Difference between revisions of "OSFI.MemoAA"

(→6.15.2 Estimates of Future Cash Flows) |

|||

| Line 1: | Line 1: | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

'''Reading''': “Property and Casualty - Memorandum to the Appointed Actuary,” 2023. | '''Reading''': “Property and Casualty - Memorandum to the Appointed Actuary,” 2023. | ||

'''Author''': OSFI (Office of the Superintendent of Financial Institutions Canada) | '''Author''': OSFI (Office of the Superintendent of Financial Institutions Canada) | ||

| − | + | [https://battleactsmain.ca/vanillaforum/categories/OSFI-MemoAA<span style="font-size: 12px; background-color: lightgrey; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 0px;">'''Forum'''</span>] | |

==Pop Quiz== | ==Pop Quiz== | ||

Revision as of 18:21, 10 August 2024

Reading: “Property and Casualty - Memorandum to the Appointed Actuary,” 2023.

Author: OSFI (Office of the Superintendent of Financial Institutions Canada)

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 4.1 Section 1 - OVERVIEW

- 4.2 Section 2 - REGULATORY REQUIREMENTS

- 4.2.1 2.1 Application of Professional Standards to the Appointed Actuary’s Valuation

- 4.2.2 2.2 Filing Directions for the AAR, Financial Condition Testing (FCT) Report and Peer Review Report

- 4.2.3 2.3 Filing Directions for the Supplementary Tables

- 4.2.4 2.4 Persons Signing the Appointed Actuary's Report

- 4.3 Section 3 - OSFI’S REVIEW PROCESS

- 4.4 Section 4 - SPECIAL LINE OF BUSINESS CONSIDERATIONS

- 4.5 Section 5 - FORMAT OF THE APPOINTED ACTUARY'S REPORT

- 4.6 Section 6 - CONTENTS OF THE APPOINTED ACTUARY’S REPORT

- 4.6.1 6.1 Introduction

- 4.6.2 6.2 Expression of Opinion

- 4.6.3 6.3 Supplementary Information Supporting the Opinion

- 4.6.4 6.4 Executive Summary

- 4.6.5 6.5 Description of Entity

- 4.6.6 6.6 Materiality Standards

- 4.6.7 6.7 Data

- 4.6.8 6.8 Expenses

- 4.6.9 6.9 Classification of Contracts

- 4.6.10 6.10 Portfolio Reporting

- 4.6.11 6.11 Estimates of Future Cash Flows

- 4.6.12 6.12 Discount Curve

- 4.6.13 6.13 Risk Adjustment for Non-Financial Risk

- 4.6.14 6.14 Liability for Incurred Claims

- 4.6.15 6.15 Liability for Remaining Coverage

- 4.6.16 6.16 Other Liabilities/Other Assets

- 4.6.17 6.17 Liability Roll Forward

- 4.6.18 6.18 Liabilities for Investment and Service Contracts

- 4.6.19 6.19 Transition Amount

- 4.7 Section 7 - OTHER DISCLOSURE REQUIREMENTS

- 4.7.1 7.1 New Appointment

- 4.7.2 7.2 Annual Required Reporting to the Board or Audit Committee

- 4.7.3 7.3 Continuing Professional Development Requirements

- 4.7.4 7.4 Disclosure of Compensation

- 4.7.5 7.5 Reporting Relationships of the Appointed Actuary

- 4.7.6 7.6 Peer Review of the Work of the Appointed Actuary

- 4.7.7 7.7 Re-submitting the report

- 4.8 Section 8 - UNPAID CLAIMS AND LOSS RATIO ANALYSIS EXHIBIT

- 4.9 Section 9 - Appendix I - Expression of Opinion

- 4.10 Section 10 - Appendix II - Unpaid Claims and Loss Ratio Analysis Exhibit

- 4.11 Section 11 - Appendix III – Annual Return Lines of Business

- 4.12 Section 12 - Appendix IV - Unpaid Claims and Loss Ratio Analysis Exhibit

- 4.13 Section 13 - Appendix V – Definitions

- 5 POP QUIZ ANSWERS

Pop Quiz

Study Tips

Much of the content of this reading is discussed in other readings pertaining the appointed actuary. As such, this reading might be a good review. It is long and detailed and there doesn't seem to be much testable material that hasn't already been covered elsewhere. If you completely skipped this reading, I honestly don't know if it would matter. (Just my guess.)

