OSFI.MCT-IFRS

STATUS: Chapters 1, 2, 8 are available in the wiki article below. (Chapter 3 is not on the syllabus)

|

Reading: “Minimum Capital Test (MCT) for Federally Regulated Property and Casualty Insurance Companies,” Draft Guideline A, Effective January 1, 2023,” June 2021.

Author: Office of the Superintendent of Financial Institutions Canada

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 4.1 Chapter 1: Overview and General Requirements

- 4.2 Chapter 2: Definition of Capital Available

- 4.3 Chapter 3: Foreign Companies Operating in Canada on a Branch Basis (Not on Syllabus)

- 4.4 Chapter 4: Insurance Risk

- 4.5 Chapter 5: Market Risk

- 4.6 Chapter 6: Credit Risk

- 4.7 Chapter 7: Operational Risk

- 4.8 Chapter 8: Diversification Credit

- 5 POP QUIZ ANSWERS

Pop Quiz

Does Alice-the-Actuary wear glasses? Click for Answer

Study Tips

| Alice-the Actuary and Ian-the-Intern are going to help you slay the beast → 😀 |

Challenge Task!

|

This is the most important reading on the syllabus and accounts for roughly 10% of the points on each exam. OSFI considers the MCT ratio (Minimum Capital Test ratio) to be a prime indicator of an insurer's health. This ratio compares capital available (CapAv) to capital required (CapReq). The benchmark MCT ratio is 150%. If an insurer's ratio falls below this benchmark, it may be in danger of having insufficient assets to cover its liabilities, and may come under increased regulatory scrutiny.

You must first understand how to calculate the MCT ratio. You must also have a conceptual understanding of how items in the financial statements affect the final ratio. The MCT ratio is the first of several financial health ratios listed in the paper MSA.Ratios.

Here are a few suggestions for how to study this reading:

Get an Overview:

- Spend a few minutes looking at table of contents of the source text and read the first paragraph of each of the 8 chapters, excluding chapter 3. (Everything you need for the exam is in the wiki article but since this is the most important reading on the syllabus, you should keep the source text handy anyway.)

Practice the Basic Calculations:

- BattleActs has numerous randomized web-based problems that cover basic components of the MCT calculation. You can access them through the mini BattleQuizzes within the wiki article, or by using the Calculation Problems link. Once there, click the button at the top of the page that says:

Daily Practice:

- This goes without saying! When you're first learning the MCT material, you should practice the web-based problems daily. Once you're able to solve them consistently, you can reduce the frequency but when it gets close to the exam, go back to daily practice. Of the 60-plus readings on the syllabus, the MCT material has historically accounted for over 10% of the points on the exam.

Conceptual Understanding:

- As you get better and better at the calculations, you'll start to understand how the various components of the MCT calculation relate to each other. See example 2 in the section Introduction and 2 Easy Examples.

Previous Exam Questions: (mostly not relevant anymore)

- As of 2022-Fall, the old exam problems covering MCT are no longer relevant. Many of them covered multiple readings, most of which have either been removed or significantly updated. Still, it might be helpful to glance at how these old questions are laid out but for the most part you will not be able to solve them. You can find them through the BattleTable from the prior outdated MCT article or BattleCards - Prior Exams.

Estimated study time: 2 weeks (not including subsequent review time)

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

In Plain English!

Chapter 1: Overview and General Requirements

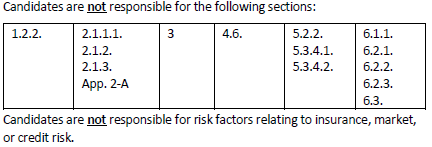

- Sections excluded from the source text:

- → (1.2.2) Audit requirement

Introduction and 2 Easy Examples

MCT stands for Minimum Capital Test. It is a standardized measure of capital adequacy for insurers. The OSFI.MCT-IFRS reading is about calculating & understanding the MCT ratio in the context of IFRS-17 (International Financial Reporting Standards). The mechanics of the calculation are covered in the web-based problems in the mini BattleQuizzes within this wiki article. (If you page down you'll see the big blue quiz buttons.) You can also access the quizzes and calculation problems for all readings using these links:

- Quiz Scores ← to access quizzes for all wiki articles

- Calculation Problems ← to access just the calculation problems

All insurers have assets available to them such as cash, investments, and real estate. These are listed in the insurer's financial statements on page 20.10, Statement of Financial Position - Assets. Financial statements are covered in a separate wiki article, CCIR.Instructions, but we'll cover what you need to know for MCT below. The MCT concept of capital available is a little different however. Capital available is roughly the same thing as equity and is listed in the insurer's financial statements on page 20.11 Statement of Financial Position - Liabilities and Equity. If you've taken an accounting class, you'll know the following formula, also called the Fundamental Accounting Equation:

- Assets = Liabilities + Equity

The MCT reading also details a procedure for calculating capital required. This is an estimated amount the insurer requires to support its particular risk profile, above and beyond normal reserves for unpaid claims. Obviously we want capital available to be greater than capital required. Otherwise, the insurer is at risk for insolvency.

| Example 1: Calculate the MCT Ratio. Super-easy! |

Suppose we have:

- CapAv (Capital Available) = 62,400

- CapReq (Capital Required) = 50,355 ← This is also called the Target Capital Required.

We'll assume that the diversification credit has already been taken. This credit is discussed later in this article. Let's also define the following:

- minCapReq = CapReq / 1.5 ← This is the Minimum Capital Required.

Then the most important formula you have to know is the formula for the final MCT Ratio:

MCT Ratio = CapAv / minCapReq

For our simple example, we have:

- MCT = 62,400 / (50,355/1.5) = 185.9%

This is comfortably above OSFI's supervisory target of 150%, so this insurer is probably doing ok. In practice, we would need much more info than just a single year's MCT ratio to be able to draw meaningful conclusions about an insurer's overall health. The MSA ratios are a great supplement. Note that all federally regulated insurers are required to maintain an MCT ratio of 100%, so OSFI's supervisory target of 150% is a more strict requirement.

The source text discusses very briefly the basis for the target capital required:

- CapReq (or target CapReq) corresponds to a CTE of 99% over a one-year time horizon (Conditional Tail Expectation).

- This essentially means that the target capital required will be adequate 99% of the time.

| Example 2: Does the MCT Ratio go up or down in the following situation? |

Situation: Suppose there's a shift in the type of business an insurer writes from auto physical damage to auto liability. Without doing any calculations, can you tell whether the MCT Ratio will go up or down?

- The MCT Ratio will go down, because auto liability has a longer tail than physical damage. In other words auto liability is riskier, and increased risk causes an increase in capital required. Since capital required is in the denominator, the MCT Ratio will go down.

That type of conceptual question sometimes shows up on the exam but it's pretty easy if you understand the concept that MCT capital required is proportional to risk. The higher the risk, the more capital is required. Simple!

Allocation Methodology

| Warning! This short section seems totally pointless but Alice-the-Actuary can't be certain it won't appear on the exam. 😟 |

According to the source text:

- Insurers may need to undertake an allocation exercise to determine capital requirements.

