CIA.IFRS17-IC

Updates COMPLETE: (for Fall 2022)

|

Reading: “Educational Note: Application of IFRS 17 Insurance Contracts,” October 2021, Introduction and Chapters 1, 2, 5, 6, 7, and 9.

Author: Canadian Institute of Actuaries

Contents

Pop Quiz

What does the acronym "IFRS" stand for? Click for Answer

Study Tips

This reading is organized around questions & answers. For example, here's the very first question from chapter 1 of the source text:

Basically you just have to memorize the given answer. In the wiki article, Alice-the-Actuary has kindly condensed the answers to make them easier to understand and memorize. For some of them, she'll also give you a memory trick. 😉 The goal is to acquire a general understanding of IFRS 17 insurance contracts and to memorize the answers to questions that are most likely to appear on the exam. This reading has no calculation questions.

The chapters from the source text covered in the syllabus are chapters 1,2,5,6,7,9 (about 100 pages) and there are roughly 180-190 questions & answers in total. 😟 But don't press the panic button! Not everything is equally important.

You can almost completely ignore the vast majority of material from this reading because it's either too detailed, too much of a side topic, or otherwise just not appropriate for an exam question. According to the syllabus, IFRS 17 accounts for 7-10% of the exam, which is 5.0-7.0 total points. Now, there are already multiple readings on the topic of IFRS 17 (6 in total), so it's reasonable to expect 1.5-3.0 points from this reading.

Estimated study time: 1-2 days (not including subsequent review time)

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

In Plain English!

Introduction

This paper is basically a long series of questionnaires or an FAQ of the most common IFRS17 questions which may occasionally make the article feel a little disjointed. I've tried to simplify and hone in on the questions that I think cover the most important parts of IFRS17 related to P&C insurers

Can you give a 30-second elevator speech to your CEO about IFRS 17?

Before Alice gives you her answer, let me explain the concept of an elevator speech. If you find yourself in the elevator with the CEO and they ask you what you're working on, you should be able to give them a 30-second synopsis. And you should be able to do it confidently. (This is a great opportunity to impress someone in a position of power!) It's something you need to practice and it's also a good skill for a job interview. If your resume lists experience with IFRS 17, it would be perfectly reasonable for the interviewer to ask you for a synopsis.

IFRS 17 Elevator Speech: IFRS 17 is a new international standard for reporting insurance liabilities. The effective date is Jan 1, 2023 and it represents a significant change from current actuarial practice in Canada. A crucial difference versus current practice is how the discount rate is selected for calculating the present value of liabilities. IFRS 17 uses current interest rates which are probably lower than actual investment return rates. That means balance sheet liabilities would be higher than in the past and that's a big deal. The benefit though would be better standardization across the industry in terms of financial reporting.

Your CEO (or the interviewer if you're in a job interview) might then have follow-up questions, but after your expert synopsis they will forever remember you as a confident knowledgeable actuary worthy of a fast rise within the company!

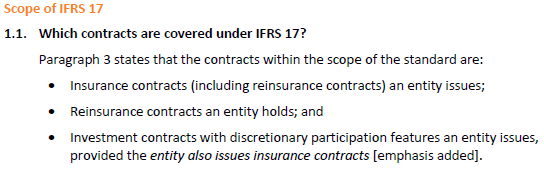

Chapter 1 - Classification of Contracts

| Main concepts in this section. Click link to go directly to topic. |

This chapter starts by addressing the building blocks of IFRS17 -> An Insurance Contract. What actually defines an insurance contract? An insurance contract has three key points:

- The issuer has to accept significant insurance risk from a policyholder

- Which arises from an uncertain future event

- That adversely affects said policyholder

We naturally follow-up by asking

Question: 1.1 - What is insurance risk?

- Risk, other than financial risk, that is transferred from the policyholder to the contract issuer

- Note:

- Insurance risk must exist before an insurance contract is created

- Therefore: Lapse risk, persistency risk, and contract expense risks arising from a contract are not insurance risks, since they only exist after a contract is issued.

Two questions to ponder:

- Can you think of any examples of insurance risk?

- When would lapse, persistency and contract expense risk be considered insurance risk?

The document goes further and defines an insured event as: An uncertain future event covered by an insurance contract that creates insurance risk.

Uncertainty in this context has three aspects:

- → Probability

- → Timing

- → Size

of loss

Question: 1.3 - What does it mean for a loss to be "significant"?

- Insurance risk is only significant if there is at least one scenario with commercial substance where the compensation paid by the insurer has a discernible effect on the economics of the transaction disregarding the likelihood of that scenario.

Phew! That's a lot of words. In plain English, it just means that there must be a non-zero chance that the insurer will suffer a loss greater than the premium received. That's it really.

The text goes into detail about the types of contracts which are not covered under IFRS17 and separation of the components of a contract. I'd recommend reading it really quickly but do not expect this to be an important part to focus on.

Moving on, we are going to talk about Contract Boundaries.