Estimated study time: 2 hours (not including subsequent review time)

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

In Plain English!

Section 1 - OVERVIEW

The Office of the Superintendent of Financial Institutions (OSFI) outlines requirements for the Appointed Actuary’s Report (AAR) under the Insurance Companies Act (ICA). The AAR is a detailed actuarial report given to regulators, discussing the suitability of actuarial and other policy liabilities in financial statements. It includes the actuary's opinion, backed by data and calculations. The report serves regulators, OSFI's actuaries and the insurer's management.

Section 2 - REGULATORY REQUIREMENTS

2.1 Application of Professional Standards to the Appointed Actuary’s Valuation

This section emphasizes that the Appointed Actuary must ensure the valuation of insurance contract liabilities complies with Canadian professional standards. These standards are set by the Canadian Institute of Actuaries (CIA) and are crucial for ensuring credibility and reliability of the valuations. It underscores that the Appointed Actuary should be able to apply judgment and develop their own methodologies, but they should be consistent with the professional standards and should be defensible. The Actuary also needs to make sure that data used is accurate, relevant, and consistent over time. If there are any changes in data or methodology from the previous year, these need to be justified and clearly disclosed in the report.

2.2 Filing Directions for the AAR, Financial Condition Testing (FCT) Report and Peer Review Report

The section details the filing procedures and deadlines for the AAR, FCT Report, and Peer Review Report as mandated by OSFI. Reports should be electronically submitted through the Regulatory Reporting System (RRS), with specific deadlines for each. Non-compliance will result in penalties. For security and ease of access, reports should be in PDF format, searchable, and without security protection. Hard copies are required for some entities, but most should avoid this unless specifically contacted. Proper file naming is stressed, and the ICA requires entities to file their AAR along with their Annual Return.

2.3 Filing Directions for the Supplementary Tables

When submitting the AAR and FCT reports, organizations need to fill out and send the associated Excel sheets. These additional charts allow OSFI to easily gather and analyze specific data.

2.4 Persons Signing the Appointed Actuary's Report

The AAR must be signed by the Appointed Actuary, who must be a Fellow of the CIA.

Section 3 - OSFI’S REVIEW PROCESS

OSFI may conduct extended reviews of the AAR and, if assumptions or methods seem inappropriate, the Superintendent can require modifications and a re-filing of the AAR. The Appointed Actuary should promptly respond to any supplemental requests and always have supporting documentation available for OSFI's review, with the possibility of an independent actuary's report being requested.

Section 4 - SPECIAL LINE OF BUSINESS CONSIDERATIONS

Nothing testable. This section very briefly discusses marine insurance, title insurance, and business acquired before the transition date.

Section 5 - FORMAT OF THE APPOINTED ACTUARY'S REPORT

This is another short section with almost no testable information. It states that the AAR may vary somewhat from actuary to actuary but that most AARs include the given list of 22 sections. Obviously you don't have to memorize these. Some of the more obvious sections to include are:

- Expression of Opinion

- Supplementary Information Supporting the Opinion

- Materiality Standards

- Data

Some of the sections specific to IFRS 17 are:

- Risk Adjustment for Non-financial Risk

- LIC (Liabilities for Incurred Claims)

- LRC (Liabilities for Remaining Coverage)

If you were asked to list items that must be included in the AAR, you could list these. They are pretty obvious.