Other than to list 5 principles of allocation, the above statement is not explained any further. If I were taking the exam again, I would memorize these 5 allocation principles because this type of bullet point list often appears on the exam: [Hint: FACCS]

- allocation methods should be Free from bias

- allocation methods should be Accurate when allocating revenue & costs

- allocation methods should be Consistent with allocation methods used by the insurer for other business decision-making purposes

- allocation methods should be Consistent over time

- allocation methods should be Systematic & reasonable

Note that I rearranged the order that was given in the text to make the memory hint spell a word. It sounds like the word "facts" and in my mind, I pretend I'm a police detective interviewing a witness: "Just the FACCS, sir, the allocation facts." Anyway, it's a dumb memory hint but that what makes me remember it! 😜 And as always, if anyone can think of a better memory trick, just post it in the forum and I will link to it from the wiki!

Transitional Arrangements

| WARNING! This section is even more pointless than the previous section on allocation methods. 😧 |

This very short section isn't going to fully make sense until you've covered the IFRS 17 material. I have traditionally put the MCT article in the #1 spot in the Ranking Table because it had always been the most heavily tested topic. Unfortunately it now relies somewhat on IFRS, which isn't covered until a little later, but we'll tell you what you need to know. Anyway, the transitional arrangement explains how to deal with the following:

- Business combinations and portfolio transfers entered into and effective on or prior to June 30, 2019

I think it's unlikely this section will be asked on the exam because it isn't part of the core MCT calculation, but I didn't want to leave it out completely. So after you've learned everything else, and if you're still looking for more things to memorize (ha ha!), the statement regarding transitional arrangements you would need to memorize is:

- The contractual service margin (CSM) arising from favorable development... (from business combinations and portfolio transfers entered into on or prior to June 30, 2019)

- ...can be included in capital available.

In plain English, it's giving the insurer a way to increase capital available. This arrangement is valid for 3 years starting January 1, 2023. You can click the link in the above bullet point to go to the part of the wiki where the CSM concept is explained.

A Full MCT Example

| Alice's Pro Tip! Calculating the MCT Ratio will DEFINITELY appear on the exam. Learn it! 😁 |

In this section, we'll cover a full example of calculating the MCT ratio. It's relatively easy because you're directly given the main components of the MCT formula - you just have to know what to do with them. Later on in this article, we'll look at more complicated examples where you have to calculate each component yourself from the raw financial statement data.

When I say you're directly given the main components, here's an example of what I mean. If you glance down at the example, you'll see that total value for insurance risk is given as 34,600. Insurance risk however, has 3 separate components:

- liability for incurred claims (LIC)

- unexpired coverage

- unregistered reinsurance

- earthquake and nuclear catastrophes

In practice, you would have to calculate these 3 components separately then sum to get the total value of insurance risk. The same general comment also holds for market risk, credit risk, and operational risk. Together, these risk charges comprise capital required (as shown the example) and the detailed calculations are covered in chapters 4-7. The detailed calculations for the components of capital available are covered in chapter 2. It might be an idea to take a quick glance at the chapter 8 on the diversification credit. Just click the link. It's very short.

| Another Pro Tip from Alice! Mini BattleQuiz #1 has a randomized web-based version of this MCT problem. It's scored by the computer and contributes to you BRQ score. 🤓 |

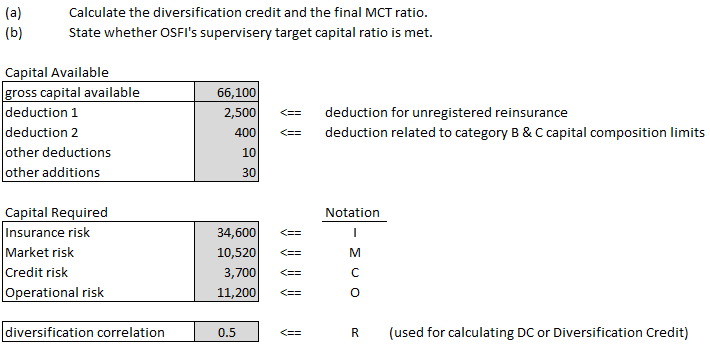

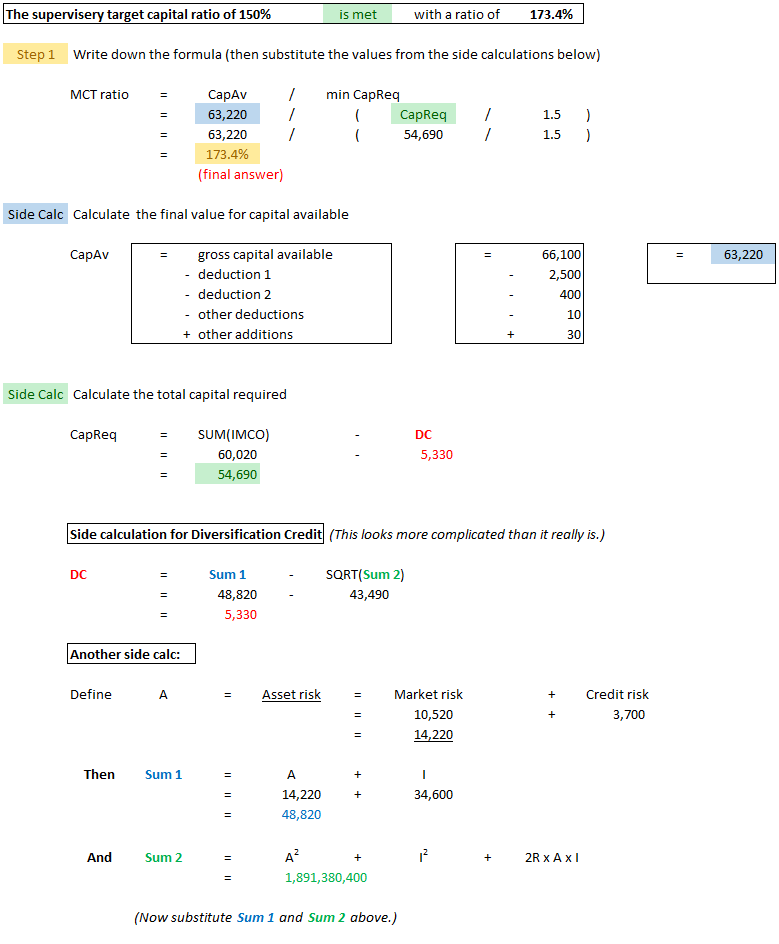

| Here's the given information... |

| Here's the solution... |

Now that you've gone through this full example, you should memorize the 4 main components of capital required. If you know that IMHO stands for "In My Humble Opinion", then the memory trick below should be easy to remember because it's very similar.

Question: identify the 4 components of MCT capital required [Hint: IMCO - In My Crummy Opinion!]

- Insurance risk - risk of loss FROM the potential for claims (from policyholders & beneficiaries)

- Market risk - risk of loss FROM changes in prices in various markets

- Credit risk - risk of loss FROM counterparty's potential INABILITY or UNWILLINGNESS to fully meet contractual obligations due to the insurer

- Operational risk - risk of loss FROM inadequate or failed internal processes, people, systems or from external events

And here are 2 more examples of calculating the MCT ratio in Excel format. Answers are included but you can try solving them yourself before looking. The mini BattleQuiz also has a randomized web-based version of this problem and here's another pro-tip from Alice.

| Alice's Pro-Tip for web-based problems: All the web-based problems can be copied into Excel. Just highlight the given information and paste into a blank Excel worksheet. You can then solve the problem in Excel and type your final answer back into the web page to be scored and incorporated into your BRQ. 😉 |

Chapter 2: Definition of Capital Available

- Sections excluded from the source text: (About 10 of the 17 pages in chapter 2 are excluded.)

