. I don't know if the exam committee still considers it important but it's worth a quick look. It's an easy question.

Note also the title of this reading, Comparison of IFRS 17 to Current CIA Standards of Practice. To me, that means a good potential exam question would be to list the differences between IFRS 17 and pre-IFRS17 practice, so pay attention to those lists. Before I read the paper, I thought they would provide simple numerical examples that illustrate the differences between IFRS 17 and pre-IFRS17 practice, but they don't.

If you decide to look at the source text, you'll see references sprinkled throughout such as IFRS 17.34 or IFRS 17.78. These are references to the official IFRS document for IFRS 17, but this document is not on the syllabus.

Response from the Exam 6-Canada exam committee:

|

So, there are 2 questions:

1. Does the FCF include or exclude premiums?

2. Are premiums treated as positive or negative quantities?

Or am I just missing something and everything is consistent within the readings? Thank you.

Estimated study time: 2 days (not including subsequent review time)

BattleTable

- this reading was new for 2019-Fall, then removed for 2021-Spring, then reinstated for 2023-Fall

| Questions held out from Fall 2019 exam: #27. (Skip these now to have a fresh exam to practice on later. For links to these questions, see Exam Summaries.) |

reference part (a) part (b) part (c) part (d) E (2018.Fall #28) IFRS 17: 1

- actuarial liabilities

- 1 This question was originally from CIA.Valn but the IFRS 17 material from that reading has been removed from the syllabus. It covers roughly the same material as the new IFRS 17 reading (discussed below) but in a different way. That means the answer in the examiner's report is probably not relevant anymore. You should base your study of IFRS 17 on the new reading.

Full BattleQuiz You must be logged in or this will not work.

In Plain English!

Section 1: Introduction

International Financial Reporting Standard 17, Insurance Contracts is a new standard that will become effective in Canada on January 1, 2023. We will refer to it simply as IFRS 17.

Question: what principles does IFRS 17 establish [Hint: RMPD]

- For insurance contracts within the scope of the IFRS 17 standard, the principles established are:

- Recognition

- Measurement

- Presentation

- Disclosure

Alice likes to think of IFRS 17 as a RaMPeD up version of current CIA standards. I don't know if the above question is something that would actually be asked on an exam, but it seems like something you should know before diving into the reading.

Of the 4 items that IFRS 17 covers, it is the M, measurement, that is the most important. In particular, this reading covers:

- similarities & differences between the measurement of insurance contract liabilities between IFRS 17 and current CIA Standards of Practice

The value of contract liabilities shows up on the "liabilities" side of the balance sheet. It's measurement is extremely important. Before continuing, note that wikipedia has an easy-to-read overview of IFRS 17.

Section 2: IFRS 17 Overview

Suppose we've already calculated the nominal value of the liabilities using the chain ladder technique. Under pre-IFRS17 practice, the next step was to apply discounting and PfADs. Recall the simple formula from CIA.MfAD:

- APV = PV + PfADs

where APV = Actuarial Present Value, PV = Present Value, PfADs = Provision for Adverse Deviations.

Recall also the 3 categories of PfADs / MfADs:

- claims development risk (2.5% - 20.0%)

- interest rate risk (25 - 200 basis points)

- reinsurance recovery risk (0 - 15%)

Under IFRS 17, this is going to change. Here's a question that Alice thinks is virtually certain to be asked on the exam:

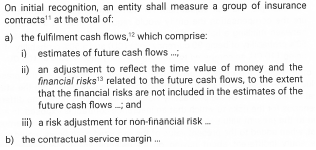

Question: briefly describe the 3 building blocks of the measurement of insurance contract liabilities under IFRS 17 [Hint: PV-risk-CSM]

- Present Value of future cash flows

- - similar to PV(liabilities) without PfADs (but includes provisions for financial risk, unlike with current CIA practice)

- (differences discussed in Section 7: Probability-Weighted Cash Flows)

- risk adjustment for non-financial risk

- - similar to PfADs for non-economic risk

- (differences discussed in section 9, but that section has been removed from the syllabus)

- Contractual Service Margin (CSM)

- - represents unearned profit from a group of insurance contracts (so no front-ending of profits – this is discussed in detail further down in this section)

- (new concept in IFRS 17 – current CIA standards do allow front-ending of profits)

And here are a few additional items related to these building blocks that need mentioning...