Section 6 - CONTENTS OF THE APPOINTED ACTUARY’S REPORT

6.1 Introduction

This section should identify the scope of the AAR and should indicate clearly that the AAR is an actuarial valuation report or supports an actuarial opinion. This section should also identify:

- the entity involved,

- the date of valuation,

- the author's identity

- the author's full contact information (address, email, phone)

- the author's authority for preparing the AAR

I highlighted a word in each bullet point as a memory aid. When you do that, it becomes easier to remember because obviously you need the name of the entity and the date of the valuation. Then the last 3 bullet points are also obvious pieces of information you would want about the author.

This isn't specifically discussed in the source text but the the author's authority for preparing the AAR refers to the qualifications, credentials, or official capacity that enable the author (in this case, an actuary) to create the Appointed Actuary’s Report (AAR). This would typically include: - Professional Qualifications: The actuary's professional credentials, such as being a member of a recognized actuarial society or having specific actuarial certifications.

- Legal or Regulatory Authority: Any legal or regulatory basis that empowers or requires the actuary to prepare the report. This could involve specific laws or regulations that designate the actuary's role in preparing such reports.

- Experience and Expertise: The actuary's relevant experience in the field, which contributes to their capability to undertake this task.

- Appointment Details: How and by whom the actuary was appointed to this role, possibly including references to the governing body or organization that authorized the appointment.

This section is crucial as it establishes the credibility and legitimacy of the report by demonstrating that the author is qualified and authorized to prepare such a detailed and critical document.

6.2 Expression of Opinion

Section 6.2 of the AAR document mandates that the Appointed Actuary must use a specific opinion format as per the CIA Standards of Practice. Any deviation will result in a qualified opinion by OSFI. The section requires the Actuary's original signature, name, date, and signing location. Opinions presented to shareholders and policyholders must align with those filed with OSFI, with any discrepancies and their reasons reported to OSFI. Qualifications or limitations in the valuation must be noted, but caveats or disclaimers should only appear in Section 6.3. If the External Auditor Report is unavailable, a conditional qualified opinion is required, with subsequent actions depending on the Auditor’s final opinion.

6.3 Supplementary Information Supporting the Opinion

Section 6.3 of the AAR requires detailed references to how the Appointed Actuary's figures are derived, including tables for consolidated results. It also mandates the inclusion of an exhibit reconciling non-consolidated AARs with the consolidated opinion, valuing non-federally regulated subsidiaries under Canadian actuarial practices.

6.4 Executive Summary

Section 6.4 of the AAR requires a summary of key results and findings, including a comparison of actual vs. expected prior year experiences, changes in methods or assumptions, significant issues, and deviations from CIA Standards or memorandum requirements.

6.5 Description of Entity

Section 6.5 of the AAR requires the Appointed Actuary to describe the entity's history, business lines, and management, including recent changes and their impact on valuation. It mandates detailed information on the entity’s reinsurance arrangements, including types, terms, non-performance risks, and any material financial or related party reinsurance agreements, as well as retrospective reinsurance contracts and funds withheld.

6.6 Materiality Standards

In the entity's Annual Return preparation, both management and the external auditor agree on a materiality level, which must be reported in the AAR along with the Appointed Actuary's criteria for selecting their materiality standard in valuing liabilities.

6.7 Data

Section 6.7 of the AAR emphasizes the need for the Appointed Actuary to review, verify, and ensure the sufficiency, reliability, and accuracy of the data used for valuation, including data prepared by others, and to establish suitable check procedures as per CIA Standards of Practice.

6.8 Expenses

Section 6.8 of the AAR requires the Appointed Actuary to disclose the determination of directly attributable expenses, allocation of total entity expenses, treatment of acquisition costs, and investment expenses. It also mandates disclosure of recoverability tests for insurance acquisition cash flows as per IFRS 17.

6.9 Classification of Contracts

For the first year of IFRS 17 implementation in fiscal year 2023, Section 6.9 requires the Appointed Actuary to disclose any changes in contract classification from IFRS 4 to IFRS 17, including details of liabilities/assets and the rationale for reclassification, in a specified table format.