- → (2.1.1.1) Qualifying criteria for inclusion of capital instruments in category A for regulatory capital purposes

- → (2.1.2) Category B capital

- → (2.1.3) Category C capital

- → (App. 2-A) Information Requirements for Capital Confirmations

(2.1) Summary of Capital Components

Chapter 2 explains how to calculate capital available, which is the numerator in the MCT ratio. The very first item in this section is the following list:

Question: identify qualitative considerations regarding MCT capital available [Hint: APAS]

- Availability - is the capital element fully paid & available to absorb losses?

- Permanence: - until when is the capital element available?

- Absence - does the capital element have an absence of encumbrances & mandatory servicing costs?

- Subordination - is the capital element subordinated to the rights of policyholders & creditors in an insolvency or winding-up?

These qualitative considerations are not referred to again and play no role in the MCT calculations as presented in the text. It was however asked in this old exam question so just memorize it:

- E (2015.Fall #19)

The much more important information is how to calculate the regulatory capital available.

Question: identify the main components of regulatory capital available.

- category A capital (common equity)

- category B capital

- category C capital

- non-controlling interests ← inclusion in capital available is subject to certain conditions

That doesn't seem too hard! But an exam problem isn't just going to give you these quantities directly. Each of these categories of capital have subcomponents that are generally available from financial statements. Details of the new IFRS 17 financial statements are covered in a different wiki article, CCIR.Instructions, but we'll cover here what you need to know.

| Category A capital consists of these items: |

- Common shares issued by the insurer that meet the category A qualifying criteria

- Surplus (share premium) resulting from the issuance of instruments included in common equity capital and other contributed surplus

- Retained earnings

- Earthquake, nuclear and general contingency reserves

- AOCI (Accumulated other comprehensive income)

- Residual interest, reported either as equity or as a liability, of owner-policyholders of mutual entities

Unfortunately, the MCT source text doesn't tell you where in the IFRS 17 financial statements you can find these quantities but they appear to be the following lines from page 20.11 - Statement of Financial Position - Liabilities & Equity:

Under Policyholders' Equity:

- Line 410: Residual Interest (Non-Stock) ← shout-out to desert70!

Under Shareholders' Equity: (include everything except Preferred Shares on Line 520)

- Line 510: Common Shares

- Line 530: Contributed Surplus

- Line 540: Other Capital

- Line 550: Retained Earnings

- Line 560: Nuclear and Other Reserves

- Line 570: AOCI

Side note: The source text mentions that dividends are removed from capital available in accordance with applicable accounting standards. I'm assuming this refers to dividends paid by the insurer to stockholders.

In any case, you should memorize the 7 items above. You don't have to memorize the line numbers however. An exam question may provide a bunch of financial statement items and you would have to know which ones to add together to get capital available. As I was writing this, I noticed that the first letters of the above items can be grouped to spell RC-CORNA. To me it sounds like RC-Cola. That's a Coca-Cola knock off. Their webpage is pretty dumb if you care to click on the link.

Category B and Category C capital are not broken out any further. An exam problem should give you these quantities directly.

|

| Good News! Most of the published exams provide the capital available directly so you don't have to calculate it. Hopefully that will continue.

(Note however that the most recently available exam is 2019-Fall because the CAS subsequently stopped publishing exams and examiners' reports.) |

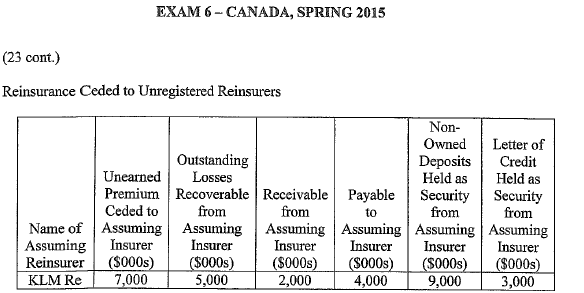

(2.2) Capital Composition Limits

The MCT procedure puts a limit on the amount of category B and category C capital that can be included in capital available. The text doesn't explain why there's a limit but I guess they don't want companies loading up too much on these types of financial instruments. Anyway, here are the 2 rules regarding capital composition limits:

- The sum of category B and C capital cannot exceed 40% of total capital available (excluding AOCI or Accumulated Other Comprehensive Income.)

- Category C capital cannot exceed 7% of total capital available (excluding AOCI or Accumulated Other Comprehensive Income.)

That seems simple but there's a little trick: You first have to have the total capital available. Unfortunately, the source text isn't very clear on how you get that. Here's a step-by-step procedure:

- Calculate the capital available using RC-CORNA ← I think of this quantity as the GROSS capital available

- Apply all regulatory adjustments ← this is covered in the next section and I call the result NET capital available

- Subtract AOCI from NET capital available

- Use 40% of the previous step for the "BC" test and 7% of the result for the "C" test.

Now, I realize that just listing the steps isn't very helpful by itself. The example showing how it works in practice is at the end of the next section because it needs some of the material covered in the next section.

(2.3) Regulatory Adjustments to Capital Available

In addition to the calculation of the deduction for capital composition limits and unregistered reinsurance, there are many other adjustments that can potentially be made to capital available prior to calculating the deduction for capital composition. Unfortunately, you have to know how to handle them as you can see from the exam problems referenced below but there is a trick to it. See Alice's pro-tip below the table. In any case, the source text also provides extremely detailed explanations of each of these adjustments but that seems like far too much for the exam. If you'd like to see these explanations, please refer to Section 2.3.1 in the MCT source text.

- 1 The calculation for unsecured unregistered reinsurance exposures and self-insured retentions is not covered until section 4.3 in the MCT source text.

Type of Adjustment Item Comment deduction Interests in and loans or other forms of lending provided to non-qualifying subsidiaries, associates, and joint ventures in which the company holds more than a 10% ownership interest -- deduction 1 Unsecured unregistered reinsurance exposures and self-insured retentions see E (2015.Spring #23) (but calculation is outdated) deduction The earthquake premium reserve (EPR) not used as part of financial resources to cover earthquake risk exposure see E (2015.Spring #23) (not a calculation) deduction Insurance acquisition cash flows n/a deduction Accumulated other comprehensive income on cash flow hedges -- deduction Goodwill and other intangible assets see E (2019.Fall #19) deduction Deferred tax assets see E (2019.Fall #19) deduction Cumulative gains and losses due to changes in own credit risk on fair valued financial liabilities -- deduction Defined benefit pension fund assets and liabilities -- deduction Investments in own instruments (treasury stock) -- deduction Reciprocal cross holdings in the common shares of insurance, banking and financial entities -- addition Contractual service margin (CSM) associated with title insurance contracts CSM is an IFRS 17 concept (click link) deduction or addition Adjustments to owner-occupied property valuations --

Alice's Pro Tip: If you've memorized the main capital components (category A, B, and C capital, and non-controlling interests) and the subcomponents of category A, then the only items you have to memorize from the table above are:

Everything else is a deduction. That means if you get a "weird" line item in the given information that isn't the CSM for title insurance or an adjustment to owner-occupied property valuations then it must be a deduction. And if you scan the list of deductions of few times, there's a good chance you'll recognize them if they show up, especially the ones that came up on previous exams. |