Cash flows are within the boundary of a contract if they [Hint: SCP]:

- Arise from Substantial rights and obligations that exist during the reporting period

- In which the entity can Compel the policyholder to pay premiums

- Or which the entity has substantive obligations to Provide insurance services

That's a lot of words. In plain English, it just means the period in which a policy is in force. For example, a policy effective from Jan 1 2020 to Dec 31 2020 would have a contract boundary of 1 year. During the period from Jan 1 2020 to Dec 31 2020, the insured can be compelled to pay premiums or risk having their policy cancelled, while the insurer must pay out any claims that occur during the said contract boundary.

Question: Why is the boundary limited at Dec 31 2020? What if a policyholder chooses to renew?

- The boundary ends at year end because (most) insurers can reprice the risk at renewal.

- Practical ability refers to the fact that although an insurer is able to reprice a risk, it may not necessarily be possible to do so. For example, an insurer may not be able to increase rates in a very soft market because they will risk losing market share.

- The insured cannot be compelled to continue to pay premiums after Dec 31 2020.

Conceptually, reinsurance follows the same logic as direct insurance contracts with one main difference- Reinsurance contracts can have different contract boundaries than the underlying contracts they cover because:

- Reinsurance may cover contracts that already existed before the reinsurance coverage goes into effect.

- Reinsurance may also cover contracts that are going to be issued in the future.

Now that we have contract boundaries defined, we need to ask ourselves when a contract should be recognized.

A contract should be recognized at the earlier of the:

- Beginning of a coverage period

- Date of the first payment

- Moment a contract becomes onerous

I think this is a very interesting point. For the first 2 bullets, it basically means the first date of the coverage (i.e. Jan 1 2020 in our prior example). However, for the third bullet point, should we decide a contract is onerous, we need to recognize it immediately when the sale is made, rather than waiting for the coverage to start. A sale is normally closed well in advance of the coverage start date.

The source goes on to talk about Levels of Aggregation

Question: 1.19 - Considerations for when should contracts should be grouped together?

- When rights and obligations are different when viewed individually vs collectively.

- One contract cannot be measured without considering another.

One of the most important points in this paper related to the concept of a portfolio of insurance contracts

A portfolio of insurance contracts comprises similar risks that are managed together.

- → Examples of similar risks would include grouping: ON Auto, ON Prop, AB Comm Auto etc.

You wouldn't group ON Auto and ON prop together for example since they are not similar. Usually, a good reference for portfolio groupings would be the reserving groups that are used in the AA's report.

The text doesn't give concrete guidance on what 'managed together' means but we can consider:

- Distribution channels (Ex. you wouldn't consider two lines of business to be managed together if one of the is broker-distributed while the other relies on direct distributions)

- Regulatory level (Ex. Compulsory third party insurance in Australia)

- Capital Allocation (How capital is allocated to each line when using an internal model)

- Entity Management structure (Is commercial and personal auto handled by one department or different departments)

- The way contracts are reported together in performance reports (AA report)

- The way in which investments and asset liability risks are managed

Note: Product line groupings by regulators may not be appropriate to define portfolio groupings under IFRS17. Regulators are focused on solvency while IFRS17 is focused on the appropriate reporting of profits and losses.

Question: 1.23 - What are the impacts of an entity's portfolio choice? [Hint: SABE]

- impacts whether further Subgroupings of contracts within a portfolio are appropriate (Ex: if original portfolios are large and broad)

- impacts the level at which entities can make an Accounting policy choice (For example: to reflect income in profit/loss or disaggregate income between profit or loss and other comprehensive income

- impacts the level at which an entity would consider its ability to reassess risks in order to define contract Boundaries

- impacts Expenses included in measurement (as expenses need to be directly attributable at portfolio level)

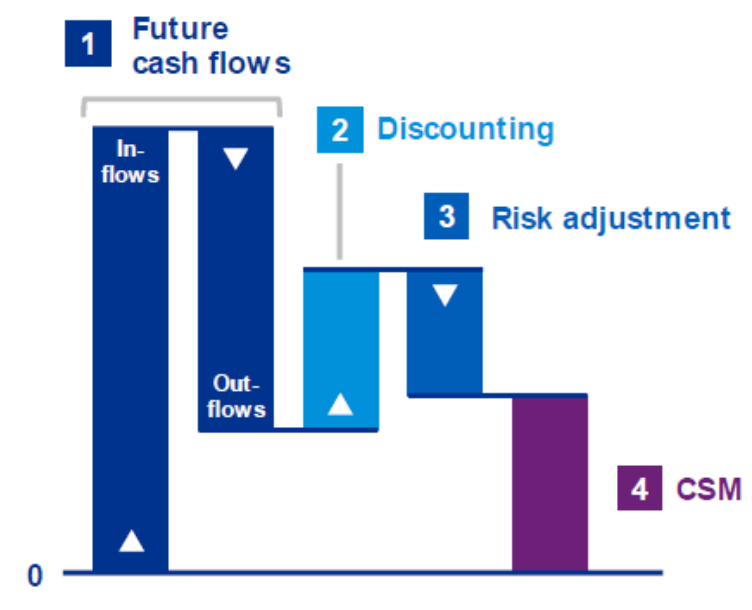

Section A - Introduction to the General Measurement Approach

Section A provides a high level overview of the General Measurement Approach (GMA) which consists of:

- Estimates of Future Cash Flows - Probability weighted mean of the full range of outcomes (Expected Value)

- Discount Rates - To adjust for the time value of money, taking into account financial risk associated with the cash flows (old interest rate PfAD is now here)

- Risk Adjustment for non-financial risk. (Old Claims PfAD)

- Contractual Service Margin (CSM) or Loss Component (LC)

Illiquidity risk may be included in the discount rate or as part of the Risk Adjustment

Chapter 2 - Estimates of Future Cash Flows

A pretty important chapter that address the building blocks of our measurements - The Fulfillment Cash Flows.