6.10 Portfolio Reporting

Section 6.10 mandates that the Appointed Actuary report on the determination of each portfolio at the legal entity level, disclose material changes from the prior year, and include details like the Actuarial Lines of Business and unique circumstances affecting contract boundaries.

6.11 Estimates of Future Cash Flows

Section 6.11 requires the AAR to report on future cash flow components, including how they are generated, and details of claim expense cash flows with a clear indication of the approach used. It also mandates a description of methods used for internal loss expense provisions and the impact of any methodological changes, especially if material.

6.12 Discount Curve

The AAR must detail and justify the approaches, inputs, assumptions, and methodologies used for developing the discount curve, choosing discount rates, adjusting for financial risk, and reporting discount rates by year and liquidity category. Additionally, it should disclose contract groups under the Premium Allocation Approach where future cash flows aren't adjusted for time value of money and financial risk, based on specific conditions related to LIC and LRC.

6.12.1 Bottom-Up Approach

For the bottom-up approach in Section 6.12.1 of the AAR, the Appointed Actuary must detail the construction methods for the risk-free curve, sources and periods for risk-free rates, and provide these rates by year. Additionally, descriptions of liquidity classes, allocation of actuarial lines of business to these classes, rationales for the number of classes, and techniques for deriving illiquidity premiums are required. The section also mandates details on the use and construction of replicating portfolios, including types of assets used and their rationale.

6.12.2 Top-Down Approach

In Section 6.12.2 on the top-down approach, the AAR requires detailed information about the reference portfolio, including whether the entity's assets or a hypothetical mix are used, the types of assets per liquidity category, and adjustments to the yield curve to eliminate non-relevant factors. The section also mandates explanations for the appropriateness of chosen assets and adjustments for liquidity characteristics differences.

6.12.3 Reference Curves for Liquid and Illiquid Categories

Section 6.12.3 mandates reporting on liquid and illiquid reference curves as defined by the CIA IFRS 17 Discount Curves – Fiera Capital. The Appointed Actuary must disclose if this data was used for deriving the illiquidity premium and explain any differences between the entity's discount curves and the reference curves, including a comparison of present values calculated using both sets of curves.

6.13 Risk Adjustment for Non-Financial Risk

Section 6.13 requires the Appointed Actuary to disclose the risk adjustment (RA) amount and technique used, both gross and net, including the confidence level, level of aggregation for non-financial risk, and methodology for setting the RA. It details specific requirements for the Cost of Capital, Quantile Techniques, and Margin approaches, including how diversification benefits are reflected, techniques for determining the confidence level, and justifications for changes from the previous year. For combining/hybrid approaches, disclosures from applicable methods should be included.

6.14 Liability for Incurred Claims

Section 6.14 of the OSFI P&C Memorandum to the Appointed Actuary, 2023, discusses the "Liability for Incurred Claims." This liability encompasses the fulfilment cash flows related to past services allocated to contract groups. The section is divided into sub-sections, each focusing on a different aspect

6.14.1 Estimates of Future Cash Flows

Outlines the need for detailed commentary on the estimates of future cash flows (gross, ceded, net), considering various factors like salvage, subrogation, trends in claims, coverage changes, reinsurance costs, reporting and payment lags, loss reserving practices, regulatory changes, and maintenance expenses.

6.14.2 Discounting the Estimates of Future Cash Flows

Discusses adjusting cash flow estimates to reflect the time value of money and financial risks.

6.14.3 Risk Adjustment for Non-Financial Risk

Requires explicit risk adjustment for liability for incurred claims (LIC), with disclosure of approach and amount.

6.14.4 Comparison of Actual Experience with Expected Experience in Prior Year-End Valuations

Involves comparing actual and expected experiences by accident year for each actuarial line of business, and requires commentary on material developments and any changes.