Question: define the term fulfilment cash flows or FCF (this is kind of like APV)

- FCF ← discussed in much greater detail in the IFRS discount rate reading CIA.IFRS17-DR

- = Σ (building blocks 1 & 2) ← (building block 1 includes risk adjustment for financial risk)

- = PV(future cash flows) + (risk adjustment for non-financial risk) ← (PV in IFRS 17 includes risk adjustment for financial risk)

- FCF ← discussed in much greater detail in the IFRS discount rate reading CIA.IFRS17-DR

- (Note: The source text doesn't specifically mention "risk adjustment for financial risk" and this could be misleading. The document published by the International Actuarial Association does specifically mention "risk adjustment for financial risk" as part of FCF. Here is the paragraph I'm referring to from page 20 of that document:

- There is more information on this in this forum thread.)

Question: when is a CSM amount established and what is the amount

- when: FCF < 0 (the text treats a negative FCF as a profit)

- amount: CSM = – FCF

- (CSM offsets the negative FCF amount and is released into income as services are provided)

Question: what is meant by front-ending of profits

- The concepts of front-end and back-end profits are easier to understand in terms of buying a car. Suppose a dealer paid $19,500 for a car and sold it to you for $20,000. The dealer's front-end profit is $500. But the dealer can also make a back-end profit by selling you add-ons like rust protection or a racing stripe (ha, ha) or by providing the financing.

- Unfortunately, the source text doesn't provide any insurance examples to illustrate the IFRS concepts of front-end profit, FCF, or CSM, so I tried to come up with my own example. Suppose that under pre-IFRS17 practice we have:

- expected cost per policy (with discounting & PfADs) = $950

- average premium = $1,000

- → front-end profit = $50

- But suppose under pre-IFRS17 practice there is adverse development so that

- ultimate cost per policy = $1,075

- → back-end loss = $75.

- ultimate cost per policy = $1,075

- (and the front-end profit is completely erased with a swing of $125)

- Under IFRS 17, however, the original front-end profit is not permitted:

- expected cost per policy (all cash flows including claims & premiums) = $950 - $1,000 = $-50

- → FCF = -$50 (this is slightly confusing because profits are negative and losses are positive)

- expected cost per policy (all cash flows including claims & premiums) = $950 - $1,000 = $-50

- We now need to create a CSM for +$50 to offset the profit of -$50. This eliminates the front-end profit. Instead, this $50 is released into income as services are provided.

- If there is no adverse development then the full $50 will flow to profits.

- If there is adverse development then some or all of this CSM income will be erased, and the back-end profit will be something lower than $50. There might even be a back-end loss if there is more than $50 per policy of adverse development.

Valuation Methods under IFRS 17

Question: identify and briefly describe 2 valuation methods under IFRS 17

- GMA (General Measurement Approach)

- this is the default approach

- PAA: (Premium Allocation Approach)

- a simplified version of GMA but one of these eligibility requirements assessed at contract inception must be met:

- - can be used for short-term contracts (policy term ≤ 1 year)

- - can be used for longer-duration contracts IF PAA is a reasonable approximation to GMA over the life of the contract

- - applies only to LRC component of insurance contract liabilities (see below)

- (Discussed further in Appendix D of the source reading, but I'm not sure you need to know those details. The text doesn't actually explain how either method works so it seems a little pointless to continue memorizing small details.)

- GMA (General Measurement Approach)

There are 2 more terms within IFRS 17 that you need to know:

Question: define the term Liability for Incurred Claims or LIC

- insurer’s obligation to pay claims for events that have already occurred

Question: define the term Liability for Remaining Coverage or LRC

- insurer’s obligation to provide insurance coverage for events that have not yet occurred (basically just the premium liabilities)

Here's a link to the official IFRS 17 website. It isn't specifically part of the syllabus but I found it helpful. Take a quick look now then you can come back later to review:

Under the IFRS accounting model, we have the following relationship on the balance sheet:

- insurance contract liability = LRC + LIC

And the CSM (Contractual Service Margin) is part of LRC.

mini BattleQuiz 1 You must be logged in or this will not work.