Question: 2.1 - What are the requirements for measuring the future cash flows?

- Include all future cash flows within the contract boundary, including those that may have been previously accounted for separately from the insurance contract liability

- Are unbiased estimates of the probability weighted mean of the full range of possible outcomes

- Reflect the perspective of the entity rather than a market perspective

- Are current and explicit

The following are included in Future Cash Flows: Premiums, Incurred losses, Policy Administration and maintenance costs, ALAE, salvage and subrogation, premium taxes and levies, etc.

Cash flows can be estimated at any level of aggregation that is most practical for the entity. You can estimate at a higher level and aggregate down, or start your estimation at a lower level.

Fulfillment Cash flows include the risk adjustment as well as the effect of discounting.

The source talks about having an unbiased expected value estimate of the fulfillment cash flows which we can summarize as follows:

- Should consider full range of outcomes and extreme events in either side of the tail (ex. catastrophic losses on property or a drop in mortality due to a cure for cancer being discovered)

- Should not have an intention of attaining a particular outcome

- Should not have an intention of influencing a particular behaviour

Only Cash flows that can be directly attributed to the contract and are generated due to the existence of the contract should be included in the FCFs. Cash flows such as investment returns, reinsurance, etc are not to be included.

The source goes into huge detail in 2.10 about the extent in which FCFs have to differentiate between contracts with different characteristics (age, gender, etc) Personally, I would skim it and just remember the following 2 points:

- It is up to the insurer's judgement to determine what characteristics of individual contracts are used to estimate FCFs.

- Only factors that can be reasonably collected without undue cost and that they are likely to materially impact the measurement of the FCFs of the groups should be collected.

Treatment of Inflows:

- → Policy loans and repayments are treated as part of the FCFs

- → Interest accredited on prepaid premiums are treated as an adjustment to the aforementioned premium

- → Extra premiums for substandard risks are treated identically to other premiums.

Treatment of Outflows:

- → Input from financial markets or external sources may be used in estimating cash outflows, but they have to be adjusted to reflect the insurer's characteristics

- → Stochastic projections are allowed but not necessarily required (Mainly for skewed risks)

- → Risk of departure from estimated policyholder behavior (anti-selection) should be considered in the Risk Adjustment

Now that we have a general sense of the building blocks of the fulfillment cash flows, we go into more detail by talking about internal costs

Estimates of future management costs usually takes into account the budget and business plans which usually:

- Accounts for inflation

- Considers expected future economies of scale

- Considers if the entity is expected to be measured as a going concern

The source again goes into plenty of detail in 2.22 about cash flows other than claims payments and contractual services that may be considered (which seems more accounting than actuarial).

General overhead costs should be excluded if they cannot be directly attributable to the portfolio of insurance contracts that contain the contract

Once directly attributable costs are identified, IFRS17 distinguishes between insurance acquisition cash flows and other internal costs where further differentiation may be required in separating costs needed for the settlement of claims which are considered in both the LIC and LRC.

A good summary is for 2.22 is as follows:

- Only focus on costs directly attributable to the fulfillment of a contract

- Allocated the costs to a function - Acquisition cash flows, servicing costs and settling claims

- Allocate the identified estimated costs per function to each group “using methods that are systematic and rational, and are consistently applied to all costs that have similar characteristics

Question: 2.23 - What are insurance acquisition cash flows?

- Cash flows arising from the costs of selling, underwriting and starting a group of insurance contracts (issued or expected to be issued) that are directly attributable to the portfolio of insurance contracts to which the group belongs.

- We also need to include cash flows that are not directly attributable to individual contracts or group of insurance contracts within the portfolio such as direct payments related to commissions and underwriting costs.

- If a payment is contingent on persistency within a contract boundary, it will generally be considered an administration cost.

Insurance acquisition cash flows should be established as an asset if they are incurred in the reporting period before the reporting period in which the contract or group of contracts (to which the acquisition cost is allocated) is recognized.

In plain English, if your contract starts in January 2022 and your acquisition costs are incurred in November 2021, you have an asset.

These assets are then derecognized (shout-out to JL!) over time as the insurance contracts that generate these costs are recognized (Conceptually similar to the DPAE under IFRS4)

In the event that they are paid prior to initial recognition of the group, they are also reflected as an asset.

Examples of insurance acquisition cash flows:

- Sales commissions to sales personnel

- Payments to managers of agencies or brokerages based on a percentage of commissions or other measurements of sales

- Underwriting costs

- Contract set up costs

Examples of non-insurance acquisition cash flows:

- Payments to managers of agencies or brokerages not based directly on sales

- Payments to managers of agencies or brokerages based on policy persistency

- Premium and commission processing costs

We're almost at the end!

All transaction taxes such as premium levies, GST and levies are included in the FCF estimates.

Wage-based taxes and taxes paid on behalf of the policyholder are also included.