6.15 Liability for Remaining Coverage

Under the General Measurement Approach (GMA), the liability for remaining coverage comprises the fulfilment cash flows related to future service allocated to the groups of contracts at that date and the contractual service margin (CSM) of the groups of contracts at that date. The fulfilment cash flows include:

- The best estimate of future cash flows

- An adjustment to reflect the time value of money

- A risk adjustment for non-financial risk

Under the Premium Allocation Approach (PAA), the liability for remaining coverage, excluding the loss component at initial recognition and at the end of each subsequent reporting period, is measured by adjusting premiums received. This adjustment considers components such as:

- Insurance acquisition cash flows

- Investment component

- Others as required per IFRS 17.55-59

Premiums received are usually allocated on the basis of the passage of time over the coverage period. The Appointed Actuary should disclose when the basis of allocation differs from the passage of time during the coverage period for any portfolio.

6.15.1 Measurement Approach

The Appointed Actuary should disclose the portfolios and groups of contracts along with their associated measurement approach. Key points include:

- For groups of contracts measured under the Premium Allocation Approach (PAA):

- Provide detailed justification for:

- How the entity has satisfied the eligibility requirements, including a summary of calculations or tests performed, if applicable.

- The method chosen to recognize insurance acquisition cash flows.

- The process or procedure used to conclude on onerous groups of contracts.

- Provide detailed justification for:

- For each portfolio:

- Identify the groups of contracts, measurement approaches, and rationale for grouping in Tables 7.1 and 7.2 of the supplementary spreadsheet for (re-)insurance contracts issued and reinsurance contracts held.

- Disclose any material changes in portfolios, groups of contracts, and associated measurement approaches from the previous year’s AAR.

- Additionally, for each portfolio, the Appointed Actuary should disclose:

- The considerations used to determine the groups of insurance contracts for recognizing insurance revenue.

- The tests and/or considerations used to determine the groups of onerous contracts at initial recognition, those with no significant possibility of becoming onerous, and remaining contracts in the portfolio.

6.15.2 Estimates of Future Cash Flows

OSFI mandates the Appointed Actuary to provide detailed commentary on various aspects of future cash flows for GMA or onerous contract groups under the PAA including:

- expected losses

- non-acquisition expenses

- servicing costs

- commissions

- premium adjustments

- net outflows for onerous contracts.

Additionally, any subsequent events impacting liability provisions must be disclosed and discussed.

The commentary should also cover estimates for future reinsurance contracts, detailing expected losses recoverable net of reinsurance costs.

6.15.3 Discounting the Estimates of Future Cash Flows

When applicable, the entity is required to adjust the estimates of future cash flows. This adjustment is to reflect two key aspects:

- The time value of money

- The financial risks related to those cash flows, provided these financial risks are not already included in the estimates of cash flows.

6.15.4 Risk Adjustment for Non-Financial Risk

This section addresses the risk adjustment for non-financial risk for portfolios or groups of contracts, differentiated by measurement approach:

- Premium Allocation Approach (PAA):

- An explicit risk adjustment calculation for the Liability for Remaining Coverage (LRC) is not necessary for groups of contracts that are not deemed onerous.

- If groups of contracts become onerous, the Appointed Actuary must disclose the explicit risk adjustment in the calculation of the loss component for these groups.

- In such cases, column (05) in Tables 4.1 and 4.2 of the supplementary spreadsheet must be filled.

- General Measurement Approach (GMA):

- An explicit risk adjustment calculation is mandatory.

- The Appointed Actuary should disclose the approach and amount for LRC in columns (03) and (04) of Tables 4.1 and 4.2 in the supplementary spreadsheet.

6.15.5 Contractual Service Margin

This section focuses on the approaches related to the Contractual Service Margin (CSM):

- The Appointed Actuary should discuss:

- The approach used to determine the discount rate locked in at initial recognition for the measurement of CSM.

- The approach used to determine the interest to accrete on the CSM.

- Further discussions by the Appointed Actuary should include:

- The number of groups in each portfolio as stated in Tables 7.1 and 7.2.

- Considerations used to determine the number of groups (e.g., segmenting levels of profitability).