Section 3: Classification of Contracts

There isn't much in this section but this next definition is foundational.

Question: define the term insurance contract according to IFRS 17

- a contract under which 1 party (the issuer)...

- accepts significant insurance risk from another party (the policyholder)...

- by agreeing to compensate the policyholder...

- if a specified uncertain future event (the insured event) adversely affects the policyholder

- (The definition is really just 1 long sentence so I split it into 4 lines and emphasized the key words to make it easier to understand & remember. You should memorize the wording exactly. Also, here's a link to a different way of writing out the definition that might be more helpful for memorizing it. Shout-out to ME!)

Note that the term insurance risk and the meaning of significant used in the above definition are not defined in the source text, but this is covered in Frei.RskTrans. Remember the ERD rule and the 10-10 rule?

There is also a discussion of reinsurance contracts in this section of the source text. I found the presentation somewhat garbled but there are a few items that may be worth noting:

- reinsurance contracts issued by the reinsurer are just normal direct written contracts from the perspective of the reinsurer

- reinsurance contracts held by the ceding entity are separate from the underlying direct written contract

The reading then goes on to talk about lapse risk and expense risk in a direct written contract and notes that these are not insurance risks. But the transfer of these risks from one entity to another does constitute insurance risk.

I almost skipped over this reinsurance discussion for the wiki but I couldn't be sure the examiners wouldn't throw in a strange question where you had to know something about how lapse risk and expense risk could be treated. (We don't yet know which parts of the reading the exam committee will focus on.)

Section 4: Separation of Contract Components

An insurance contract can be separated into components. Under IFRS 17, each distinct component requires separate measurement & reporting.

Question: identify examples of components within an insurance contract under IFRS 17

- insurance components (non-financial risk that is the "normal" part of any insurance contract)

- service components (Ex: claims adjudication with reinsurance protection)

- investment components (amounts included in premiums that are returned customers, regardless of the occurrence of an event)

- → there is a brief forum discussion on investment components

- embedded derivatives (not on syllabus)

The source reading does not explain the separation of components nor how to determine whether a particular component is distinct. (This section doesn't seem important)

mini BattleQuiz 2 You must be logged in or this will not work.

Section 5: Measurement Approach for LRC

Recall:

- → insurance contract liability = LRC + LIC

This section is about measuring the LRC component of the liability. Under IFRS 17, contracts are measured using GMA (General Measurement Approach) but with certain exceptions.

Question: identify exceptions to using the GMA approach for insurance contracts

- contracts satisfying IFRS 17.53 may use PAA (Premium Allocation Approach) to measure LRC

- (the source text doesn't explain IFRS 17.53)

- contracts with direct participation features may use VFA (Variable Free Approach) ← not on syllabus

- reinsurance contracts may use either GMA or PAA (but never VFA)

- (This does not strike me as a likely exam question because of the lack of detail given in the source text.)

The meatiest part of Section 5 concerns the PAA method for valuing insurance contract liabilities. (Premium Allocation Approach) Earlier in this wiki article we noted that that PAA is a simplification of GMA that may be used only if certain eligibility criteria are met:

- short-term contracts (policy term ≤ 1 year)

- longer duration contracts IF measurement under PAA would not differ materially from GMA over life of contract

Eligibility is assessed at inception of contract, and PAA applies only to the LRC portion of the insurance contract liability. (The LIC portion is valued using GMA, which does not have a CSM component.)

Question: according to the CIA source reading, what is the formula for LRC under PAA (not valid for GMA) ← shout-out to oxalis

- LRC = UEP – (

premiums receivable) – DAC ← do NOT subtract (premiums receivable)

- (DAC is the same thing as DPAE)

- If you click on accounting model, you can see how the PAA approach for LRC fits into the overall picture. Look at the box in the lower right labeled: Simplifications for short-term contracts.

- LRC = UEP – (

This next question is very important because it covers differences between IFRS 17 and current CIA practice. That's why Alice made me highlight it in red.