Income taxes and other levies on the insurer are not included in the estimate.

Estimates of FCFs and assumptions should be reevaluated at every reporting period.

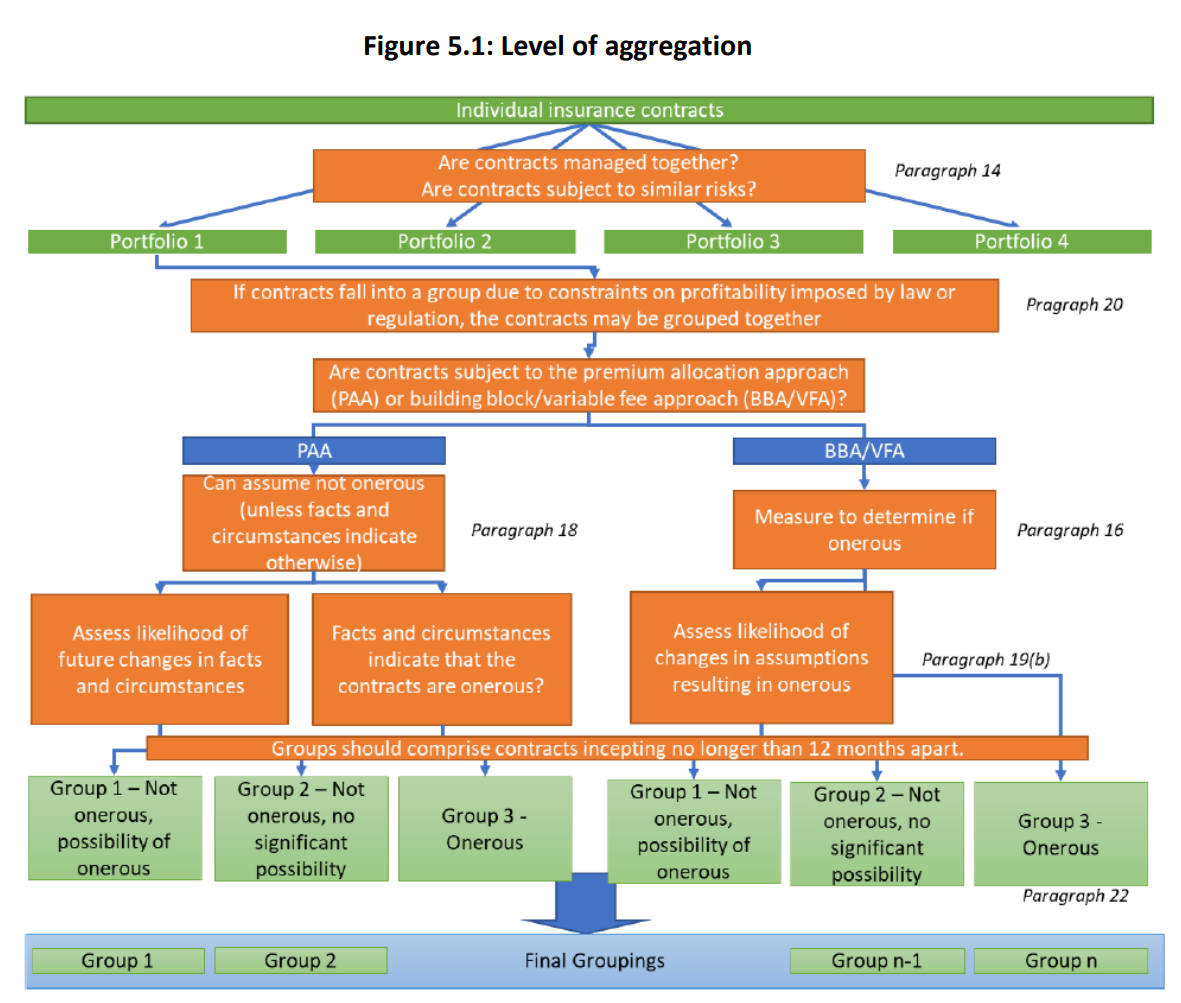

Chapter 5 - Level of Aggregation

The paper begins by explaining that insurance contracts may be aggregated into portfolios of insurance contracts (“portfolios”) and groups of insurance contracts (“groups”) within portfolios on initial recognition and not reassessed subsequently.

A key reason for doing this is to:

- Prevent the offsetting of onerous groups of contracts with profitable groups

- Report profits in appropriate reporting periods

Recall that we were talking about levels of aggregation briefly in chapter 1: Classification of contracts.

A very succinct diagram is provided in the text which I highly advise you to fully understand.

We do not have to spend too much time on 5.1-5.7 as it is mostly covered in chapter 1.

As a refresher, levels of aggregation basically just means splitting your business into portfolios and groups for the purpose of measurements.

You could technically have one contract in a group (reinsurance for example).

Levels of aggregation are important:

- To ensure accurate measurement of the CSM and earnings patterns under PAA and therefore affects profit recognition patterns for the entity

- Ensures that there is systematic and consistent treatment of cross-subsidies between insurance contract reporting

Multi-peril contracts (Think property insurance with different peril coverages) can be aggregated into a portfolio.

The standard does allow for the separation of these components into multiple contracts for accounting.