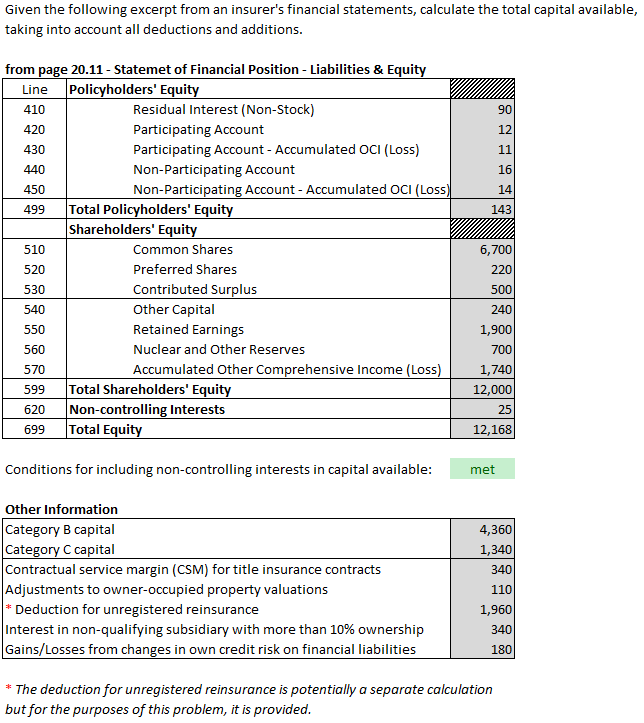

Here's a full example of calculating capital available. The only part not included is the calculation of the deduction for unregistered reinsurance but as noted above, that calculation isn't covered until chapter 4 in the source text. There's also a very good chance an exam problem will simply give the final value of capital available directly, but you can't rely on that. There have been past exam questions where you had to do at least a portion of the calculation shown below.

Side note on non-controlling interests: Section 2.1.4 on non-controlling interests is not excluded from the syllabus. It states that non-controlling interests in operating consolidated subsidiaries can be included in capital available if 3 conditions are met, but I seriously doubt you'd be asked to list these conditions for an exam question. The example below simply tells you whether or not these conditions are met. If you feel you want to memorize these 3 conditions, please refer to Section 2.1.4 in the MCT source text.

| Here's the problem: |

| Here's the solution: |

(2.4) Capital Treatment of Interests in and Loans to Subsidiaries, Associates and Joint Ventures

Recall the first deduction from capital available listed in the table for regulatory adjustments to capital available in the previous section:

- Interests in and loans or other forms of lending provided to non-qualifying subsidiaries, associates, and joint ventures in which the company holds more than a 10% ownership interest

The section is an extremely detailed elaboration of this point for various different scenarios, including where the ownership interest is less than 10%. For the exam, I think it would be unreasonable to expect you to memorize the appropriate adjustments to capital available for all these scenarios. This is the kind of detail you would need it you were actually doing the MCT calculation at work so you should know where to find it, but I think you can otherwise ignore these details.

Excel Practice: MCT Capital Available

Chapter 3: Foreign Companies Operating in Canada on a Branch Basis (Not on Syllabus)

- Chapter 3 is excluded from the syllabus.

mini BattleQuiz 3 ← This quiz is here to only make the quizzes line up with the chapters.

Chapter 4: Insurance Risk

- Sections excluded from the source text:

- → (4.6) Accident and Sickness Business

Alice's Pro Tip! There aren't many BattleCards for chapter 4. You mainly just have to learn the calculations. 😕

|

Recall the definition of insurance risk:

- the risk arising from the potential for claims or payouts to be made to policyholders or beneficiaries

Insurance risk always includes uncertainties in the amount and timing of payments. For example, a structured settlement where specified payments are made on a regular schedule does not contain any insurance risk. In any case, insurance risk has 4 subcomponents.

Question: identify the 4 subcomponents of MCT insurance risk

- LIC or Liability for Incurred Claims

- unexpired coverage (includes catastrophes other than earthquake and nuclear)

- unregistered reinsurance

- earthquake and nuclear catastrophes

Note that LIC is a term introduced by the new IFSR 17 accounting standards. All you need to know for now is that LIC (Liability for Incurred Claims) is just the "normal" reserve amount related to claims that have been incurred on in-force policies. The unexpired coverage relates to claims not yet incurred but which may occur in the future for policies currently in-force.

Before getting into the details, here is a full example of calculating the capital required for insurance risk. Overall, it's a fairly easy example but you won't understand all the pieces until you've gone through the rest of the wiki article for chapter 4. It's just to give you an overall sense for what insurance risk covers.

| Here's the problem: |

| Here's the solution: |

| End of example: Here are a couple of Excel practice problems... |

Excel Practice: Deduction from Capital Available for Unregistered Reinsurance

(4.1) Diversification Credit within Insurance Risk

This extremely short section is only 1 sentence in the source text. Here's what you need to know: Very generally, the MCT charge for a risk is calculated by multiplying the dollar-value of the risk by a risk charge. For example, if:

- dollar-value of risk = reserve amount for auto liability = $10m

- risk charge for auto liability = 10%

Then the MCT capital required is:

- $10m x 10% = $1m

That's so simple, even Ian-the-Intern can get it right! Now, here's what you have to memorize about the diversification credit for insurance risk.

Question: how is diversification risk accounted for regarding MCT insurance risk

- risk factors for each class of insurance contain an implicit diversification credit

- this is based on the assumption that insurers have a well-diversified portfolio

That seems like a pretty big assumption to me! It doesn't distinguish between an insurer with a high level of diversification and an insurer with a lower level of diversification. But the difference may not be significant enough to justify the effort to adjust for this difference. I'm not going to complain – it makes the MCT calculation easier ⭐

(4.2) Margins for Liability for Incurred Claims and Unexpired Coverage

Before we get started, make sure you always keep the big picture in the back of your mind:

The BIG Picture: Chapter 4 has a lot of formulas that you have to memorize.

|

- → Oh, one more thing: For reference, click link for a concise list of IFRS 17 terms and their definitions.

(4.2.1) Margin for liability for incurred claims

After reading this section, refer to the full insurance risk example for an example of capital required for LIC.

The very first formula given in the source text is as shown below, but the way it's written is way too complicated. Don't worry, Alice is going to help you make sense of it.