Question: identify differences between IFRS 17 and current CIA practice regarding measurement of liabilities relating to LRC (Liabilities for Remaining Claims)

- criteria:

- IFRS 17: allows PAA for short-term contracts without testing whether PAA reasonably approximates GMA

- CIA: allows (UEP – DAC) to be used only if it's a reasonable approximation to the explicit valuation approach

- criteria:

- DAC deferral

- IFRS 17: entity may choose deferral or direct expense for short-term contracts

- CIA: no deferral in explicit valuation, but deferral if (UEP – DAC) is held

- DAC deferral

- DAC amount

- IFRS 17: allows deferral of DAC that is directly attributable to the portfolio of insurance contracts

- CIA: allowable deferral is different

- DAC amount

- Discounting of LRC

- IFRS 17: requires discounting (i.e. reflecting the time value of money) if the contract has a significant financing component

- (unless the time between the service provided and related premium due date is less than 1 year)

- CIA: requires discounting

- Discounting of LRC

- Discounting of LIC

- IFRS 17: ignore discounting and financial risk for LIC if:

- - PAA is used for LRC

- - LIC cash flows are received ≤ 1 year within incurred date of claims

- CIA: requires discounting

- Discounting of LIC

→ (See also this old exam problem in CIA.Valn) → This is an easier-to-understand answer to the question of differences between IFRS 17 and current CIA practice but that section of the CIA.Valn source text was removed from the syllabus. :-(

Alice's thoughts:

- IFRS 17 seems to give the entity more choice in several areas: methods (GMA or PAA), treatment of DAC, whether to discount. That may make IFRS 17 harder to apply than the current rule-based approach, but it may provide a more customized and accurate way to measure liabilities. On the other hand, the job of the regulator might become more difficult and cross-company comparisons may not be as meaningful. Greater choice also gives companies more opportunity to manipulate their financial statements. Properly trained regulators should be able to identify this however.

And it's always good to have a few examples in your back pocket...

Question: identify examples in Canadian P&C where PAA can & can't be used for LRC

- PAA ok:

- auto outside QC (since the policy term is generally ≤ 1 year)

- auto in QC (if PAA is a reasonable approximation to GMA)

- PAA ok:

- PAA probably not ok:

- warranty

- mortagage default

- (both may have terms > 1 year, or high year-to-year variability in claims)

- PAA probably not ok:

mini BattleQuiz 3 You must be logged in or this will not work.

Section 6: Measurement Considerations

Another common exam question asks you to list items that must be taken into consideration when performing some sort of analysis. There are probably dozens of ways to answer that question for valuation in IFRS 17, but there are 2 that are specifically discussed.

Question: briefly describe 2 measurement considerations for contract liabilities in IFRS 17

- level of aggregation

- must identify portfolios of contracts

- (contracts in a portfolio have similar risks and are managed together)

- each portfolio is further subdivided into groups

- (a group is the unit of account for measurement of CSM)

- level of aggregation

- → This first consideration, level of aggregation, is also a consideration under current CIA practice, and the general concept isn't all that different. You need to put risks into homogeneous classes but make sure the classes are all still big enough to be credible.

- → Note that expenses must be allocated to groups but other assumptions may be applied at whatever level is most appropriate for estimating cash flows.

- contract boundary

- must identify contract boundary for each contract

- (this is normally the term of the policy)

- cash flow estimates include only cash flows related to claims incurred within the boundary

Section 7: Probability-Weighted Cash Flows

If you're looking at the source text, remember to exclude section 7.2 on "Cash flows that vary with assumptions related to financial risk" (That's about half of section 7.)

It's a very basic concept that cash inflows and cash outflows have to be measured so you can make good business decisions. That much is the same between IFRS 17 and pre-IFRS17 practice. The first paragraph of this section in the source text gives a definition of cash flow according to IFRS 17. I'm not sure if something like that will be asked on the exam, but it's good to know how they do it:

estimate of future cash flows = probability-weighted mean of the full range of possible outcomes

→ use all credible information available at the reporting date without undue cost or effort

Alice and I had a chuckle over that last sentence. It seems to say that you should use all available information but only if you don't have to put in too much effort to get it. I'm going to start applying that to all my work going forward. :-)

Ok, here's another list of differences you should probably memorize...