However, this could lead to inaccurate financial reporting especially in considering whether certain groups are onerous if these perils were not priced explicitly with an additive structure.

Splitting a risk out by contract is permissible under very specific circumstances, but not usually done.

Portfolios for an entity may change over time for new business, renewals or even in-force business.

While it is possible to change portfolios it is not possible to change groups.

Since a contract is required to be assigned to a group at initial recognition, portfolios may not cut across groups.

Organizational changes may require new portfolios to be created for new business/renewals (recall a group on contracts consists of similar risks managed together) but does not affect the allocation of already existing contracts which remain in their assigned groups

Now let's focus more on Groups

A group is a sub-set of a portfolio which includes contracts that are issued no more than 12 months apart and have the property that contracts expected to be loss making are not in in the same group as contracts expected to be profitable.

At initial recognition (See Chapter 1), a group is established and the composition of said group should not be reassessed except in the cases of a specified contract modification or derecognition.

This applies even if contracts within a group, or the group as a whole, are subsequently found to be onerous when they were not at initial recognition.

Contracts that only legally bind the reinsurer for a short period (P&C) may get reissued at renewal date. This renewed contract will be a new contract under IFRS17.

Question: 5.15 - At initial recognition, what are the groups that we can divide contracts into? [Hint:ONR]

- Onerous (loss-making)

- Contract has No significant possibility of becoming onerous subsequently

- Any Remaining contracts in the portfolio

When using the PAA, the entity should assume contracts in the portfolio are not onerous at initial recognition unless facts and circumstances indicate otherwise.

During the determination of groups, IFRS 17 requires reasonable and supportable information which includes things such as policy disclosure statements, valuation reports, pricing reports.

In the absence of such information, the entity can:

- Determine the group to which the contracts belong by considering the fulfilment cash flows of individual contracts at the date of initial recognition

- Reasonably undertake a measurement approach at an individual contract level, this would also enable a grouping assessment to be made

Similar to the LRC, the FCFs of the LIC can be measured at any aggregation level and allocated down or up.

If a particular characteristic that is restricted would result in policies being split between onerous and other allocations, this characteristic can be ignored.

Example, if legislation prohibits the use of gender in pricing and males would be onerous while females would not be onerous, then IFRS17 allows these contracts to be grouped together.

The source briefly talks about Reinsurance here. More detail will be provided in the reinsurance section.

In terms of groupings, the equivalent of an onerous group of contracts for reinsurance is a group of contracts with a net gain on initial recognition.

An underlying contract that is onerous at inception will be considered onerous and accounted for as such even where 100% of this risk is ceded to another party on an original-terms coinsurance basis while a gain will be recognized on the reinsurance held covering that underlying contract.

Reinsurance expenses are presented separately the expenses of the underlying contracts issued.

On acquisition of a group of contracts the acquirer reassesses the groups to identify the groups as if the contracts had been issued on the acquisition date.

When purchasing an entity, contracts are assessed at the date of the business combination date.

Finally, the text talks briefly about Transition to IFRS17 which I do not think to be particularly important.

Using a:

- Full Retrospective Approach :

- There are no exceptions and business written up to transition is grouped applying IFRS 17 retrospectively as if it had always applied

- Modified Retrospective Approach

- Identification of groups can be carried out with the information available at the transition date

- Groups can include contracts issued more than one year apart. However, this modification can only be used to the extent that an entity does not have reasonable and supportable information to apply a retrospective approach

- Fair Value Approach

- It is permitted (but not required) to include in a group contracts issued more than one year apart

- The entity can only divide into groups issued within one year (or less) where the entity has reasonable and supportable information to make the division.

- The difference here is that whereas for the other two approaches the entity must make the divisions if the information is available to do so, for the fair value approach the entity is allowed (but not required) to make the divisions if the information is available to do so

Chapter 6 - Contractual Service Margin and Loss Component

The CSM is one of the most important concepts in IFRS17 and represents the unearned profit the entity will recognize as it provides services under the insurance contracts in a group of insurance contracts.

Under the PAA approach, there would not be a CSM.

At initial recognition, the CSM is calculated as the difference between the PV of cash inflows less the PV of cash outflows within the boundary of the contract (including acquisition costs) after adjustment for non-financial risk.

If inflows > outflows, we have a negative liability which is eliminated at initial recognition through the establishment of a CSM.

If outflows > inflows, then there is no CSM (CSM cannot be less than 0), and a Loss Component (LC) is recognized immediately whereas the CSM is recognized gradually.

The CSM is rolled forward with interest accrual, adjustments for some experience items, changes in estimates of future cash flows, and allowance for the risk adjustment for non-financial risk and is released based on coverage units.

Coverage units are determined by considering:

- The expected service provided by the contract

- Length of contract

The initial determination of the CSM for the group is a prospective calculation, thereafter it is primarily a retrospective calculation or roll forward (i.e., the retrospectively calculated CSM value is adjusted based on the relevant new information and released in line with the services provided)

Profit should only be recognized as service is provided and not on the day of a sale.