The problem is it's written in words instead of symbols. The only way you're going to be able to remember this is to invent mathematical notation. Good notation is like a mnemonic device. Note that LIC or Liability for Incurred Claims is a concept from IFRS 17. Here's what I came up with:

Formula 1: margin(LIC) = (risk factor) x [ net LIC(issued) excl. RANF – AIC(re held) excl RANF ]

- margin(LIC) → margin, or capital required, for LIC (Liability for Incurred Claims)

- risk factor → this is a percentage and varies across lines of business (ex: auto liability has a risk factor of 10%)

- net LIC(issued) excl. RANF → a dollar-value representing LIC net of salvage/subrogation for insurance contracts issued excluding Risk Adjustment for Non-Financial Risk

- AIC(re held) excl RANF → a dollar-value representing AIC (Asset for Incurred Claims) for reinsurance contracts held excluding Risk Adjustment for Non-Financial Risk

The formula still looks complicated but in practice any problem you're likely to see on the exam will be much simpler. It will probably be part of a larger problem, and the calculation of insurance risk for LIC could be something as simple as the example from the previous section. In other words, you're given the risk factor for a line of business and the value of LIC for that line of business, so all you have to do is multiply. You just have to verify:

- the value of LIC is net of salvage/subrogation and excludes RANF

- if there is reinsurance involved and the question provides AIC(re held) excl RANF, you have to subtract that from LIC before multiplying by the risk factor

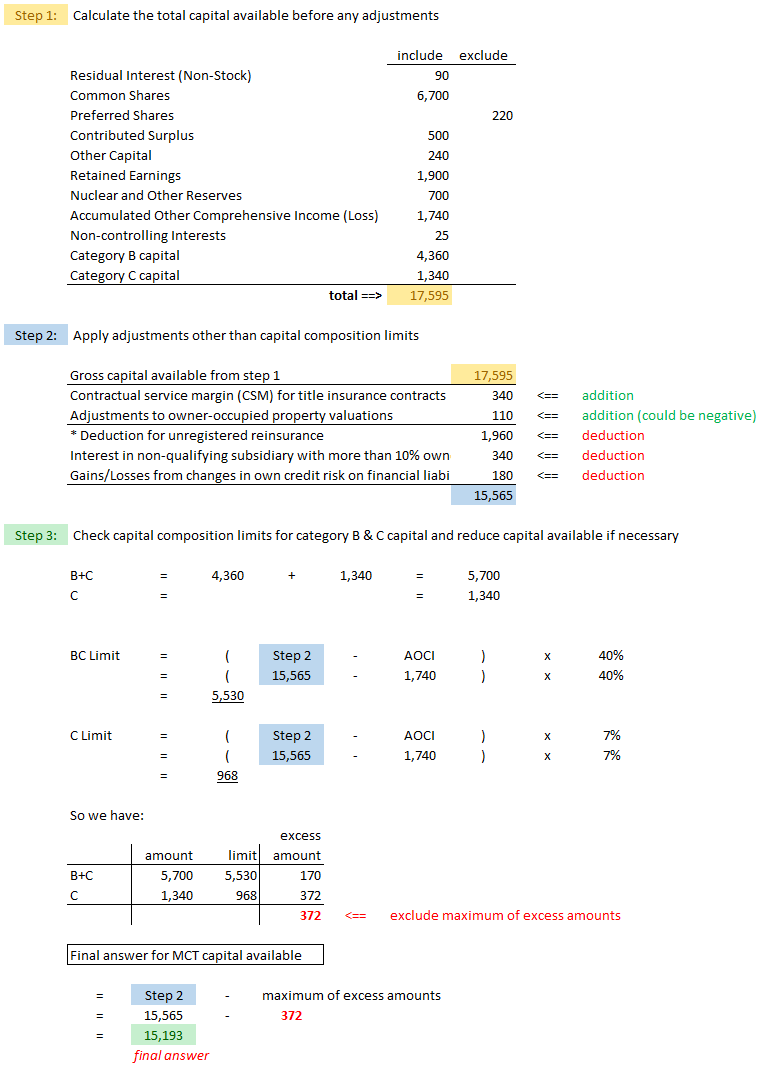

We're going to quickly look at E (2017.Fall #20) from the old version of the MCT reading. (The problem has outdated elements, but the insurance risk part is not too different). Anyway, if you don't feel like clicking on the link, below is an excerpt of the given information. Pay attention to the highlighted items.

We want to calculate:

- margin(LIC) (old term: margin for the "unpaid claims" component of insurance risk)

We're given:

- LIC (old term: Net claim liabilities)

- Risk Adjustment for Non-Financial Risk (RANF) (old term: Provision for adverse deviation (PfAD))

- Average risk factor (across all lines of business)

We have to assume "net claim liabilities" or LIC is net of salvage/subrogation and also net of reinsurance because we're not given those items. Then the term "AIC(re held) excl RANF" drops out of our formula. The solution still has one small trick however. You have to remember to subtract RANF (PfAD in the old version) from LIC:

- margin(LIC) = (risk factor) x [ net LIC(issued) excl. RANF – AIC(re held) excl RANF ]

- = 14% x [ 56,416 - 3,069 - 0 ]

- = 7,469

This is the value of the "?" on the line for unpaid claims. Once you've sorted through all the notation, it's a very simple calculation.

Remember to refer to the full insurance risk example for an example of capital required for LIC.

| Let's proceed to the next subcomponent of insurance risk: unexpired coverage |

(4.2.2) Margin for unexpired coverage

Reminder: Click link for a concise list of IFRS 17 terms and their definitions.

After reading this section, refer to the full insurance risk example for an example of capital required for unexpired coverage.

Here is the basic formula for margin(unexpired coverage). Unfortunately, there are 5 more formulas needed to complete the calculation.

Formula 2: margin(unexpired coverage) = (risk factor) x MAX [ (net unexpired coverage) , 30% x (net premiums received past 12 months) ] - ...where...

- net premiums received = premiums received net of associated reinsurance premiums paid

As for the margin(LIC) calculation earlier, the term for "risk factor" depends on the line of business and will be given to you in an exam problem. The term for "net premiums received past 12 months" is self-explanatory and would also be provided, if required for a particular problem. The term for "net unexpired coverage" however is more complicated.

It's conceivable an exam question would provide "net unexpired coverage" directly. In that case, all you would have to do is substitute into the basic formula above. If not, here's a useful formula that is pretty easy to remember. "Net" means net of reinsurance:

Formula 2a: net unexpired coverage = (unexpired coverage for insurance contracts issued) – (unexpired coverage for reinsurance contracts held)

If you're not given "net unexpired coverage" directly but you are given the 2 terms on the right side of the equation, then calculating margin(unexpired coverage) is still easy. If you're not given the 2 terms on the right side however, that's where things get more complicated. We need 4 more formulas. Pay attention because there's a lot to take in, especially if you haven't already studied the IFRS 17 readings yet:

- (unexpired coverage for insurance contracts issued)

- → we first need a few more facts from the new IFRS 17 accounting standards...

- → LRC is an IFRS 17 term and stands for Liability for Remaining Claims (LRC is roughly equivalent to the old accounting concept of premium liability)

- → LRC is the estimated liability for future claims on in-force policies (these future claims relate to the unexpired portion of the policy term)

- → the calculation of "unexpired coverage for insurance contracts issued" uses 1 of the 2 formulas given below depending on how LRC was calculated

In IFRS 17, there are 2 methods for calculating LRC:

- GMM: General Measurement Model (this is the more general method and it always works)

- PAA: Premium Allocation Approach (a simplified version of GMM that can only be used in certain circumstances)

Side notes:

- The syllabus readings specifically on IFRS 17 use the term GMA or General Measurement Approach rather than GMM. They are the same thing.

- The symbol "LC" stands for Loss Component. You can look that up by clicking the link.

- "PV" stands for Present Value in the formula below and represents the normal process for discounting future cash flows

The formula you need depends on which method was used for calculating LRC:

Formula 2b (GMM): (unexpired coverage for insurance contracts issued) = PV(estimate of future cash flows excluding premium cash flows) Formula 2c (PAA): (unexpired coverage for insurance contracts issued) = ( LRC – LC + unamortized insurance acquisition cash flows + premiums receivable ) x ELR + costs

- ELR = Expected Loss Ratio

Let's turn our attention now to the second term on the right side of formula 2a:

- (unexpired coverage for reinsurance contracts held)

- → we need a few more facts from the new IFRS 17 accounting standards...