Question: identify differences between IFRS 17 and current CIA practice regarding probability-weighted cash flows [Hint: MfADs-PET]

- MfADs: (for non-financial risk)

- IFRS 17 requires separate disclosure of risk adjustment for non-financial risk

- (under pre-IFRS17 practice, the difference between "best estimate" of cash flow and "best estimate with PfAD" is not always quantified)

- → there is a brief forum discussion & example related to this

- MfADs: (for non-financial risk)

- MfADs: (for financial risk)

- IFRS 17 includes financial risk in the present value of future cash flows

- (under pre-IFRS17 practice, MfAD for interest rate risk is separate from the best estimate of PV for cash flows)

- MfADs: (for financial risk)

- Policyholder options: (selection of limits and other coverage options can affect cash flows)

- IFRS accounts for policyholder behaviour

- (under pre-IFRS17 practice, the effect on cash flows is blurred)

- Policyholder options: (selection of limits and other coverage options can affect cash flows)

- Expenses:

- IFRS 17 includes only expenses directly attributable to the portfolio

- (under pre-IFRS17 practice, this is not a requirement)

- Expenses:

- Taxes:

- IFRS 17 excludes taxes from cash flow estimates

- (under pre-IFRS17 practice, taxes are included)

- Taxes:

Let's take a step back and think about how you can remember all these lists. I've already nagged you about repetition so you know you have to drill yourself relentlessly on the BattleCards. I often also include a hint or memory trick. But as I was working my way through this IFRS reading, I found myself getting muddled because of the level of detail that's included. It's so hard to know what the examiners will focus on and if it were a less important reading, I would tell you just to learn the basics. But you'll probably need to know more than that. The first time a topic appears on the exam, the question may very well be easy, but the questions will get harder over subsequent exams – that's the CAS pattern.

Anyway, this brings me to another learning technique: Make up a story. And the dumber the story, the better! If you can tap into humour or other emotions, your brain will create a more reliable memory. Here's my story, but you can personalize it in any way you want.

Alice stopped by my condo yesterday for a brewski but she brought her PET poodle MfAD. (Yes, she named it MfAD.) Anyway MfAD flowed on the living room rug (flow as in cash-flow.) Très ennuyant. End of story!

So you see how this story connects the hint MfADs-PET to what the question is about: cash-flows. You'll remember it better and studying will be more fun. :-)

The above discussion came from section 7.1 of the source text. There's a little more in that section but I decided to skip it because you can't memorize everything. It covered some very detailed facts about DAC. And as mentioned earlier, section 7.2 is not on the syllabus.

That just leaves section 7.3. This is another overly detailed discussion of DAC and CSM. Did you remember that CSM stands for Contractual Service Margin. This is a good opportunity for a quick review:

- CSM represents unearned profit from a group of insurance contracts (so no front-ending of profits)

You should also go back and make sure you understand front-ending of profits because that's a basic difference between IFRS 17 and pre-IFRS17 practice. (IFRS 17 doesn't allow front-ending of profits whereas pre-IFRS17 practice does.)

Anyway, section 7.3 says that under IFRS 17, acquisition expenses are included in cash-flow estimates, and that reduces CSM. You can refer to the source text if you want more details, but you should only spend time on this if you've already learned everything else.

mini BattleQuiz 5 You must be logged in or this will not work.

Section 8: Discounting

| • Discounting is discussed in much more detail in the reading: CIA.IFRS17-DR, where DR stands for Discount Rate. So don't worry too much if you don't understand everything in this section because we'll be returning to it later. • Note that he top-down and bottom-up approaches are explained more clearly in CIA.IFRS17-DR. |

Sections 8.1 & 8.1.2 are just a review of material from CIA.Discnt. These 2 sections list asset characteristics to consider when selecting a discount rate. You should take moment to review that because it has been asked multiple times on past exams.