Question: 6.5 - What changes are recognized in the CSM for contracts without direct participation features? (CSM at the end of the reporting period)

- 1. CSM at the beginning of the reporting period

- 2. + effect of any new contracts added to the group

- 3. + value of interest accretion (Using locked-in discount rate at initial recognition)

- 4. + changes in fulfilment cash flows relating to future service

- 5. + value of currency exchange differences

- 6. - amount recognized as insurance revenue because of the transfer of services

Next, we have a list of changes in the FCF that adjusts the CSM:

- Effect of new contracts added to the group

- Change in present value of cash flows related to future coverage and other services due to:

- → Experience adjustments from premiums received in the period that relate to future service, and related cash flows such as insurance acquisition cash flows and premium-based taxes, measured at the locked-in discount rates

- → Changes in estimates of the PV of FCFs in the liability for remaining coverage (e.g., due to either assumption changes or differences in number or characteristics of contracts in force at measurement date from that expected), measured at the locked-in discount rate

- → Differences between the actual and expected investment component paid in the period, measured at the locked-in discount rate

- → Changes in the data information affecting the risks of the policyholder

- Change in risk adjustment for non-financial risks that relate to future service

- → Changes in the risk adjustment for non-financial risk relating to coverage and other services provided in the current or past periods should be recognized as insurance revenue

- → The entity can disaggregate the change in risk adjustment for non-financial risk between the insurance service result and insurance finance income or expenses. If not, then the entire change in risk adjustment is disclosed as part of the insurance service result.

The list of FCFs that do not adjust the CSM:

- Change in the time value of money and financial risks

- Change in estimates of fulfilment cash flows in the liability for incurred claims

- Experience adjustments on current period cash flows except those described above

The source now expands on the transfer of services or how the CSM is released in plain English

The insurer allocates CSM equally to each coverage unit in the current and future period within the contract boundary.

CSM allocated to coverage units in the current period is recognized in the P&L.

It is imperative to deeply understand what coverage units are.

A coverage unit establishes the amount of the CSM to be recognized in the P&L and reflects:

- The quantity of benefits provided under the contracts

- Expected coverage duration

Determination of coverage units is not an accounting policy choice, but requires application of careful judgement and consideration of the facts and circumstance

In achieving this principle, the following is considered:

- Lapse expectations are included to the extent they affect expected duration of coverage

- Different levels of service across periods

- Quantity of benefits from policyholder's perspective

Coverage Units Example:

- Passage over time (Most P&C contracts, except for catastrophe insurance)

- Maximum contract cover

- Cover amounts for which policyholder could validly claim in each period

- Premiums unless they:

- → Are receivable in different periods to the insurance services;

- → Reflect different probabilities of claim for the same insured event in different periods rather than different levels of stand-ready service

- → Display different levels of profitability in contracts rather than the standready service.

Question: 6.17 - How do we deal with multiple benefits on a single contract?

- Consider whether the contracts can be separated into components for the purposes of measurement

- Determine coverage units based on the individual benefit components separately and adjust the CSM according to the recognition of all relevant coverage units during the period

- Consider whether a coverage unit reflecting the characteristics of all benefits can be determined

Coverage units are determined on a gross basis and coverage units for reinsurance treaties will be determined separately.

Coverage units can be discounted but are left to the discretion of the insurer.

The source goes on to talk about the CSM for direct participation contracts which is not important for most P&C insurers. I recommend skimming it but not spending too much time on it.

We now focus on onerous contracts

A group can become onerous if the CSM would otherwise be negative (Remember the CSM is capped at 0) and can occur at the outset of the contract or during subsequent measurement.

An onerous contract needs to be recognized immediately and a loss component established.

The loss component at initial recognition represents the expected amount of future obligations not covered by future expected cash inflows on a risk-adjusted present value basis applying the locked-in discount rate as applied for adjusting the CSM.

Over time, with unfavorable development, the loss component can increase, or it can decrease and a CSM will eventually be reestablished with favorable development.

We would normally release the LC over time, similar to the CSM using coverage units.

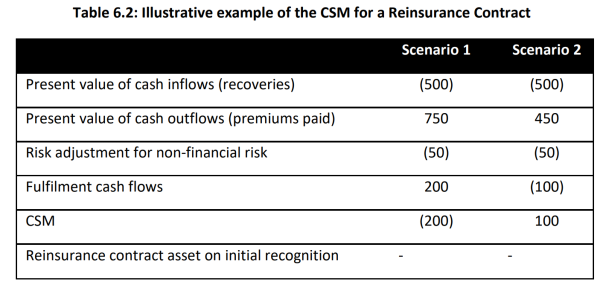

For reinsurance :

The CSM is determined at initial recognition, similar to direct contracts except for the fact that you cannot have an onerous reinsurance contract.

At initial recognition, the CSM can:

- Reduce the reinsurance held asset (where the PV of reimbursements from the reinsurance contract exceeds the PV of reinsurance premiums) and therefore defer recognition of profit

- Increase the reinsurance held asset (where the PV of reinsurance premiums exceeds the PV of reimbursements from the reinsurance contract) and therefore defer recognition of losses from the reinsurance contract

Under IFRS17, we consider the gross liabilities separately from the reinsurance held.

For an onerous group, a loss is recognized on the underlying contract while a gain is recognized on the reinsurance held called loss recovery component.

This gain adjusts the CSM of the group of reinsurance contracts held and is only applicable when the reinsurance contract held is recognized before, or at the same time as, the loss on the underlying direct contracts is recognized.