- Methods for assessing contracts' profitability to assign them to appropriate groups, along with justifications for other criteria used.

- General considerations for determining coverage units and selecting the discount rate.

- If a discount rate is not used, the rationale behind this decision.

6.15.6 Loss Component

This section outlines the responsibilities of the Appointed Actuary concerning the loss component:

- The Appointed Actuary is expected to explain the key drivers for:

- The loss component for each group of onerous contracts at initial recognition.

- The loss component for each group of contracts where a loss component arises at subsequent measurement.

- Under the General Measurement Approach (GMA), discuss subsequent changes to the loss component for each group of onerous contracts.

- For reinsurance contracts covering only a part of the group of underlying onerous contracts:

- Disclose the systematic and rational allocation method used to determine the portion of losses of the group of onerous contracts that is reinsured.

- Describe how the loss-recovery component is established.

- The approach used to allocate changes in the fulfillment cash flows of the Liability for Remaining Coverage as specified in paragraph 50(a) of IFRS 17 should be described.

- For insurance contracts measured under the Premium Allocation Approach (PAA):

- Provide commentary on the facts and circumstances associated with any groups of insurance contracts for which a loss component arises at subsequent measurement.

- Include the amount of the loss components on both a group and portfolio basis.

6.16 Other Liabilities/Other Assets

Section 6.16 covers the Appointed Actuary's duty to evaluate Self-Insurance Retention plans, report them net of reinsurance, and detail any other liabilities or assets not previously mentioned, including valuation methods.

6.17 Liability Roll Forward

Section 6.17, "Liability Roll Forward," requires the Appointed Actuary (AA) to provide liability roll forward schedules for different portfolios. These are to be shown in Tables 8.1 and 8.2 of a supplementary spreadsheet, with a separate section for issued (re-)insurance contracts and held reinsurance contracts, all based on the legal entity level.

6.18 Liabilities for Investment and Service Contracts

Section 6.18, titled "Liabilities for Investment and Service Contracts," instructs the Appointed Actuary to fill out Table 9 in the supplementary spreadsheet. This table is specifically for liabilities associated with investment and service contracts, if applicable.

6.19 Transition Amount

Section 6.19, "Transition Amount," focuses on contracts measured under modified retrospective, full retrospective approach, or fair value on transition to IFRS 17. It requires details on how the entity measures these contracts at the date of transition and how the Contractual Service Margin (CSM) is determined. For Title insurance business, if applicable, it asks for details on the approach used to determine the transition amount of title insurance contracts at the date of transition.

Section 7 - OTHER DISCLOSURE REQUIREMENTS

7.1 New Appointment

OSFI mandates that Appointed Actuaries adhere to the standards outlined in Guideline E-15. This includes being transparent about any deviations from the qualification requirements and outlining plans to fulfill these requirements. Additionally, if the Actuary was appointed in the last year, the Annual Actuarial Report (AAR) must detail:

- the date of their appointment

- the previous Actuary's resignation date

- when OSFI was informed about the appointment

- confirmation of communication with the former Actuary as per ICA section 364(1)

- a comprehensive list of the new Actuary's qualifications, considering the Canadian Institute of Actuaries (CIA)’s Rules of Professional Conduct

7.2 Annual Required Reporting to the Board or Audit Committee

This is a very short section in the source text:

- For Canadian entities:

- The AAR must disclose the date the Appointed Actuary met with the board or the audit committee, as mandated by paragraph 203(3)(f) of the ICA.

- For foreign entities:

- The AAR must disclose the date the Appointed Actuary met with the chief agent, as required by section 630 of the ICA.

7.3 Continuing Professional Development Requirements

Directly from the source text:

- The Appointed Actuary must disclose in the AAR that he/she is in compliance with the Continuing Professional Development requirements of the CIA.

7.4 Disclosure of Compensation

Alice and Andy:

- Alice the Actuary, known for her meticulous calculations within the walls of her insurance company, always made sure her compensation, from salary to bonuses, was an open book, aligning with the Financial Stability Board's principles. Her documentation was a beacon of transparency, detailing every bit of her earnings and the methods behind them, ensuring her judgment remained as clear as the summer sky!