- → ARC is an IFRS 17 term and stands for Asset for Remaining Coverage

- → ARC relates to reinsurance

- → ARC is not discussed in any great detail in the IFRS 17 syllabus readings

- → the calculation of "unexpired coverage for reinsurance contracts held" uses 1 of the 2 formulas given below depending on how ARC was calculated

As above, the formula you need depends on which method was used for calculating ARC:

Formula 2d (GMM): (unexpired coverage for reinsurance contracts held) = PV(estimate of future cash flows for current and future reinsurance contracts held) Formula 2e (PAA): (unexpired coverage for reinsurance contracts held) = ( A + C + P1 + P2 ) x ELR – P3

- ...where...

- A = ARC excluding loss recovery component

- C = unamortized reinsurance commission

- P1 = premiums payable to the assuming insurer

- P2 = expected future reinsurance premiums

- P3 = expected future reinsurance premiums net of reinsurance commissions

- ELR = Expected Loss Ratio

- Footnote from source text: The ELR for the unexpired coverage for reinsurance contracts held (PAA) in section 4.2.2.2 is the ELR for the ceded calculations, and is not necessarily the same as the ELR for the gross calculations in section 4.2.2.1 for the unexpired coverage for insurance contract issued (PAA).

Remember to refer to the full insurance risk example for an example of capital required for unexpired coverage. The example given there is quite simple. I really don't think you would be expected to memorize all of these more complicated formulas. If that makes you feel uncomfortable you can go ahead and memorize them, but you should come back to it later after you've studied all the other questions and other syllabus readings that we know will appear on the exam.

(4.3) Risk Mitigation and Risk Transfer - Reinsurance

Reminder: Click link for a concise list of IFRS 17 terms and their definitions.

When an insurer holds a reinsurance contract with a reinsurer, there are 2 risks:

- reinsurer won't pay insurer what is owed

- mis-assessment of required provision (the amount the insurer expects to be paid)

Anyway, the risks varies depending on whether the reinsurer is registered or unregistered. There's a long definition on the source text for "registered" reinsurer, but it's basically a federally incorporated or provincially regulated reinsurer. Based on available past exams, I think it's unlikely you'd be asked for the definition on the exam.

If you're paying attention, you might be wondering why reinsurance risks are discussed in chapter 4 on insurance risk. The 2 risks mentioned above are actually credit risks, and the source text explicitly states that reinsurance risk for registered reinsurance is discussed in chapter 6 on credit risk.

The much longer subsection within reinsurance risk in chapter 4 concerns unregistered reinsurance.

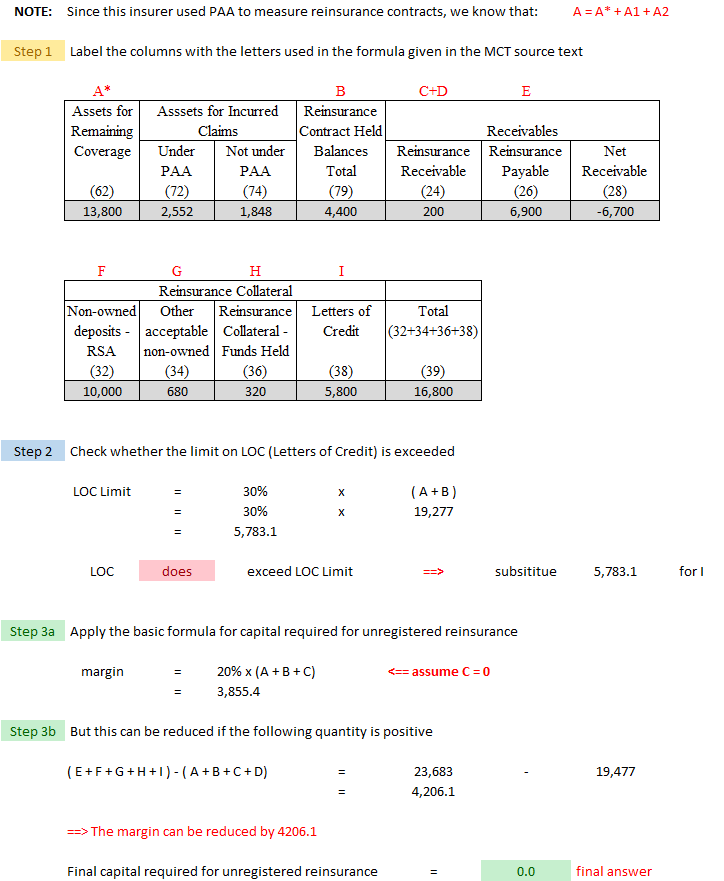

(4.3.3.2) Deduction from Capital Available (Unregistered Reinsurance)

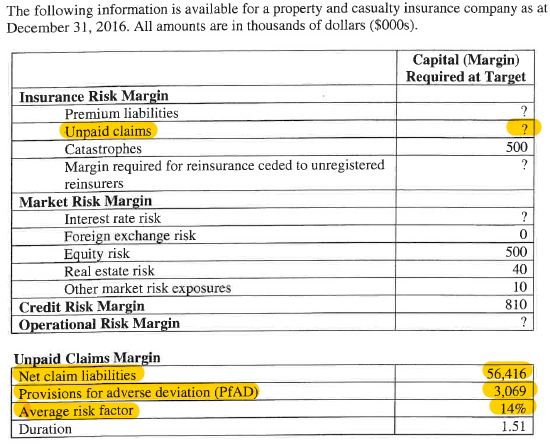

This subsection does not calculate capital required. The calculation in this subsection represents a potential deduction from capital available. The idea is that if the reinsurer has a lot of unregistered reinsurance, it could trigger a reduction to capital available and thus reduce the MCT ratio. But this reduction can be mitigated if the primary insurer has collateral from the reinsurer. Anyway, here's the formula as given in the MCT reading. (Alice calls it "Formula Un-ded" because it pertains to unregistered reinsurance and it represents a deduction. You can also call it the Zombie formula. Get it! Ha ha! Alice is in rare form today!)

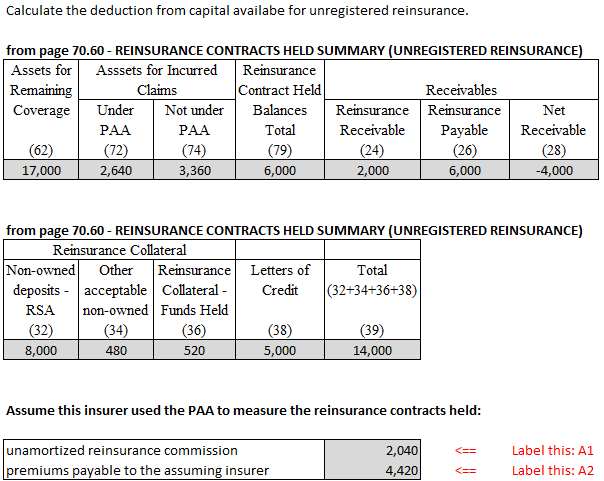

Formula Un-ded: deduction = (A + B + C + D) – (E + F + G + H + I)

Of course you can't do anything with that unless you know what the letters A through I stand for. It's written out in words in the text but it's easier to understand simply by looking at the relevant page from the financial statements. Alice created an example to demonstrate. Thanks Alice! Her advice is to know how to label the columns in the exhibit with the letters from the formula. Note also the calculation in Step 2. This is explained further down.