If a reinsurance contract held is accounted for under the PAA, the same general approach is applied, however, the adjustments are made to the asset for remaining coverage rather than the CSM as the PAA does not have a CSM component.

At subsequent measurement, the CSM is treated the same way as for direct contracts, except when underlying gross contracts become onerous due to changes in FCF relating to future service, it would not affect the CSM.

Reinsurance contracts are treated as a separate portfolio from the underlying and are grouped based on the characteristics and inception dates of the reinsurance contract, not the underlying contracts

Section B – Variations to the General Measurement Approach

The only important point here is that the PAA approach may be used in lieu of the GMA whenever it provides a good approximation to the GMA LRC.

Chapter 7 – Premium Allocation Approach

The PAA is a simplification of the GMA used to measure the LRC and can be used when:

- The entity reasonably expects that the PAA would produce a measurement for a group of insurance contracts that would not differ materially from the one that would be produced applying the GMA

- If the coverage period of each contract in the group is one year or less

Differences between PAA (IFRS17) and Premium Liabilities (IFRS4):

- PAA is net of acquisition expenses whereas the premium liabilities are gross of acquisition expenses

- PAA uses premium received whereas premium liabilities uses written premium

This means that the LRC under IFRS17 may be lower than the premium liabilities under IFRS4

The GMA can always be used and it is never mandatory to use the PAA

The PAA is not allowed when there is significant variability in the fulfillment cash flows for example due to derivatives embedded in the contract and the length of coverage of the contract

There is a great list of examples in question 7.5 where PAA may not produce a good approximation to the GMA which I highly recommend you take a look at.

Question: 7.6 - Is it necessary to test whether the PAA is a good approximation to the GMA?

Not necessary. A qualitative assessment may suffice but for a longer-term group of single premium contracts, it may be desirable to perform a few sample calculations on both bases (i.e., PAA and GMA) in order to confirm similar results for the liability for remaining coverage.

At initial recognition, and you will see this in one of the Sample Excel files provided by the CAS, PAA LRC = UEP - DAC.

PAA does not account for expected policy cancellations and if they are materially large, the LRC could be overestimated.

At subsequent measurement, the PAA can be broken down as:

- + The carrying amount of the liability at the start of the reporting period

- + Premiums received in the period

- + Amortization of insurance acquisition cash flows, unless the entity chooses to recognize it as an expense

- + Adjustment to the financing component

- - Insurance acquisition cash flows, unless the entity choose to recognize it as an expense

- - Amount recognized as insurance revenue in period (Earned premium in period)

- - Investment component paid to LIC

Insurance contract revenue is recognized on the passage of time, but if the expected pattern of risk differs significantly from the passage of time, then on the basis of expected timing of incurred insurance services

Question: 7.6 - What consists of insurance acquisition cash flows?

- Commissions

- UW costs

- Contract set up expenses

Chapter 9 – Reinsurance

We're almost done. Reinsurance is a big one however. Let's start by defining a reinsurance contract under IFRS17.

A reinsurance contract is an insurance contract where one entity (the reinsurer) takes on all or part of the insurance risks associated with insurance contracts issued by another entity.

When an entity transfers risks associated with underlying insurance contracts to another entity it is known as reinsurance held

When an entity receives risks associated with insurance contracts issued by another entity it is known as reinsurance issued

Reinsurance held contracts are presented separately on the statement of financial position than the underlying insurance contracts.

An entity is also permitted to present the income and expense from a group of reinsurance contracts held as a single amount or separately as income and expense item.

If an entity presents separately the amounts recovered from the reinsurer and an allocation of the premium paid, it shall:

- Treat reinsurance cash flows that are contingent on claims on the underlying contracts as part of the claims that are expected to be reimbursed

- Treat amounts from the reinsurer that it expects to receive that are not contingent on claims of the underlying contracts (for example some types of ceding commissions) as a reduction in the premiums to be paid to the reinsurer

- Treat amounts recognized relating to recovery of losses as amounts recovered from the reinsurer

- Not present the allocation of premiums paid as a reduction in revenue

This is pretty technical and while this is important, I do think it is more accounting terminology and maybe not as likely to appear in the exam.

Next, the measurement of the reinsurance FCFs should be separate from the measurement of the same items of underlying gross insurance contracts, although there are some linkages.

With respect to the estimate of future cash flows, there should be consistency between the assumptions used in the measurement of the reinsurance contracts held and in the measurement of the underlying gross insurance liabilities.

In terms of CSM, the CSM for reinsurance contracts held will defer the gain from, or the cost of, reinsurance contracts held.

For reinsurance specifically, the CSM can be negative. The concept of a loss component does not exist for reinsurance contracts.

Where an entity recognizes a loss on a group of underlying insurance contracts because the underlying insurance contracts are onerous, the entity is required to offset this by recognizing a gain on reinsurance contracts held which is done through the CSM of the reinsurance held.

Losses on a group of underlying contracts at initial recognition:

- Where an entity recognises a loss on underlying insurance contracts because the underlying contracts are onerous at initial recognition, the entity simultaneously recognizes a gain on the reinsurance contracts held by adjusting the CSM of the reinsurance contracts held.