At the risk of restating the obvious:

- the purpose of discounting is to account for the time value of money

To do the discounting calculation under Pre-IFRS17 practice, you had to know 3 things:

- discount rate

- discount rate MfAD or Margin for Adverse Deviation(between 25 and 200 basis points)

- payment pattern

Now IFRS 17 doesn't use MfADs, and the payment pattern is not discussed in this reading, so the main question you have to be able to answer is:

Question: how is the discount rate selected under IFRS 17

Unfortunately the answer is not clearly explained in the reading. What I've tried to do below is condense the information into a few bullet points. I've also eliminated much of the detail because I don't think those small details can easily be tested. If this makes you nervous you can read the source text yourself, but only after you've learned everything else.

There are 4 main discussion threads related to discount rate selection:

- when cash flows do not vary with returns on underlying items

- general concepts on reflecting financial risk in the discount rate selection (section 8.3 – intro only)

- when cash flows do vary with returns on underlying items

- when cash flows vary with assumptions related to financial risk

Let's consider these in turn...

Point #1: under IFRS 17, how is the discount rate selected when cash flows do not vary with returns on underlying items

- discount rate is based on a liquidity-adjusted risk-free discount rate curve

A discount rate curve is also called a yield curve. Click the link if you don't know what that is. The key is coming up with the discount rate curve and it can be done in a couple of different ways:

- bottom-up approach:

- adjust the risk-free discount curve by adding an illiquidity premium that reflects the liabilities

- → under pre-IFRS17 practice, there's no requirement to identify an illiquidity premium

- top-down approach:

- use the investment return on a reference portfolio of assets that's "similar" to the liabilities

- this reference portfolio does not have to be based on assets held by the company

- (Example: use the 10-year spot rate on a Canadian bond for a 10-year liability cash flow)

- then remove asset characteristics not relevant to the liability

- (Example: remove credit and market risk)

- → under pre-IFRS17 practice, the rate would be tied more closely to assets held by the company

Point #2: briefly describe how financial risk is incorporated into discounting under IFRS 17

- This is a little bit of a trick question because under IFRS 17, you can build financial risk into the discount rate OR the cash flows OR a combination of both.

- → under pre-IFRS17 practice, there is an explicit provision for reinvestment risk (no such provision under IFRS 17)

Point #3: briefly describe how the discount rate is selected when cash flows do vary with returns on underlying premiums.

- choose a discount rate that makes the value of the liability cash flows equal the fair market value of the underlying assets

Point #4: briefly describe how are cash flows handled when they vary with assumptions related to financial risk

- either through adjustments to the discount rate or adjustments to the cash flows themselves

- must adhere to market consistency

- IFRS 17 suggests using of stochastic and risk-neutral measurement techniques and considering the costs of options and guarantees

I think that's all you need to know from this section. If you do look at the source text, be forewarned that life insurance concepts are mixed in with the discussion and none of the life material is on the syllabus. I found that confusing because I don't know much about life insurance.

mini BattleQuiz 6 You must be logged in or this will not work.

Section 9: Risk Adjustment for Non-financial Risk

The first 2 (short) paragraphs of this section in the source text provide a nice summary of the whole section.

- paragraph 1: cash flows in IFRS 17 reflect an insurer's compensation for assuming non-financial risk (amount & timing of claim payments)

- paragraph 2: cash flows in pre-IFRS17 practice incorporate PfADs (similar to IFRS 17 but include both financial & non-financial risk)

Then there is a table that summarizes the differences between IFRS 17 and current practice regarding treatment of non-financial risk. See link below.

The most important difference listed in this table is measurement objective. IFRS 17 focuses on the compensation an entity requires, not just the effect of uncertainty. That means 2 different companies could value an identical portfolio of liabilities differently simply because 1 company wants a higher level of compensation for accepting the risk.

The rest of section 9 in the source text (roughly 3 pages) does not look like testable material. There is already plenty that can be asked from previous sections.

There was a forum question about risk adjustment related to reinsurance contracts. It's a detailed question so you can glance at it now (start by scrolling down to my answer) but it will probably make more sense if you come back to it later after you've covered some of the other IFRS 17 readings.

Appendix C: Examples of Service Components in Canadian Products

This appendix is only 1 page long and is a table. You can look at it if you want but there is nothing testable there.