Important note: The text does not actually say where each item in the above formula can be found in the financial statements, so I'm taking a little bit of a guess. My guess however is based on the previous version of the MCT reading as well as examiners' reports. In particular, if you look at how the information for unregistered reinsurance information is presented in the exam problem E (2015.Spring #23) you can see how it loosely matches up with the new format shown in the example a little further down. I've extracted the relevant portion of that exam problem below. In an old version of the MCT reading, the formula for the deduction capital available was (A+B+C)-(D+E+F) and the 6 columns of numeric data below corresponded to the variables A through F. I'm assuming it's roughly similar for the current version of MCT, although the source doesn't make it very clear.

You don't have to spend a lot of time on that old exam problem - it's more informational, just to give you an idea of how the information could be presented to you. One thing to keep in mind however is that the quantities "C" and "D", which mean something a little different now, are not separated in the table below. In other words, I've labelled the column for "Reinsurance Receivables" as "C+D". This doesn't matter for this problem, but in the next section when we calculate the margin required for unregistered reinsurance, we make the assumption that C = 0.

| Here's the problem: |

| Here's the solution: |

| Ok, let's discuss! |

About the quantities A & B in the deduction formula above: (You can check the source text for the precise definitions of variables C, D, E, F, G, H, I.)

- First of all, the source text defines A as:

- → the amount of premiums associated with unexpired coverage on reinsurance contracts held

- In the pre-IFRS 17 version of MCT, A represented unearned reinsurer premiums, but in IFRS 17, it's much more complicated. The value of A depends on how the primary insurer measured the reinsurance contracts and in IFRS 17, there are 2 ways to do this. This was briefly mentioned here earlier in this wiki article. The methods are GMM (General Measurement Model) and PAA (Premium Allocation Approach). Anyway, I simplified the calculation of A in the above problem to make it more manageable as follows:

- → Simplification: you are told that the reinsurance contracts were measured using PAA

- This is very important because if PAA was used then the formula for A is:

Formula A (PAA): A = ARC + (unamortized reinsurance commission) + (premiums payable to the assuming insurer) - ..where..

- ARC = Asset for Remaining Coverage (Column 62 on page 70.60 of the financial statements)

- That formula is not explained any further in the source text. You just have to memorize it and hope that if you get a problem like this, they will tell you that PAA was used. If GMM was used, the formulas are much more complicated and I don't think it's reasonable to expect you to memorize them. You should glance at the source text however, just to see what I mean.

- The quantity "B" represents the ceded claim amounts relating to the unexpired portion of the policy that the primary insurer expects to get back from the reinsurer.

Let's now take a closer look at Step 2:

- There is a limit on the amount of LOC (Letters of Credit) that is permitted to be included in the calculation. This limit is 30% x (A + B). If you look at this section in the source text, this limit is not mentioned. It doesn't appear until section 4.3.3.4 on collateral, which I found confusing. (I thought I had missed something.) Here is a very important fact that has come up in past MCT exam problems:

Whenever you see LOC (Letters of Credit) in a formula, you must always check whether it exceeds the limit of 30% x (A + B)

Graders have deducted points for not checking, even if the limit is not exceeded and would otherwise have no bearing on the final answer. If the limit is exceeded, you must cap LOC at the limit.

Here is the only old exam problem I could find where you had to calculate the deduction from capital available for unregistered reinsurance. The calculation is outdated but you can see (on the second page of given information) that they gave you the necessary information as an excerpt from the financial statements, as in the example above.

- E (2015.Spring #23)

FYI.. There is a (small) error in the examiner's report for this problem for part (a) (if you care to look) although it doesn't affect the final answer. It pertains to the capital composition limit.

- The excess for category C shares was calculated incorrectly. The correct answer is that the category C limit was not breached so there is no category C excess and hence no deduction required from capital available. (The BC deduction however is correct and is required). See also this brief forum discussion on this point.

Good news! The 2015 exam problem from above is the only time you had to actually calculate this deduction from capital available. All the more recent published MCT exam problems either gave you the capital available directly (so you didn't have to calculate anything) or they gave you the equity components and other deductions without providing any information on unregistered reinsurance so you had to assume the deduction for that was 0.

In the following (outdated) exam problem, to calculate the capital available you had to sum the appropriate components and then subtract the appropriate deductions. (Note that you did have to check the category B & C capital composition limits.)

- E (2019.Fall #19)

Anyway, click for another example of calculating the deduction for unregistered reinsurance. After you've looked at that, here are 2 Excel practice problems:

Excel Practice: Deduction from Capital Available for Unregistered Reinsurance

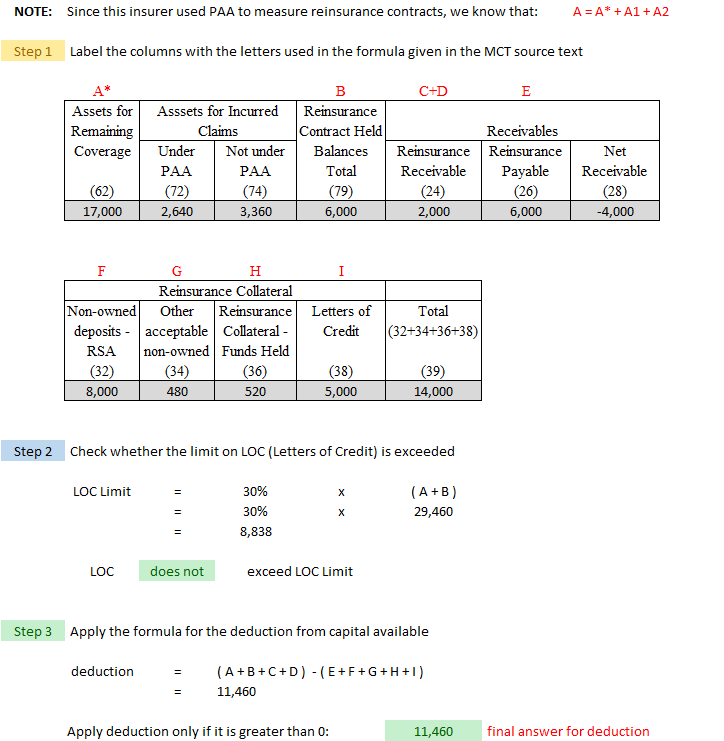

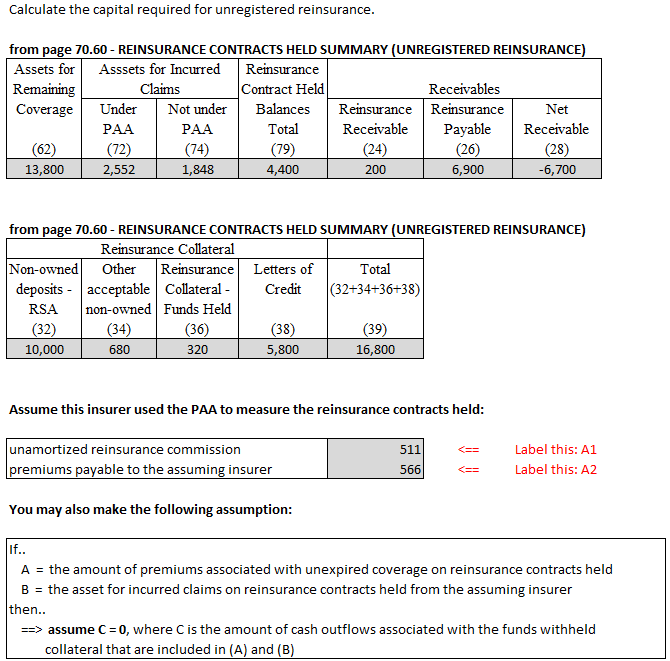

(4.3.3.3) Margin Required (Unregistered Reinsurance)