- The quantum of the CSM adjustment is the loss recognized on the underlying contracts multiplied by the percentage of claims on the underlying contracts that the entity expects to recover from the reinsurance contracts held.

Losses or reversals of losses on a group of underlying contracts at subsequent measurement:

- At subsequent measurement, where changes in the fulfilment cash flows do not adjust the CSM on underlying contracts because they are onerous, then the entity similarly does not adjust the CSM on the reinsurance held for changes in FCFs associated with these same contracts.

- When an entity groups together onerous underlying contracts covered by reinsurance contracts held and other insurance contracts not covered by the reinsurance contracts held, then the entity is to use a systematic and rational method to determine the portion of the losses arising on the group of underlying insurance contracts which are covered by the reinsurance contracts held.

For the second point, we call it the Loss Recovery component under IFRS17, which is subsequently adjusted in subsequent periods to reflect changes in the onerous group of underlying contracts.

After a loss recovery component has been established, the loss recovery component is adjusted in subsequent periods to reflect changes in the onerous group of underlying insurance contracts.

No method is prescribed for this adjustment, however the carrying amount of the loss recovery component cannot exceed the portion of the carrying amount of the onerous group of underlying insurance contracts that the entity expects to recover from the related group of reinsurance contracts held.

The reversals of a loss recovery component are reflected in the measurement of the CSM of the group of reinsurance contracts held in the period, unless those reversals reflect changes in the FCFs of the group of reinsurance contracts held.

IF reinsurance held is measured under PAA, then changes are made to the Asset for remaining coverage instead as there is no CSM under the PAA.

Another purpose of the loss recovery component is to determine the amounts that are presented in profit or loss as reversals of recoveries of losses from reinsurance contracts held and are consequently excluded from the allocation of premiums paid to the reinsurance and instead treated as amounts recovered from the reinsurer.

Question: 9.10 - What is the Risk Adjustment for reinsurance held?

- The risk adjustment for reinsurance held is the difference in the risk position of the entity with (i.e., net position) and without (i.e., gross position) the reinsurance held.

- It can also be thought of as the cost of reinsurance as an indicator of the entity’s view of the compensation that would be required to keep (i.e., not reinsure) the risk.

The risk adjustment for reinsurance held will either increase the reinsurance contract asset or reduce the reinsurance contract liability.

FCFs also need to reflect possibility of reinsurer non-performance (Old reinsurance PFaD) using two methods:

- Adjust the cash flows directly

- Adjust discount rates to reflect this risk

This allowance is meant to reflect:

- Potential reinsurance counter party failure due to defaults

- Allowances for disputes resulting in reduced payments as well as reflecting the effects of collateral

Default allowances reflects the current standing and financial condition of the reinsurer.

If the allowance for non-performance in the FCF is changed, then the CSM is not adjusted.

There are two interpretations in IFRS17 with respect to the risk of non-performance:

- Counter party risk is not considered in the risk adjustment as this is not a risk formally transferred by the contract

- Counter party risk is appropriate to consider in the risk adjustment since this is a risk that, at an entity level, exists for the party with the reinsurance held as a result of entering the contract to transfer risk. Important to make sure there is no double counting of credit risk between RA and FCF

The grouping for reinsurance held does not necessarily have to be the same as the underlying groupings and a reinsurance is permitted to have a single contract in a group.

There may be cases where the legal form of a reinsurance contract is not sufficiently granular reflect the substance of its contractual rights and obligations. In this circumstance, a contract might be disaggregated into components. This is however not an accounting policy choice.

It needs to be based on facts and relevant circumstances necessary to override the presumption of the contract of as the most basic unit of account.

Facts to consider include:

- Whether the risks covered by the contract are independent

- Whether components of the contract can lapse separately

- Whether components of the contract can be priced separately

In question 9.13, the source goes into a long tirade about what constitutes the contract boundary for a group of reinsurance contracts. This can basically be simplified as follows:

The contract boundary ends when the reinsurer is not able to force the policyholder to continue paying premiums for insurance service, and neither can the policyholder compel the reinsurer to continue providing services at the original agreed premium.

There's also two nuances that needs to be remembered in the context of reinsurance:

- For proportionate reinsurance (QS), initial recognition occurs when the underlying contracts are recognized. (i.e. if reinsurance coverage starts in January 2021 and the underlying contracts begin coverage in February 2021, then the initial recognition date of the reinsurance is February 2021)

- For Non-proportionate contracts (XOL), the date of initial recognition is simply when the reinsurance coverage begins.

Contractual options such as recapture, cancellation, commutation that are embedded derivatives are separated and subject to IFRS9. The cash flows would then take into account the characteristics of the reinsurance contract and expected behavior of the parties to the contract in exercising these options on a basis consistent with the assumptions used in the measurement.

Profit participation is a feature that seeks to return ceding premium based on the performance of the underlying book.

These features may include elements that meet the common definition of an investment component and should be shown as an investment component and excluded form both reinsurance premiums paid and reinsurance recoveries.

Reinsurance issued is shown on the balance sheet as part of the insurance contract liabilities or assets rather than with reinsurance contract held assets or liabilities.

POP QUIZ ANSWERS

- "IFRS" stands for International Financial Reporting Standards