- Meanwhile, Caleb the Consultant, a consultant with a knack for navigating complex projects, meticulously outlined his consulting fees, the rationale behind them, and their proportion to his firm's revenue in a detailed report.

- Each year, they both sent their compensation disclosures to OSFI in a separate cover letter, a ritual that not only fulfilled regulatory requirements but also symbolized their commitment to impartiality and confidentiality. Together, Alice and Caleb exemplified the essence of integrity and transparency in the actuarial profession, setting a standard for actuaries from the Atlantic to the Pacific!

The following 5 items related to compensation must be disclosed as described below.

Compensation - Total $

- Appointed Actuaries must disclose compensation in line with Financial Stability Board's Principles and OSFI requirements, ensuring unbiased judgment.

Compensation Methodology

- Disclosure includes methodology for deriving direct and indirect compensation, promoting transparency and impartiality.

Compensation Details - Internal Actuary

- Employee actuaries' compensation details, such as salary and bonuses, must be openly documented, including variable compensation calculation methods.

Compensation Details - Consulting Actuary

- External consultant actuaries are required to detail consulting fees, determination basis, and fees' revenue proportion, ensuring full disclosure.

Compensation - OSFI

- Compensation disclosures are sent to OSFI in a separate cover letter, ensuring confidentiality and compliance with regulatory requests.

7.5 Reporting Relationships of the Appointed Actuary

The Appointed Actuary's Report (AAR) provides essential disclosures about the actuary's reporting relationships and dependencies. These disclosures vary depending on whether the actuary is an internal employee or an external consultant.

Internal Appointed Actuaries

- Must disclose the name and position of their direct supervisor(s), including both solid and dotted line reporting relationships.

- Should report any changes in reporting relationships that occurred within the past year.

- Need to disclose any expected changes in reporting relationships.

External Appointed Actuaries

- Should disclose the names and positions of their main contacts within the entity, specifically regarding roles and functions like valuation, Financial Condition Testing (FCT), and Minimum Capital Test (MCT) support.

- Must include the name and position of the individual who hired them.

- Need to disclose the entity employees with whom they discuss their findings and reports.

7.6 Peer Review of the Work of the Appointed Actuary

The topic of peer reviews of the appointed actuary's work is covered in detail in other readings. This reading doesn't provide much detail but simply refers OSFI's guideline E-15. This short section does however contain 1 comment in bold font (presumably because it's important) but it's pretty obvious:

- For each peer review report, the Appointed Actuary should summarize each key finding or recommendation, and the status of each finding / recommendation by year.

7.7 Re-submitting the report

If the AA report is resubmitted, the AAR must disclose the reason(s) for resubmission.

Section 8 - UNPAID CLAIMS AND LOSS RATIO ANALYSIS EXHIBIT

8.1 Introduction

The purpose of the Unpaid Claims and Loss Ratio Analysis Exhibit (UCLR Analysis Exhibit), as shown in Appendix II, is to allow the presentation of industry loss information in a standard format.

The format facilitates the analysis of:

- the impact of discounting on estimates of future cash flows

- loss trends

Each class of business is shown separately.

8.2 Data

This section seems way too detailed for an exam question. It discusses things like whether the data is presented by accident year or underwriting year. I don't think there are any likely exam questions based on this section.