The calculation for margin required (also called capital required) for unregistered reinsurance has a similar layout to the deduction calculation in the previous section. The same comment about simplifying the calculation of the quantity "A" also applies. Here's the basic formula:

Formula Un-req: margin required = 20% x (A + B + C) ← shout-out to AW!

Recall the important note from earlier regarding our assumption that C=0. Recall that C is the amount of cash outflows associated with the funds withheld collateral that are included in A and B. I realize this might be confusing but if you focus on the mechanics of the calculation and where it fits within the whole MCT procedure, you should be ok. (You can go back to the source text and read about it in more detail later, but I doubt those details will appear on the exam anyway.)

There also are 2 extra things you have to do as shown in the example:

- check whether the LOC limit has not been exceeded (and cap LOC if necessary, just like in the previous section)

- check whether the result of the basic calculation for capital required can be reduced further

- → this reduction is possible when payables and collateral exceed receivables

| Here's the problem: |

| Here's the solution: |

| End of example: Here are a couple of Excel practice problems... |

Excel Practice: Capital Required for Unregistered Reinsurance ← Sep 07, 2022: minor correction to the 2nd problem (shout-out to desert70 & AW!)

(4.4) Self-Insured Retention

This short section on Self-Insured Retentions (SIRs) seems very condensed and I'm not sure there's any testable information here. Just to be safe however, Alice asked Ian-the-Intern to dump a couple of factoids into the BattleCards for quiz 4.

A self-insured retention represents the portion of a loss that is payable by the policyholder. The insurer would pay that portion of the claim initially and the policyholder should then reimburse the insurer. There's a chance however that the policyholder won't pay and that's where the risk arises. For the insurer to get credit for SIRs (meaning a reduction in capital required) the portion payable by the policyholder must be deemed collectible by OSFI and OSFI may require collateral such as a letter of credit (LOC).

(4.5) Earthquake and Nuclear Catastrophes

Note: The MCT calculation for capital required due to earthquakes and nuclear disasters is essentially the same as in the pre-IFRS 17 version of the MCT reading. The only difference is that the phase-in has been eliminated because the phase-in period ran from 2014 to 2022 and has now ended. The effective date of the new MCT guidelines is January 2023.

This has traditionally been a heavily tested section of the MCT reading as you can see from the excerpt below of the BattleTable for the old MCT reading. Ian-the-Intern stayed late last night to pull out all the earthquake questions for you. Thanks Ian! You can do the calculation problems but some of the short-answer questions require knowledge from the other earthquake reading, OSFI.Eqk but you'll see those again later when you get to that reading. For now, you can do part (a) of most of these. If any ask for a "phase-in" approach, you can skip it. The "phase-in" approach is no longer relevant.

Before you look at these exam problems: Study the web-based problem for MCT Capital Required for Earthquakes in mini BattleQuiz #4 which is just below the BattleTable. Everything you need is explained there. After you understand the web-based problem, come back to these old exam problems.

Nuclear: Calculating the margin for nuclear reserves has never been asked on the exam but it's a pretty easy calculation. It's shown in the full insurance risk example at the beginning of chapter 4 of this wiki article. (Click the link to go directly there.)

reference part (a) part (b) part (c) part (d) E (2019.Spring #18) earthquake:

- calc ER (Eqk Reserves)MCT impact:

- of ER decreaseBCAR.Cat OSFI.Eqk E (2018.Fall #19) earthquake:

- calc reserves/componentOSFI.Eqk E (2018.Spring #17) earthquake:

- calc reserves/componentOSFI.Eqk OSFI.Eqk E (2017.Fall #18) earthquake:

- calc reserves/componentOSFI.Eqk E (2017.Spring #19) earthquake:

- calc reserves/componentearthquake:

- non-modeled approachE (2016.Fall #17) earthquake:

- calc reserves/componentOSFI.Eqk OSFI.Eqk E (2015.Fall #16) earthquake:

- calc reserves/componentOSFI.Eqk OSFI.Eqk

Questions held out from Fall 2019 exam: #17, 19*, 20, 21, 22. (Skip these now to have a fresh exam to practice on later. For links to these questions, see Exam Summaries.)

- * The examiner's report solution for #19 contains an error when checking whether (category B) + (category C) capital exceeds the cap. The right side of the inequality should be 10,500 not 7,500. This is does not change anything else in the solution. (shout-out to NZ!)

Chapter 5: Market Risk

- Sections excluded from the source text:

- → (5.2.2) Foreign exchange risk margin

- → (5.3.4.1) Identical equity securities or indices

- → (5.3.4.2) Closely linked equity securities or indices

Chapter 6: Credit Risk

- Sections excluded from the source text:

- → (6.1.1) Use of ratings

- → (6.2.1) Credit equivalent amount

- → (6.2.2) Credit conversion factors

- → (6.2.3) Risk factors

- → (6.3) Capital Treatment of Collateral and Guarantees

Chapter 7: Operational Risk

Note: The MCT calculation for capital required due to operational risk is the same as in the pre-IFRS 17 version of the MCT reading.

Recall the definition of operational risk:

- risk of loss from inadequate or failed internal processes, people, systems or from external events

There are 3 sub-categories or components of operational risk as shown below. You multiply each by the appropriate risk factor to obtain capital required.

sum(IMC) (sum of Insurance, Market, Credit risk) premium volume & growth intra-group pooling

There was a question in the forum regarding the formula for the premium growth charge. (This is the 5th line of the "A" components in the practice template. See post here.)

Note that intra-group pooling should not be included when determining whether there is a growth charge. See here. shout-out to Dulcinea!

Risk Factors for Operational Risk: An exam problem on operational risk should provide the risk factors you need to complete the calculation but you should still memorize them in case the problem does not provide them. See the web-based problem in the quiz below. Also note the following:

See also this (brief) forum discussion. |

Chapter 8: Diversification Credit

As promised earlier, this chapter is short and easy. First, here's the definition:

diversification credit: a reduction to capital required recognizing that not all risk categories are likely to suffer their maximum loss simultaneously

The formula was given in the Full MCT Example from earlier but here it is again:

Let:

- C = Credit Risk

- M = Market Risk

- I = Insurance Risk

Then define:

- A = Asset Risk = C + M

The formula for the Diversification Credit is:

- DC = A + I - SQRT( A2 + I2 + 2·R·A·I )

The quiz for chapter 8 is currently labelled as "quiz 3" because chapters 4,5,6,7 aren't available yet.

POP QUIZ ANSWERS

- Yes, she does! Click for Answer