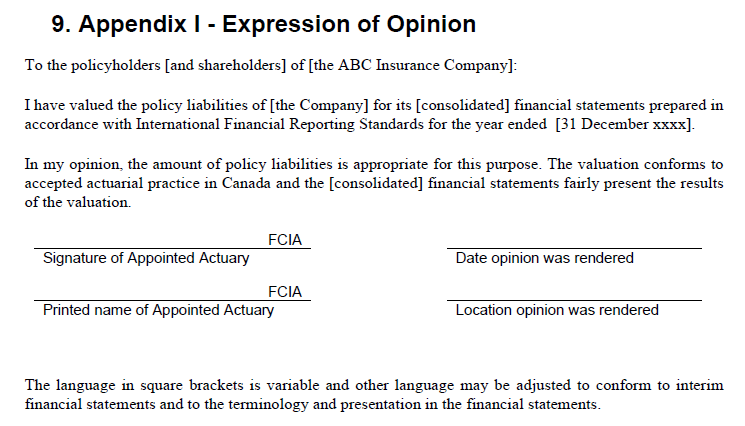

Section 9 - Appendix I - Expression of Opinion

I've copied the entirety of section 9 from the reading below. See below the expression for hints on how to study this.

|

The U.S. version of Exam 6 often asks the candidate to reproduce the language of the opinion as given above, and they are very strict about the wording. This has never been asked on published exams for Exam 6-Canada, but it seems a reasonable question. To memorize it, it helps to break it down into specific sentences as follows:

- Sentence 1: To the policyholders [and shareholders] of [the ABC Insurance Company]:

- This is a very very obvious introductory sentence.

- Sentence 2: I have valued the policy liabilities of [the Company] for its [consolidated] financial statements prepared in accordance with International Financial Reporting Standards for the year ended [31 December xxxx].

- There are 3 key items in this sentence as indicated by the underlined words.

- Sentence 3: In my opinion, the amount of policy liabilities is appropriate for this purpose.

- This sentence will vary based on whether the amount of policy liabilities shown in the financial statements is indeed appropriate.

- If the policy liabilities are too low in the appointed actuary's opinion then "appropriate" should be replaced with "deficient / inadequate".

- If the policy liabilities are too HIGH in the appointed actuary's opinion then "appropriate" should be replaced with "redundant / excessive".

- Sentence 4: The valuation conforms to accepted actuarial practice in Canada and the [consolidated] financial statements fairly present the results of the valuation.

- The 2 key ideas in this sentence are underlined.

- Fill-in-the-blanks: The name and signature of the appointed actuary are obvious. But don't forget that the date and location are also required.

Section 10 - Appendix II - Unpaid Claims and Loss Ratio Analysis Exhibit

The source text shows PDF versions of blank Excel templates for the Unpaid Claims and Loss Ratio Analysis Exhibit. There are no examples and no real discussion of how this exhibit fits with the appointed actuary's expression of opinion. For that reason, an exam question related to this exhibit seems unlikely. In any case, a summary of the information contained in this exhibit is:

- Paid Losses

- LIC (Liability for Incurred Claims) including FCFs (Fulfillment Cash Flows)

- AIC (Assets for Incurred Claims) including FCFs (Fulfillment Cash Flows)

- Loss Ratio

- Claim Counts

It is organized by AY and by Line of Business.

If I were studying again for this exam, that's all I would learn. If there was then an exam question on this topic, I would take an educated guess.

Section 11 - Appendix III – Annual Return Lines of Business

This section is just a list of lines of business like Personal Property, Automobile-Liability - Private Passenger, Mortgage, etc. You would not have to memorize anything from here. It appears to be information only, to indicate the line of business categories to used in completing the Unpaid Claims and Loss Ratio Analysis Exhibit.

Section 12 - Appendix IV - Unpaid Claims and Loss Ratio Analysis Exhibit

Section 12 is detailed instructions on the various rows and columns in the Unpaid Claims and Loss Ratio Analysis Exhibit. If you had to complete this exhibit as part of your work duties, this would be a useful section but I don't think there are any likely exam questions.

Section 13 - Appendix V – Definitions

This section looks like a throwaway section. There are only 4 definitions provided but one of them is interesting as it pertains to IFRS 17. The old formula for Loss Ratio is:

- Loss Ratio = claims / EP

But this is only valid 2022 and prior. After 2022 we use the equivalent IFRS 17 concept of insurance revenue:

- Loss Ratio = claims / insurance revenue